This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

The debate of AMD (NASDAQ: AMD) versus Nvidia (NASDAQ: NVDA) hardware for tasks like gaming or PCs is one that could wage forever. But the debate of Nvidia versus AMD hardware for artificial intelligence (AI) processing is a short one: Nvidia beats AMD all day long. However, that's an older notion that's beginning to shift.

AMD is starting to see real momentum in its product offering, and may start competing with Nvidia on a more level playing field in the near future. A shift in the landscape could make AMD a better investment than Nvidia for 2026.

So, which am I picking for 2026? Let's find out.

AMD's key weakness is starting to improve

From a product offering standpoint, Nvidia has owned the data center space since the artificial intelligence (AI) buildout began in 2023. Nvidia's technology stack, plus its leading software, made it the no-brainer choice to train AI models on, but AMD has improved its offering.

Thanks to a handful of acquisitions and partnerships, AMD's ROCm software has improved to become a more competitive offering with CUDA (Nvidia's software). During its recent financial analyst day, AMD noted that ROCm downloads have increased 10x year over year, showcasing that this software may be gaining traction in the AI community.

If AMD can offer a similar level of performance to Nvidia, Nvidia may be in trouble. It's no secret that Nvidia's hardware is far more expensive than AMD's, and this shows up in the two companies' margins.

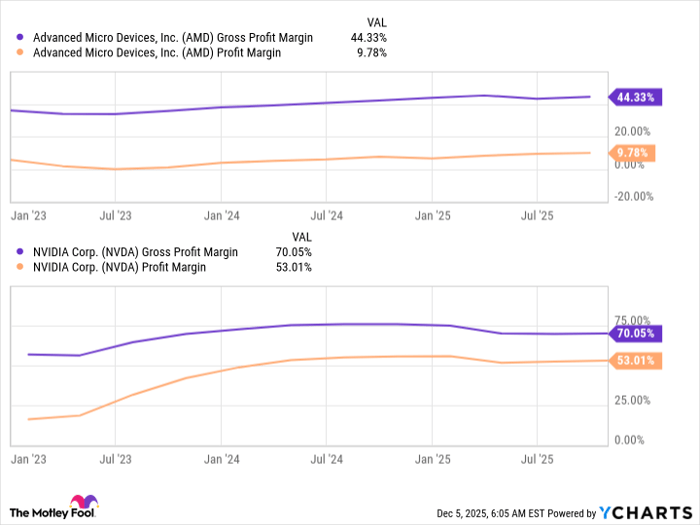

AMD Gross Profit Margin data by YCharts

Nvidia's gross margin and net income margin are far greater than AMD's, which shows that a huge chunk of the cost of Nvidia GPUs goes to paying its profits. With a greater scrutiny on how much money AI hyperscalers are spending on their data center capital expenditures, turning to cheaper alternatives like AMD in exchange for some performance decrease may be a smart move.

As of right now, I doubt this will happen. Companies are fairly locked into the Nvidia ecosystem, and Nvidia CEO Jensen Huang noted the company was "sold out" of cloud GPUs right now. This wouldn't be the case if Nvidia were losing market share to cheaper alternatives, but this could open the door for AMD.

If potential customers are trying to obtain more computing power in a short time frame and Nvidia doesn't have the capacity, those companies may go to AMD to fulfill their needs. If those clients find that AMD's hardware is comparable, they could start moving more business from Nvidia to AMD.

We'll see if that thesis plays out, but the reality is there is plenty of room for both these companies to thrive.

The AI computing market is massive

Nvidia believes that global data center capital expenditures will rise to $3 trillion to $4 trillion by 2030, up from $600 billion in 2025. AMD is also bullish on this space and believes there will be a $1 trillion compute market by 2030. These two projections are fairly similar, as Nvidia's projections include all data center costs, while AMD's focuses on just compute.

If both companies are right on the market opportunity, there is a massive growth runway, which is why AMD told investors to expect a 60% compounded annual growth rate (CAGR) in its data center division. Nvidia likely expects a similar growth rate, making both stocks genius investments for 2026 if the 2030 projections from each company pan out.

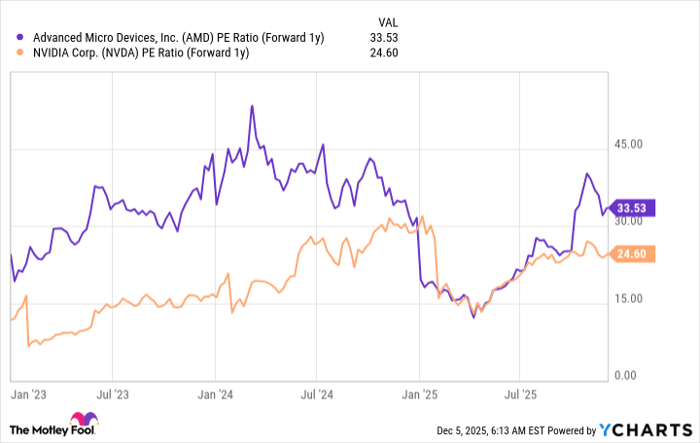

Currently, Nvidia is the far cheaper stock, trading at 25 times next year's earnings versus 34 for AMD.

AMD PE Ratio (Forward 1y) data by YCharts

That's a significant premium that investors must pay to own AMD, which hasn't been as successful in its AI endeavors.

As a result, I think Nvidia is the better stock pick over AMD, as there are fewer expectations priced in. However, if AMD starts to deliver on its growth projections, don't be surprised if AMD outperforms Nvidia in 2026. Both companies are valid investments, and I won't be surprised when either beats the market in 2026.

The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.