This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

- Several companies have a realistic chance of reaching the $5 trillion milestone next.

- Alphabet's case is strong, given its robust business, high margins, exciting tailwinds, and valuation.

- Even if it doesn't get there before its peers, Alphabet is a buy for long-term investors.

The list of corporations with a market capitalization of $1 trillion is short -- but what about those that have hit $5 trillion? It's hardly a list, as it's composed of just one company, Nvidia.

However, several others aren't too far behind. One of them is Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), the parent company of Google, which has a current market cap of $3.4 trillion. Will it be the next to hit $5 trillion?

The case for Alphabet

Alphabet isn't the corporation closest to the $5 trillion mark. Other than Nvidia, which has already achieved that milestone but is currently worth less than that, Microsoft and Apple are both ahead. The former has a market capitalization of $3.7 trillion, while the latter is valued at $3.9 trillion.

It's also worth mentioning Amazon, which is currently trailing at $2.4 trillion. However, it may be able to catch up, provided it gains significant market value while its peers decline over the next couple of years.

There are good reasons to believe Alphabet could perform at least as well as Amazon for the foreseeable future. Both are leaders in the cloud computing market. Amazon has a larger market share, but Alphabet is growing sales in that division more quickly.

The rest of their businesses put Alphabet squarely in the lead for one reason -- margins.

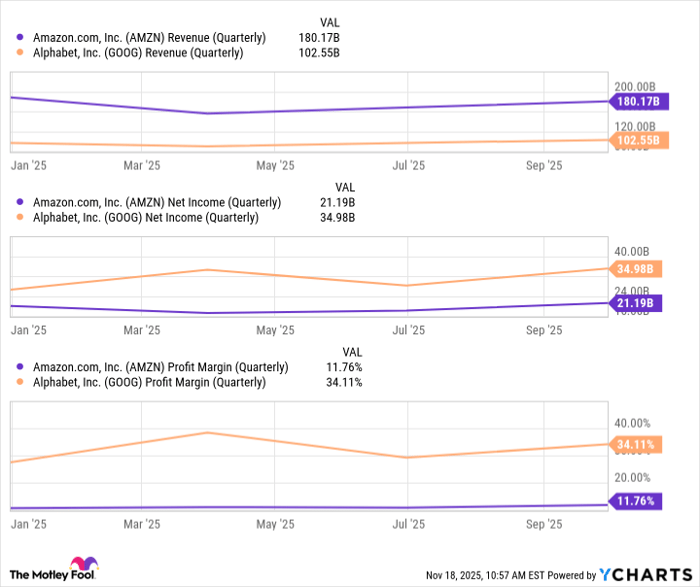

AMZN Revenue (Quarterly) data by YCharts.

Amazon generates higher sales, but Alphabet has higher profits and higher margins. Meanwhile, Alphabet still reigns supreme in search, despite challenges from artificial intelligence (AI) chatbots.

The company has made changes to address this issue, including an AI overview and an AI mode within its renowned search engine. Furthermore, Alphabet eliminated a major risk this year and avoided the worst outcome -- that of losing its Chrome browser, a crucial part of its advertising empire -- in its antitrust lawsuit. In my view, Alphabet has enough momentum to stay ahead of Amazon in the next couple of years.

What about Apple? Despite the iPhone maker's recent better-than-expected financial results, it's still facing significant threats.

The tariff situation is constantly evolving, and more news on that front could negatively impact Apple's stock price, as it still manufactures most of its products in China, a country President Trump has targeted with tariffs. Alphabet is also already cashing in on its AI strategy, whereas Apple has been lagging behind its similarly sized tech peers.

Alphabet's AI offerings through its cloud division, including its AI overviews and AI mode, as well as algorithms that increase engagement on YouTube -- leading to higher ad revenue -- are all important tailwinds for the company. So Alphabet could perform much better than Apple and beat the iPhone maker to a $5 trillion valuation.

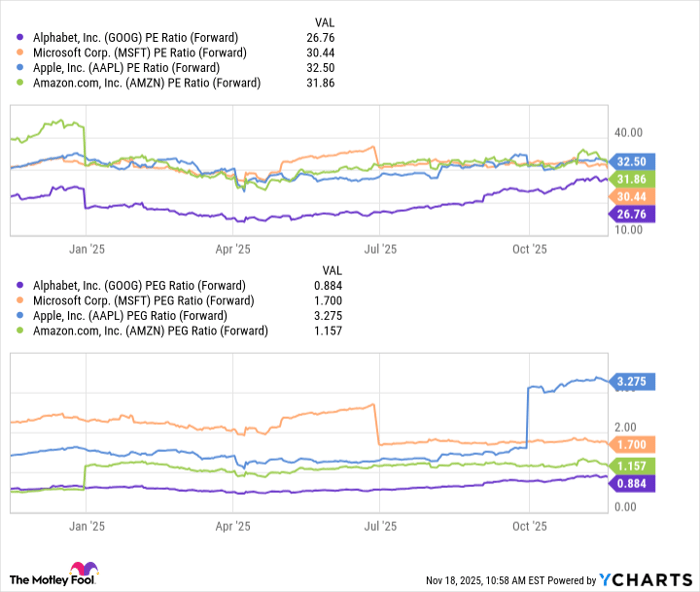

What about Microsoft? Both companies are thriving in the cloud and AI spaces. Microsoft arguably has an edge over Alphabet in both. However, Alphabet appears more reasonably valued when considering traditional valuation metrics.

GOOG Price-to-Earnings Ratio (Forward) data by YCharts.

That's one reason Alphabet could overtake even Microsoft to become the next $5 trillion company.

The more important question

Of course, outcomes are always hard to predict. A lot could happen in the next 12 months (or so) that would disrupt Alphabet's path to a $5 trillion market cap, and one of its peers could get there before.

Will Alphabet perform well enough in the next couple of years to be the next company to reach this goal? That's less important than determining whether the stock is worth holding for long-term investors, regardless of what happens in the short term. In that department, Alphabet looks like a great pick. It's a leader in several industries, boasting massive growth prospects in digital advertising, cloud computing, AI, and streaming.

The tech giant also has a hand in innovative and potentially disruptive new sectors, such as self-driving vehicles. Further, Alphabet benefits from a strong competitive advantage, thanks to its brand name, switching costs in cloud computing, and network effects in internet search.

After eliminating a major antitrust threat, the company's prospects look stronger than ever. All things considered, Alphabet appears to be a buy, even if it doesn't become the next $5 trillion company.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.