This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

- Meta is known for its social media leadership, and it’s also building a strong presence in artificial intelligence.

- The company has the strength to pay investors a dividend and invest in growth.

Meta Platforms (NASDAQ: META) is a company many of us have close contact with daily. That's because it's the owner of some of the world's most commonly used apps: Facebook, Messenger, Instagram, and WhatsApp. About 3.5 billion people around the globe use at least one of these daily.

The tech giant doesn't consider itself just a social media company, though. In recent years, it's made major steps in the world of artificial intelligence (AI) -- for example, it's developed its own large language model, and this tool powers certain Meta products, like the company's AI assistant.

So, owning Meta stock offers you access to a social media titan as well as a potential winner in the exciting field of AI. But should you wait to get in on this player? No -- Here's one compelling reason to buy Meta shares hand over fist right now.

A solid earnings track record

It's important to note that Meta's well-established social media business has helped it produce a long history of earnings growth. Advertisement across Meta's apps drives revenue, as many sorts of businesses sign up for ads to reach us where they know they'll find us -- on these social media platforms. In the recent quarter, advertising revenue climbed about 25% to $50 billion.

In fact, Meta's financial picture is so strong that the company is able to expand and invest in AI as well as pay shareholders a dividend.

While AI represents a considerable investment for Meta today, this effort could deliver big down the road. Meta is using AI to improve the overall advertising experience and boost the capabilities of its apps to keep users on them longer -- all of this should encourage advertisers to keep coming back to Meta and even increase their ad spending. Finally, the investment in AI could lead to additional products and services that may expand revenue streams in the coming years.

Why buy now?

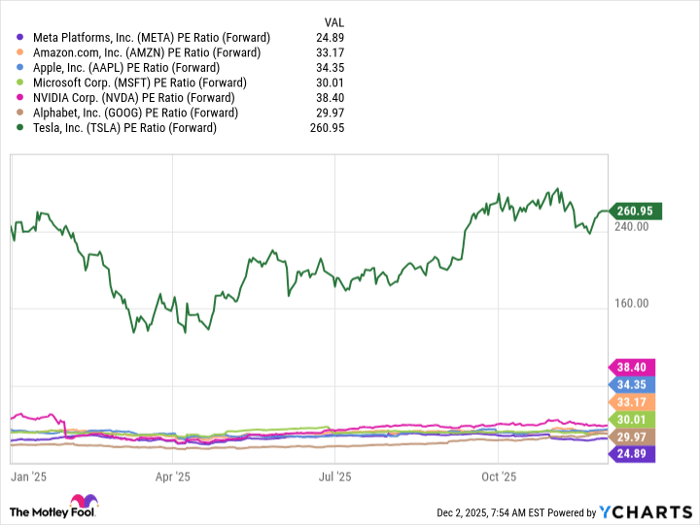

All of this makes Meta a fantastic stock to own well into the future. But why buy now? Right now, Meta is the cheapest of the Magnificent Seven tech stocks that have driven the S&P 500 to record highs in recent years.

Meta trades for 24x forward earnings estimates, which looks cheap relative to peers and also seems very reasonable considering the complete Meta package.

META PE Ratio (Forward) data by YCharts

This is particularly noteworthy today as investors worry about the formation of an AI bubble, as valuations of many AI stocks have exploded higher. Meta, trading at these levels, looks much less vulnerable than players that are trading at lofty valuations.

This, along with Meta's strengths in social media and AI ambitions, makes it a stock to buy hand over fist right now.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.