This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

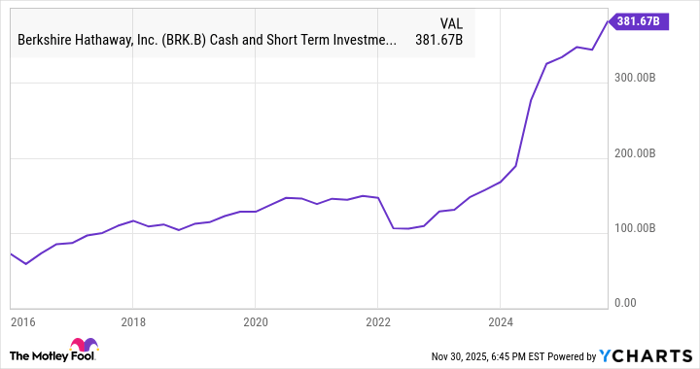

- Berkshire Hathaway is holding an enormous amount in cash and short-term investments as of the third quarter of 2025.

- Some investors worry that this implies a significant market downturn could be coming.

- However, the situation is not as dire as some people may think.

There are few names in the investing world that have as much of an impact as Warren Buffett, so when the stock market mogul speaks, it often pays to listen.

Some investors have noted that Buffett's holding company, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B), has been stockpiling cash in recent years. In fact, in the third quarter of 2025, the company's cash holdings reached a record high of nearly $382 billion. That figure has ballooned over the last year, leading some investors to worry that Buffett is predicting a market crash.

Should investors exit the market now? Or is it safe to keep investing? Here's what you need to know.

Why is Buffett stockpiling cash right now?

On the surface, Berkshire's significant cash holdings may seem to suggest that the market is overvalued. Some investors may take it a step further and assume that a serious market downturn is looming. But there are many reasons why a company may hold a substantial amount in cash.

BRK.B Cash and Short Term Investments (Quarterly) data by YCharts

The market as a whole has earned record-breaking returns over the last few years, and it's not uncommon for investors to rebalance their portfolio or engage in some profit-taking by selling a portion of their shares at these high prices -- leading to greater cash holdings.

At the same time, there's a good chance that Berkshire is simply waiting for the right investment. Buffett has famously rigid standards when making investment decisions, so stockpiling cash likely has less to do with general market uncertainty and more to do with the fact that there are fewer appealing investment options available right now.

"The one problem with the investment business is that things don't come along in an orderly fashion, and they never will," Buffett noted in Berkshire's 2025 annual meeting when asked about the company's cash stockpile. "We'd spend $100 billion, and those decisions are not tough to make, if something is offered that makes sense to us and that we understand and offers good value."

What does this mean for you?

Perhaps the biggest takeaway from Buffett's investing strategy is to focus less on how the market will impact your portfolio and more on being choosy about where you buy.

There's never a wrong time to invest in the stock market as long as you're investing in the right places. If a company has solid fundamentals, offers value, and has room for growth, now can be a fantastic time to buy -- no matter what the market does in the coming weeks or months. Those stocks are always out there; it's just a matter of finding them.

This approach is more important now than ever. Many stocks may be overvalued at the moment, and sometimes, even weak companies can see their stock prices soar when the market is surging. Those investments may look appealing on paper, but if they don't have healthy foundations, they're likely to stumble hard during the next correction or bear market.

"[F]ears regarding the long-term prosperity of the nation's many sound companies make no sense. These businesses will indeed suffer earnings hiccups, as they always have. But most major companies will be setting new profit records 5, 10 and 20 years from now." -- Warren Buffett, The New York Times, 2008

Strong companies will very likely bounce back from whatever the market throws at them, going on to experience long-term growth. The more of these stocks you own, the less you'll need to worry about the next market downturn.

Berkshire Hathaway's enormous cash pile may be worrying to investors concerned about a stock market crash, but Buffett himself is not sounding any alarms. Rather, his timeless advice to invest only in companies that provide value and have potential for long-term growth can make it easier to navigate these uncertain times.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.