This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Two of the big three cloud computing companies are Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) and Amazon (NASDAQ: AMZN). While both Google Cloud and AWS (Amazon Web Services) have seen solid growth, Alphabet's stock far outpaced Amazon's in 2025, climbing nearly 60% as of this writing, versus a modest gain for Amazon.

Let's look at which stock is set to outperform in 2026.

The case for Alphabet

Alphabet has been one of the best-performing mega-cap tech stocks in 2025, largely because it was able to flip the script from being viewed as an AI loser to perhaps having the potential to be one of the biggest AI winners. While the company turned in some strong numbers, its performance was much more about changing perceptions.

It did this largely through the advancements with its Gemini foundational large language model (LLM) and custom artificial intelligence (AI) chips. Gemini has become one of the best LLMs in the market today, and Alphabet has infused it throughout its products, including its core search business. AI-powered features, like AI Overviews, AI Mode, and Lens, have helped the company accelerate its search revenue, while its Gemini stand-alone app has also gained traction.

At the same time, its Tensor Processing Units (TPUs) have become increasingly viewed as one of the top alternative AI chips to Nvidia's graphics processing units (GPUs). These chips are in their seventh generation, and Alphabet uses them to power much of its internal workloads, giving it a huge structural cost advantage. Meanwhile, the chips are so highly regarded that Anthropic has committed to buying $21 billion worth of them next year.

As time progresses, the advantage Alphabet has of owning both top-notch AI chips and a top-tier LLM should only widen, as it creates a powerful flywheel that will make both better over time.

The case for Amazon

While Alphabet was able to change investor perceptions this year, Amazon was not. However, the company could now be in a similar spot to where Alphabet was heading into 2025.

Much of Amazon's lackluster recent performance can be tied to the growth of AWS, which trails that of Microsoft Azure and Google Cloud. However, Amazon saw AWS revenue growth accelerate to 20% last quarter, and the company said it was capacity-constrained. As such, it's boosting its capital expenditure (capex) budget to try to meet growing demand.

At the same time, the data center that it built for Anthropic, featuring its custom Trainium chips, is still ramping up. It is also in talks with OpenAI about making an investment in the company, where OpenAI would start to use some of its AI chips. The two companies already signed a $38 billion cloud computing deal, although that was to use Nvidia GPUs.

Meanwhile, Amazon's e-commerce business is really clicking. The company is seeing huge operating leverage come from its robotics and AI investments, while its high-margin sponsored ad business is growing quickly from a large base. This could be seen in its third-quarter results, as its North America revenue rose 11%, while its segment adjusted operating income soared 28%.

The verdict

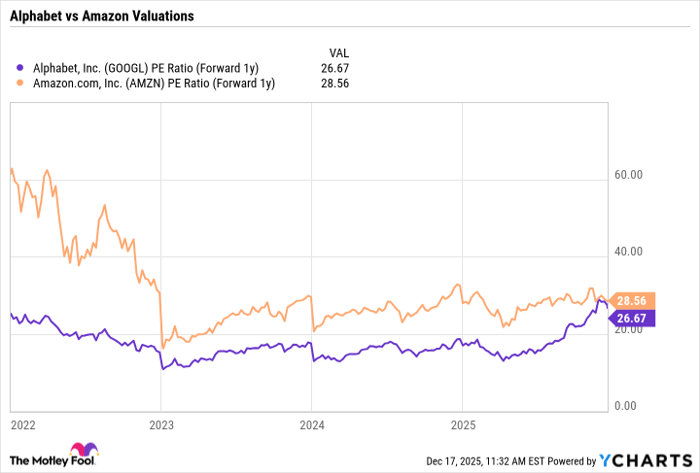

Alphabet and Amazon are two of my favorite stocks heading into 2026. Both stocks are trading at attractive valuations with forward price-to-earnings ratios (P/Es) of below 30 times and solid growth prospects ahead.

Data by YCharts.

I think Alphabet is going to become one of the biggest winners in AI over the long term, but for 2026, I think Amazon's stock can outperform. As AWS revenue continues to accelerate and Trainium gains some traction, Amazon can begin to shift perceptions, much like Alphabet did last year. I think that will really help power a stock that is trading well below other leading retailers like Walmart and Costco, which have forward P/Es nearing 40 times.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.