This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

The "Magnificent Seven" is the name given to the group of Nvidia, Apple, Microsoft, Alphabet, Meta, Tesla, and Amazon (NASDAQ: AMZN). These seven companies are bundled together because they have driven much of the stock market's gains in recent years. As of Dec. 15, they are seven of the world's top nine most valuable companies and represent nearly 35% of the S&P 500.

So far this year, every "Magnificent Seven" stock has produced double-digit returns except for one: Amazon.

Once the face of growth stocks, Amazon has lagged over the past year, frustrating its investors along the way. Despite that retreat, Amazon may be positioned to bounce back in 2026.

Why has Amazon's stock been lagging?

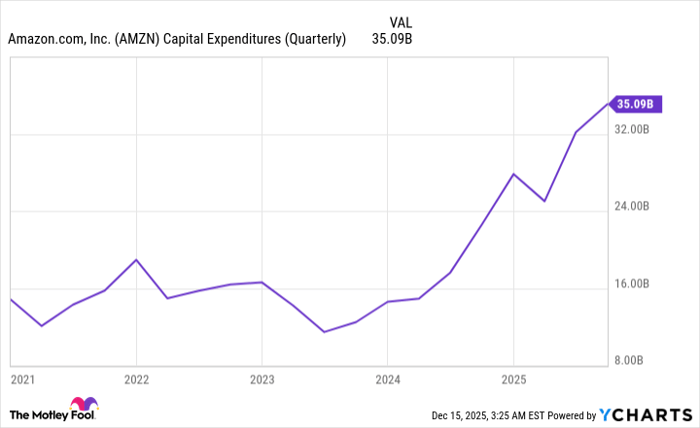

There hasn't been one issue that's caused Amazon's underperformance. It's more a combination of factors. First, Amazon has spent a lot of money this year, with capital expenditures (capex) of around $90 billion through the first nine months of 2025.

Given how much Amazon has been spending (mostly on AI infrastructure), investors have been wanting more to show for it -- especially when it comes to Amazon Web Services (AWS) growth. With many of the "Magnificent Seven" stocks making big splashes in AI, some people viewed Amazon as falling behind in the race.

AMZN Capital Expenditures (Quarterly) data by YCharts.

Amazon's heavy spending has weighed on its free cash flow, and that's not something investors typically like without seeing more immediate results. Add in how expensive Amazon's stock has been, and there was little room for error in many investors' eyes.

AWS is positioning itself for the future

AWS may not have been producing the results that we've grown used to seeing over the years, but investors jumping ship seems like a premature overreaction (which is no surprise if you know investors). Yes, AWS has been losing market share to Microsoft's Azure and Alphabet's Google Cloud, but it's still the world's largest cloud platform by far.

Cloud platforms are, and will continue to be, crucial to AI training and scaling. That's why Amazon has been focusing so much on building out more infrastructure and adding computing capacity. It has added more than 3.8 gigawatts in the past 12 months and plans to double its capacity through 2027.

This investment is noteworthy because, according to calculations from investment bank Oppenheimer, each incremental gigawatt of capacity could add $3 billion in revenue. The high capex might be weighing on Amazon's financials right now, but it's poised to pay off in the long term.

Amazon has an underrated profit machine

There's no doubt that AWS is Amazon's profit engine, accounting for most of its operating income. However, advertising is a high-margin business that has been growing steadily over the past couple of years.

On one hand, Amazon has access to data from its millions of customers and Prime members, making it more effective at helping advertisers with targeted ad campaigns. They know what customers buy, when they buy it, what they watch, what they listen to, what they browse, and other information that allows advertisers to target with greater precision.

On the other hand, Amazon's massive reach means it has plenty of places to set these ads. Whether it's online, when you search for a specific product, stream something on Prime Video, watch Twitch, or listen to music, there's no shortage of real estate for advertisers looking to reach potential customers. Amazon also announced that it recently struck partnerships that allow its advertisers to buy ad space on Netflix, Spotify, and SiriusXM.

In the third quarter, Amazon's advertising services revenue grew 24% to $17.7 billion, outpacing its revenue from subscriptions ($12.5 billion). Beyond revenue growth, advertising is a high-margin business that can help Amazon boost its overall profitability. I expect the momentum to continue in 2026.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.