This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Warren Buffett has many favorite stocks, ones that have played an important role in his portfolio for years and that have helped the billionaire deliver market-beating returns over time. Buffett, as chairman and chief executive officer, has led Berkshire Hathaway to a compounded annual increase of nearly 20% over 59 years. That's compared to the 10% compounded annual gain for the S&P 500 over that time period.

Buffett chooses companies that he believes have solid competitive advantages and that can withstand the test of time. The investing giant aims to invest for the long term, so he looks for companies that may excel for years to come. And he aims to get in on them at a reasonable price.

I consider the following stock Buffett's favorite as it holds a special place in his portfolio: the top spot. Clearly, the company is a solid investment -- but could it double your money in five years? Let's find out.

Taking a bet on technology

Buffett first bought shares of this player back in 2016, taking a bet on an industry he usually doesn't invest in -- technology. This stock is Apple (NASDAQ: AAPL), seller of the famous iPhone, Mac, and other leading devices. Buffett surely noticed Apple's fantastic moat, brand strength that keeps customers coming back.

Over time, this has driven revenue and profit growth and stock performance, too. Buffett is so grateful for these results that he thanked Apple CEO Tim Cook during the latest Berkshire Hathaway shareholders meeting back in May. Apple stock has advanced about 900% since Buffett initially bought the shares.

Buffett in recent quarters cut his position in Apple, and though he didn't spell out the reason, it's possible that the movement was simply to lock in gains after such a solid performance. Meanwhile, the fact that Apple remains his biggest holding shows he still believes in the company's prospects.

An $8 trillion market value

Now, let's consider whether this Buffett stock could double your money in five years. To do so, the stock price would rise to about $550, bringing the stock's market cap to $8.1 trillion. Let's do some math, involving the company's sales growth, to imagine the path to this level.

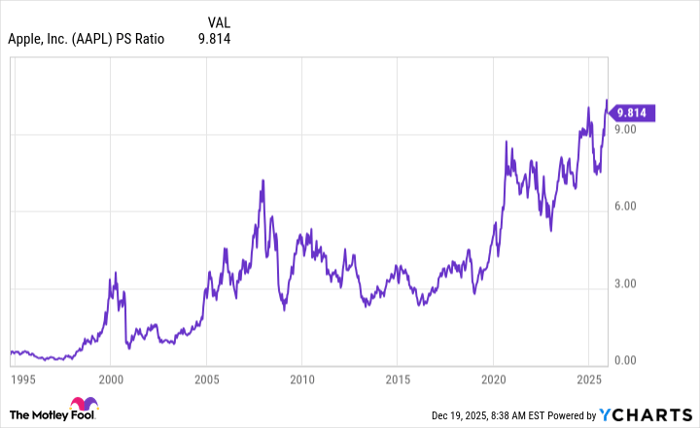

From Apple's actual 2023 sales of $383 billion through analysts' average estimates for $482 billion in annual sales next year, Apple has delivered a compound annual growth rate (CAGR) of 5.9%. And the stock trades for just under 10x sales.

A CAGR of 5.9% from 2023 through 2030 would imply annual revenue advancing to $610 billion by the end of that period. And revenue at that level would bring Apple to a price-to-sales ratio of 13, higher than it's ever traded in the past.

AAPL PS Ratio data by YCharts

Considering a market value of $8.1 trillion, to maintain a PS ratio of about 10, Apple would have to reach $800 billion in annual sales by 2030, suggesting a CAGR of 9.6% from 2023.

So, Apple's growth rate would have to accelerate quite a bit from current levels, and revenue itself would have to double from last year's level over the coming five years. This scenario is possible, but I don't think it's extremely likely. This doesn't mean Apple makes a bad investment, though.

Growth you can count on

Apple actually represents an excellent buy today as the stock, even if it doesn't double in a few years, could generate steady growth you can count on. The company has built out a massive presence of active devices around the world, and those are creating recurrent revenue that's reaching record levels -- this is as users sign up for Apple's services.

As mentioned earlier, Apple has brand strength that has equaled successful launches of iPhone updates, so we may expect growth with each innovation.

Finally, Apple got in on artificial intelligence (AI) later than rivals, with the rollout of AI features across its devices beginning about a year ago. This may have held Apple's performance back earlier in the AI boom, but the company today is well-positioned to benefit from its progress in AI.

All of these points make Apple a great wealth-building Buffett favorite to buy and hold -- even if it doesn't double your money in five years.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.