This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

- Rising competition isn't a bad thing for Nvidia.

- Wall Street expects impressive 2026 growth from the chipmaker.

- Nvidia believes the AI buildout will persist for years.

Nvidia (NASDAQ: NVDA) has been an excellent stock to own over the past three years, but the bullish sentiment around the company is starting to fade. Investors are growing increasingly worried about rising competition, and concerned that Nvidia may be losing its edge. However, I don't think that's the case. In fact, there are three excellent reasons why I think investors should consider scooping up shares before 2026 arrives.

1. The rise of its competitors may stem from its lack of supply

There are two parts to the bearish thesis around Nvidia's stock. First, rising competition could dethrone Nvidia from its position as the top artificial intelligence computing unit provider. Its graphics processing units (GPUs) are the most flexible and powerful options available, but they could lose market share to application-specific integrated chips (ASICs) in the near future, such as Tensor Processing Units (TPUs) from Alphabet.

Another bearish assumption is that the AI infrastructure buildout is going to slow down as the companies involved come to reckon with the meager returns on investment that those capital expenditures have thus far delivered. Investors fear that this issue will persist, and that the hundreds of billions being spent to construct AI data centers may make little to no profit.

I think both of these concerns are fair arguments, but they don't reflect reality quite yet. Addressing the first concern, Nvidia noted during its Q3 earnings call that it is "sold out" of cloud GPUs. As a result, AI hyperscalers are turning somewhat more to alternative computing units. While this could eat into Nvidia's market share, it also helps the company avoid getting overextended. Nvidia has had problems during some prior chip cycles when it ordered too much supply amid rising demand, then was left with excess inventory that it had to take huge losses on after the trends driving demand peaked.

I don't foresee this being an issue in the AI-accelerator niche in the near future.

The second point is more reasonable, but with all of the AI hyperscalers announcing record capital expenditures for 2026, I don't see it as a pressing issue. Data centers take years to construct, and the ball is already rolling on many of these projects. Nearly all of the AI hyperscalers have asserted that they see the risk of underbuilding as being far greater than the risk of overbuilding. As a result, the buildout will continue.

2. Nvidia's 2026 is expected to be excellent

Despite the market turning somewhat bearish on Nvidia, Wall Street analysts still project monster growth for the company. For its fiscal 2027 (which will end in January 2027), they expect Nvidia's revenue to rise by 48%. That would be an incredible growth rate for an already massive enterprise.

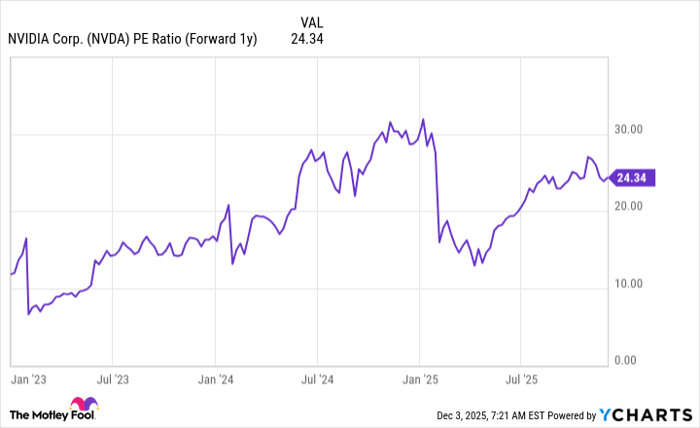

As long as Nvidia's stock isn't carrying too much of a premium already, it should be able to convert a substantial amount of that top-line growth into stock price gains. Right now, it trades at 24 times next year's expected earnings, which isn't necessarily cheap. However, it's far cheaper than many of its peers, and considering the company's growth rate, I think it's a reasonable price to pay for the stock now.

NVDA PE Ratio (Forward 1y) data by YCharts.

3. The AI buildout could last for many years

Although there are growing concerns surrounding the sustainability of the AI buildout, the reality is that most companies involved think it will last for many years. Nvidia rival AMD projects a compound annual growth rate for its data center revenue of 60% over the next five years. Nvidia projects that global data center capital expenditures will rise from $600 billion in 2025 to $3 trillion to $4 trillion by 2030, and it's well positioned to capture a significant chunk of that spending. Investors should therefore take advantage of the recent weakness in Nvidia's stock to scoop up shares, as its price could rise heading into the new year.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.