This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

- Nvidia stock has soared 21,000% in 10 years.

- This performance is thanks to Nvidia’s dominance in the artificial intelligence chip market.

Nvidia (NASDAQ: NVDA) has helped investors take serious steps along the path to wealth -- and with a gain of more than 21,000% over the past decade, it's clearly made some early investors multimillionaires. This is because the company emerged as the world's dominant designer of chips powering the high-growth industry of artificial intelligence (AI).

From today's higher levels, I wouldn't expect Nvidia stock to deliver a repeat performance over the next few years, but the stock still has what it takes to climb significantly -- and even help investors grow their portfolios into the millions of dollars over the long run. Here's why this stock still is a multimillionaire-maker.

Nvidia's daring move

First, a quick look at how Nvidia became a millionaire-maker in recent years. The company made a daring move, tailoring its graphics processing units (GPUs) to suit the needs of the promising field of AI -- and it did this early on, putting itself on track for leadership. Nvidia won this bet, and the company's ongoing innovation has kept it in the top spot.

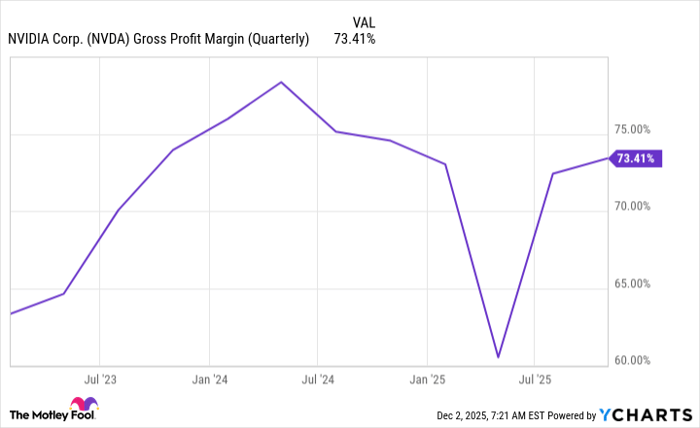

All of this has translated into enormous growth, with double- and triple-digit revenue gains over the past few years. Profitability on sales also has been strong, as gross margin shows us -- Nvidia generally has maintained a level greater than 70%.

NVDA Gross Profit Margin (Quarterly) data by YCharts

That said, investors have worried that Nvidia's best days are in the past and growth will slow in the later stages of the AI boom.

AI across industries

Now let's consider why Nvidia, even at this phase of the AI story, remains a stock that may significantly increase your wealth. And this is because Nvidia is positioned to serve every phase of AI and will be a key player as the use of AI expands across industries. Nvidia's GPUs are the top product used for the training of AI models -- but, importantly, these GPUs also are needed to power the models through their tasks.

The AI giant already has designed specific tools to facilitate the use of AI in various industries like healthcare and automotive, with a particular focus on autonomous vehicles. And just recently, Nvidia announced an investment in telecom giant Nokia as part of an effort to transform telecom networks -- AI will drive this new connectivity, and Nvidia will be at the heart of this.

So, Nvidia is taking AI into a broad range of industries and revolutionizing the way things are done -- this should result in strong revenue growth for many years to come. Nvidia's growth won't be tied uniquely to providing GPUs to data centers; instead, the use of AI across many areas should significantly contribute to the company's growth.

This could supercharge stock performance over the long term -- and as part of a diversified portfolio of quality assets, Nvidia could continue to be a multimillionaire-maker for investors.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.