This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

- Palantir trades at a stratospheric 109 times revenue while Nvidia's 24 times sales looks almost (almost!) reasonable by comparison.

- Palantir's military-style data analytics platform limits its addressable market compared to Nvidia's universal AI infrastructure play.

- Both stocks are priced for a perfect AI future that may not materialize smoothly, and investors could find better opportunities elsewhere in the AI ecosystem.

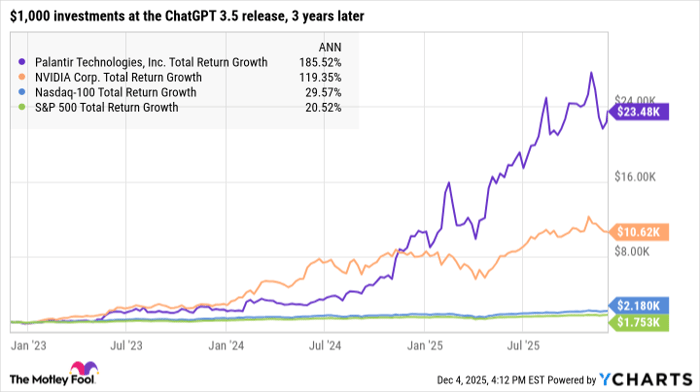

The stock market hasn't been the same since OpenAI unleashed ChatGPT to the public three years ago. As of Dec. 4, the S&P 500 (SNPINDEX: ^GSPC) market index has posted a 75% total return since then. The tech-heavy Nasdaq-100 index gained a dividend-adjusted 118% over the same period.

But the kings of artificial intelligence (AI) are soaring far above these not-so-pedestrian returns. AI chip champion Nvidia (NASDAQ: NVDA) is up more than tenfold and AI platform master Palantir Technologies (NASDAQ: PLTR) more than doubled Nvidia's stellar gains:

PLTR Total Return Level data by YCharts

But past performance is never a guarantee of future results. What matters to today's investors is a fundamentally different question -- which AI stock is the better investment for new money today?

When AI valuations go orbital

Let's address the elephant in the room, or the rocket ship in the stratosphere directly above Wall Street. Palantir's stock has gone absolutely parabolic in 2025, trading at roughly 109 times trailing revenue. That triple-digit figure is not a typo. For context, even during the dot-com bubble's wildest moments, most high-flyers topped out around 50 times sales.

Nvidia, meanwhile, has seen its valuation actually compress even as its business keeps breaking records. At about 24 times revenue, it's still priced for perfection. However, compared to Palantir, Nvidia's stock price looks almost reasonable.

Mind you, Nvidia is already absolutely massive and it should be harder to keep the hypergrowth going from an annual revenue base of $187 billion. Palantir's trailing-12-month sales look minuscule in comparison, stopping at $3.9 billion. The law of large numbers says that Nvidia's sales growth must slow down at some point. Meanwhile, Palantir's long-term value is limited by its focus on the smaller market of government contracts. The company is pushing into commercial contracts too, but how many businesses need military-style data analytics?

The political cycle wild card

Palantir's recent surge coincides suspiciously with a favorable shift in the federal spending environment. The company's government revenue, while growing at a respectable 40% year over year, suddenly seems poised for acceleration as Washington embraces AI-powered defense and intelligence applications.

But here's the risk nobody's talking about: government contracts follow political cycles. What happens if spending priorities shift after the 2026 midterms? What if the regulatory environment becomes less friendly to aggressive data analytics? Palantir's commercial business is growing faster at 54%, but government contracts still represent nearly half of revenue. That's a lot of exposure to political winds that can change direction every two years (with sharper shifts around the four-year presidential election cycle).

Nvidia faces its own unique challenge -- its biggest customers are becoming its biggest competitors. Amazon, Alphabet, and Microsoft are all developing custom AI chips while still buying billions worth of Nvidia's GPUs. It's like selling weapons to armies that are simultaneously building their own armories. Nvidia can maintain this delicate balance, but it requires constant innovation and careful relationship management.

"Less overvalued" wins by default

I can't believe I'm writing this, but at current prices, Nvidia is the better buy -- and that's despite my concerns about customer competition and a still-rich valuation. Here's why:

- Valuation sanity: OK, "sanity" is a stretch but at 24x sales vs. 109x, Nvidia's premium is at least loosely grounded in financial reality.

- Proven moat: CUDA's ecosystem lock-in is real and tested, while Palantir's competitive advantages remain harder to quantify.

- Diversification: Nvidia sells to everyone in AI; Palantir's concentration in government and large enterprises limits its addressable target market.

- Profit machine: Nvidia's 57% net margin vs. Palantir's 20% shows who's actually printing money today.

But here's the real takeaway: Both stocks are priced for a perfect AI future that may not materialize as smoothly as bulls expect. Palantir needs flawless execution and continued government AI spending to justify its valuation. Nvidia needs to fend off increasingly capable competitors while maintaining its innovation edge. Both might actually succeed in the long run, but it won't be easy.

For investors seeking AI exposure today, the smartest move might be looking elsewhere in the ecosystem -- perhaps at the hyperscalers building AI services, semiconductor equipment makers enabling the whole industry, or even "boring" companies successfully implementing AI to improve their operations. Sometimes the best investment isn't choosing between two expensive options -- but finding a completely different third path.

So, if forced to pick between these two AI titans, I'd reluctantly choose Nvidia. But I reduced my Nvidia exposure in 2025, converting some of my AI-boom paper gains into cash profits.

My highest-conviction call in this duel is simple: Neither stock really offers a compelling risk/reward balance for new money at December 2025 prices. The AI revolution is real, but that doesn't mean every AI stock is a buy at any price.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.