This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

- Investing legend Warren Buffett has made moves that may suggest what’s next for the stock market.

- Buffett, at the helm of Berkshire Hathaway, has delivered decades of market-beating results.

Warren Buffett has become an investing legend, and that's thanks to his ability to generate market-beating returns over time. The billionaire, leading Berkshire Hathaway for nearly 60 years, has over that time delivered a compounded annual gain of almost 20% -- that's compared to the S&P 500's compounded annual increase of about 10% over the period.

Buffett has done this by investing in the same manner throughout all market environments: identifying quality companies with strong competitive advantages and getting in on these players for the right price. The famous investor doesn't follow market trends or get caught up in euphoria or despair; instead, he keeps his cool and searches for opportunity.

In recent years, though, opportunity hasn't been as readily available as he would have liked. "Often, nothing looks compelling; very infrequently, we find ourselves knee-deep in opportunities," he wrote in a recent letter to shareholders. And actions Buffett has taken in the quarters leading up to his retirement, set for the end of this year, may be seen as a warning for Wall Street. Let's take a closer look -- and see what history says may happen in 2026.

Buffett's transition

So, first, a quick note about Buffett's retirement. Don't worry: The top investor isn't completely disappearing from the investing scene. He will carry on as chairman of Berkshire Hathaway, but as of Jan. 1, he's turning his role of chief executive officer over to Greg Abel, currently the holding company's vice-chairman of non-insurance operations. Abel will then lead Berkshire Hathaway investment decisions.

In Buffett's final few years as CEO, it doesn't look like he's been "knee-deep" in opportunities because he's been a net seller of stocks for the past 12 consecutive quarters. This means that his stock sales surpassed his equity purchases during each three-month period.

And this brings me to the subject of Buffett's warning to Wall Street. As Buffett favored selling stocks over buying them in recent years, he's also built up a record cash position -- and this continued in the third quarter, with Berkshire Hathaway's cash level reaching $381 billion. So, Buffett has preferred setting aside cash for investing at a later time than allocating it to purchases today.

A trend that Buffett may not like

The investing giant hasn't offered us exact reasons for his decision, but since we do know that he favors buying stocks for a good price, it's fair to say that one key element may be holding him back. And this is valuation.

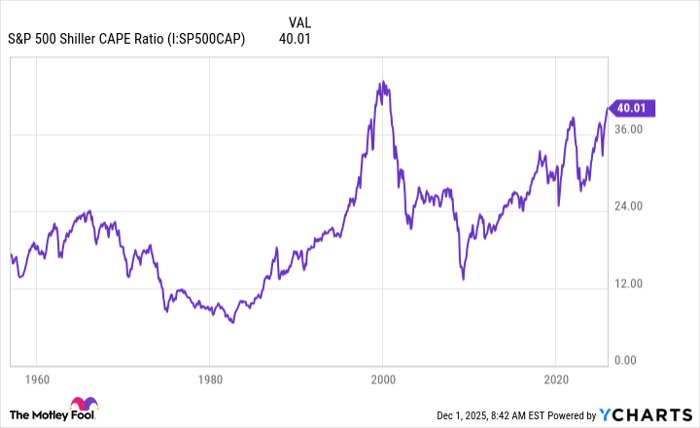

A look at the S&P 500 Shiller CAPE ratio shows us that stocks are at one of their most expensive levels ever. The metric, a measure of stock price in relation to earnings over a 10-year period, recently climbed to 40, a level it's only reached once before since the S&P 500's formation as a 500-company benchmark.

S&P 500 Shiller CAPE Ratio data by YCharts

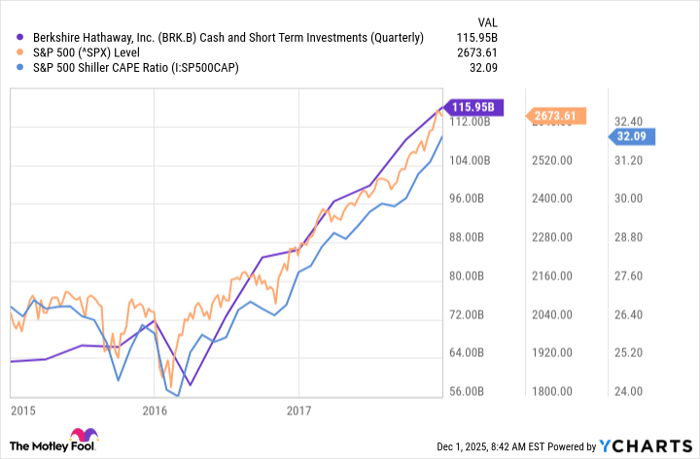

Now, let's consider what history has to say about what may happen in 2026. At times when Berkshire Hathaway's cash levels have been on the rise and reached a peak, the S&P 500 then has taken a dip, as you can see in the chart below, particularly in early 2016 and then toward 2017. The S&P 500 Shiller CAPE ratio also has been on the rise prior to these stock market dips, suggesting valuation may play a role in this trend.

BRK.B Cash and Short Term Investments (Quarterly) data by YCharts

The most important point

This historical pattern suggests we may see a dip in stocks in 2026 -- but this doesn't necessarily mean that the year will finish in the negative. Stock market declines that have followed Buffett's increases in cash levels generally have been short-lived, and most important of all, the S&P 500's declines always have resulted in recovery and gains in the years to follow.

So, what does all of this mean for investors? Buffett's actions imply opportunities aren't overly abundant right now -- and that could start weighing on demand for stocks. This "warning" means investors should pay close attention to valuations and avoid buying stocks that are overpriced or have questionable long-term prospects.

Fortunately, though, if stocks do slip in 2026, history shows us these periods aren't long lasting -- and that's why investing for a number of years has been a winning strategy for Warren Buffett and could be a winning strategy for you too.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.