This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

- Nvidia recently announced a massive backlog for its computing chips.

- The stock isn't overvalued, contrary to some notions.

Nvidia (NASDAQ: NVDA) has been one of the most successful investments over the past few years, and 2025 is no exception. The stock is up nearly 50% for the year, although it's a bit down from the highs it was at just a few weeks ago.

The last time we heard from Nvidia, after its recent Washington D.C. GPU Technology Conference (GTC), the stock had spiked due to some incredible announcements. The next time we'll hear significant news from Nvidia is on Nov. 19, when it is slated to announce its third quarter fiscal year 2026 earnings (ended around Oct. 31).

Nvidia's stock has historically done quite well following an earnings announcement, so investors may be considering buying shares in anticipation. I think right now is an excellent time to invest in Nvidia's stock, and investors should consider scooping up shares before Nov. 19.

Nvidia has a massive backlog

As a long-term investor, I couldn't care less how a stock reacts to a quarterly earnings announcement. I'm trying to identify companies that have the potential to produce market-beating returns over the long run, and Nvidia checks that box for me.

Nvidia makes industry-leading graphics processing units (GPUs), which are the computing backbone behind nearly all of the artificial intelligence (AI) technology we experience today. These devices have been difficult to obtain since the AI arms race kicked off in 2023, and the future is no exception. During its Washington D.C. GTC event, Nvidia announced that it has $500 billion in cumulative orders for its high-end products, with a large chunk slated to be delivered over the next five quarters.

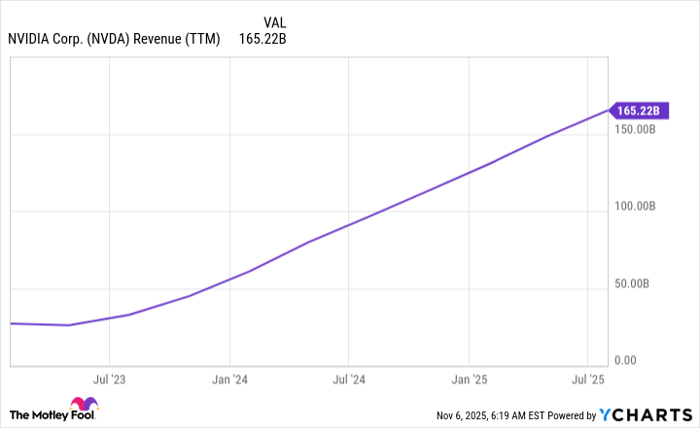

For reference, Nvidia generated $165 billion in revenue over the past 12 months.

NVDA Revenue (TTM) data by YCharts

Now, there's no guarantee that Nvidia can convert all of those orders into actual sales, as supply constraints are still active. However, I think it's safe to say that Nvidia's growth will be much faster than Wall Street analysts predict, as they have consistently underprojected Nvidia.

Next year, the average of 52 analysts projects Nvidia will generate $287 billion on average, or about 39% growth. Furthermore, forward earnings metrics are based on these projections from analysts. And with them undershooting the revenue guidance, it makes the stock look cheaper than it actually is.

Nvidia's stock isn't as expensive as some think

The range of analysts' estimates is quite wide for Nvidia. At the low end, one analyst projects $226 billion in sales. At the high end, one analyst projects $412 billion. Nvidia is expected to grow revenue at about a 60% pace in 2025, and if it can keep this up, that suggests a revenue projection of $331 billion.

If Nvidia can maintain its 52% profit margin, that would indicate profits of $172 billion. At today's valuation, that means Nvidia trades for a market cap of $4.75 trillion. That means Nvidia's stock is currently trading for 28 times next year's earnings, which isn't a bad price to pay considering its growth rate.

I think this showcases that Nvidia's stock is actually a lot cheaper than the market thinks it is, especially if it can convert on its orders. If it can, then Nvidia is a no-brainer buy right now. We'll likely hear more upbeat guidance on Nov. 19, and by buying today, you can capture all of the remaining upside in Nvidia's stock.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.