This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

-

Palantir and Alphabet have emerged as major players in the high-growth AI market.

-

Both are generating strong revenue growth -- and they see ongoing demand from customers.

Palantir Technologies (NASDAQ: PLTR) and Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) both have been benefiting from the artificial intelligence (AI) boom in recent quarters. Palantir sells AI-driven software that helps customers make better use of their data. And Alphabet uses AI to improve its Google Search platform and sells AI products and services to customers of its Google Cloud business.

All of this has resulted in earnings growth and stock performance for both companies over the past few years. But now, even as the AI boom marches on, Wall Street expects only one of these stocks to climb in the coming 12 months and has an overwhelming number of buy recommendations on this player. Meanwhile, Wall Street predicts the other stock will fall. Let's take a closer look at each of these AI powerhouses and find out which one Wall Street favors right now.

Palantir Technologies

Palantir may seem like an overnight success, as the stock has soared more than 2,000% in just three years, but this company actually has been around for more than 20 years. In its early days, Palantir depended on government contracts for growth, but the release of its AI-driven software system -- known as Artificial Intelligence Platform (AIP) -- a couple of years ago supercharged the growth of another customer. The commercial one.

Today, businesses and organizations are flocking to Palantir for AIP, and as a result, total commercial revenue has surpassed U.S. government revenue for four straight quarters. But this doesn't mean government business is slipping – instead, Palantir now is generating double-digit growth from both commercial and government businesses, and demand has prompted the company to lift annual forecasts across the board, from revenue to adjusted income from operations. Finally, Palantir has expertly balanced growth and profitability, suggesting we may expect a healthy earnings picture as this story progresses.

Amid this growth, however, Wall Street doesn't advise buying Palantir stock right now -- most analysts have a "hold" recommendation on the shares. And the average price forecast calls for a decline of a little more than 4% over the coming 12 months.

Alphabet

Alphabet is most known for its ownership of Google Search, the world's most popular search engine -- it holds more than 90% of this market, and that's helped advertising across the Google platform power Alphabet's earnings over time. Advertising makes up most of the company's revenue, but in recent quarters, AI has helped the Google Cloud business take off.

Customers have flocked to Google Cloud for AI infrastructure and tools, and the unit's revenue has soared. In the latest quarter, Google Cloud revenue climbed 34% to more than $15 billion. And this along with strong performance across the search business has pushed the company's overall revenue to a new milestone, surpassing $100 billion in a quarter for the first time. This is on top of a long-established track record of revenue and profit growth.

Analysts are overwhelmingly optimistic about Alphabet's potential over the coming 12 months, as we can see through their forecasts. Wall Street's average price estimate calls for an increase of about 6% for the stock, and most analysts have a "buy" or "strong buy" recommendation on the shares.

What does this mean for investors?

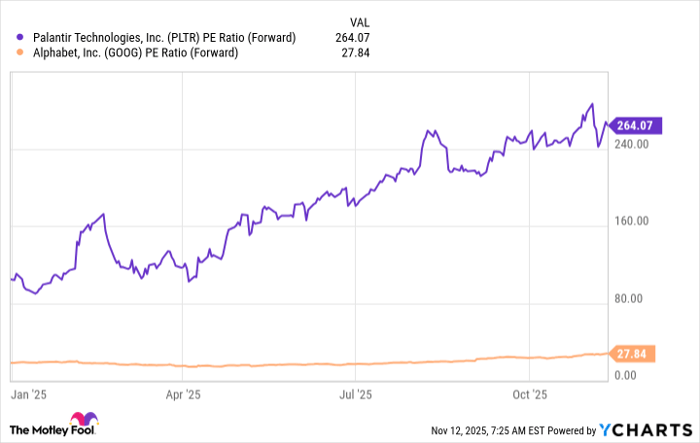

So, Wall Street clearly is cautious about Palantir -- and much of this has to do with the company's valuation. A look at it compared to that of Alphabet points to Alphabet as the better bargain today.

PLTR PE Ratio (Forward) data by YCharts

This doesn't necessarily mean that you should rush out and sell your Palantir shares or avoid the stock entirely, though. The company still has the earnings strength and market position to advance over the long term, but this high valuation may weigh on appetite for the stock in the near term. So Palantir is best left to aggressive growth investors right now, while Alphabet makes a solid buy for anyone seeking a potential AI winner.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.