This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Over the last three years, artificial intelligence (AI) has become a theme so influential that the broader market seems to ebb and flow based on this singular narrative. The S&P 500 and Nasdaq Composite indices are both hovering near record highs, with megacap technology stocks being some of the largest contributors to the market's ongoing rally.

While just about every major investment fund on Wall Street can't seem to get enough of AI, Berkshire Hathaway's Warren Buffett -- who just retired as CEO -- has primarily stuck to his contrarian methods. Throughout the AI revolution, Berkshire has been a net seller of stocks -- hoarding cash on its balance sheet and collecting passive income through Treasury bills.

Last quarter, Berkshire finally put some of its excess capital to use and made a significant addition to its portfolio. Let's dig into some of the fund's moves in recent years and try to make sense of what drove these decisions. From there, we'll take a look at valuation and assess if now is a good opportunity to follow in Buffett's footsteps.

No longer the apple of Buffett's eye

Berkshire Hathaway has long been a fan of consumer businesses and financial services. For decades, many of the firm's largest positions have included insurance companies and banks, as well as a mix of consumer staples and discretionary brands.

Back in 2016, Buffett made headlines following Berkshire's purchase of Apple (NASDAQ: AAPL) stock. Many investors viewed this as a rare instance of Buffett investing in the technology sector. However, given Apple's brand moat, consumer loyalty, robust hardware ecosystem, and steady cash flow generation, the company actually checks off many of Buffett's investment criteria.

A combination of meaningful price appreciation and subsequent buying over the last decade ultimately turned Apple into Berkshire's largest position. Throughout the AI revolution, however, Buffett has been trimming exposure to the iPhone maker.

| Position | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|---|---|---|

| Apple shares (in millions) | 906 | 789 | 400 | 300 | 300 | 300 | 280 | 238 |

Data Source: 13f.info

Since the end of 2023, Berkshire has reduced its exposure to Apple by roughly 73%. Many pundits on Wall Street have criticized Apple for being late to the AI market. While I personally agree, I do not think this necessarily played much of a role in Buffett's decision to sell the stock.

To me, the rationale behind these sales was more macro-oriented. Since October 2023, both the S&P 500 and Apple stock have risen by about 60% -- an abnormally high return in a rather short period. Buffett has always exercised prudent judgment. I think taking advantage of a frothy market and rotating capital into more passive vehicles seemed like a better deal in the eyes of Buffett.

Billionaires are plowing into Alphabet stock

For much of the AI revolution, companies such as Nvidia and Palantir Technologies have been the main attractions. When it comes to legacy internet companies, both Amazon and Microsoft have also become heavily featured in the broader AI discussion.

One company that has been relatively quiet for the last few years, however, is Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG). For a while, the rise of large language models (LLMs) such as ChatGPT were viewed as a knockout punch for traditional search engines -- namely, Google.

But over the last few years, Alphabet quietly trudged along and built out its AI roadmap. Now, billionaires are finally catching on. During the third quarter, notable investors, including Stanley Druckenmiller, Israel Englander, Ken Griffin, Philippe Laffont, and now Warren Buffett, all poured into Alphabet stock.

Is Alphabet stock a good buy right now?

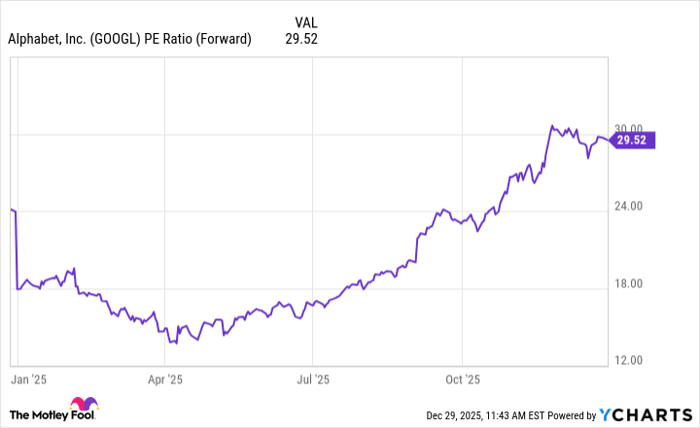

Alphabet currently boasts a forward price-to-earnings (P/E) multiple of 29. While the time to buy the stock at bargain prices may have passed, there are still plenty of upsides.

GOOGL PE Ratio (Forward) data by YCharts

Today, Alphabet has integrated its own LLM, Gemini, into core aspects of its business -- from an overhauled Google search landing page to the company's Android consumer electronics devices.

In addition, Alphabet has also invested heavily into its own hardware in the form of custom application-specific integrated circuits (ASICs) called Tensor Processing Units (TPUs) -- integrating this technology into its budding cloud computing platform. Most recently, Alphabet announced a $4.7 billion acquisition of Intersect -- a provider of clean energy power sources for data centers.

By vertically integrating all aspects of the AI value chain across its ecosystem, Alphabet is positioning itself to emerge as a durable leader of the next technological supercycle. Against this backdrop, I think Alphabet is poised for meaningful valuation expansion over the next several years and see the company as a compelling opportunity to buy and hold for patient investors with a long-term time horizon -- just like Berkshire Hathaway.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.