This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

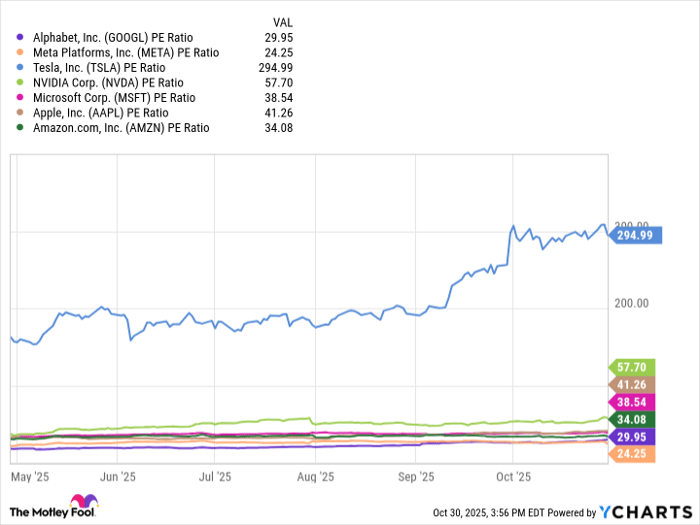

- Alphabet has the second-lowest P/E ratio among the "Magnificent Seven" stocks.

- Alphabet's Q3 results showed the beginning of its AI-driven success.

- The increase in capital expenditures is more likely to embolden investors than disappoint them.

OpenAI's ChatGPT has disrupted the entire tech industry as companies scramble to incorporate generative artificial intelligence (AI) into their ecosystems. Such moves often make older technology obsolete, and many have feared this is the case with Google parent Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG).

Google Search dominated for decades as users turned to the platform to find websites, and it earned tens of billions in revenue annually by tying these searches to digital advertising. However, many users now ignore Google altogether and have moved on to ChatGPT, even as Alphabet's response with Gemini and AI-enabled searches has not fully succeeded at stemming the tide away from its platform.

Fortunately, despite concerns about the search business, Alphabet's efforts to respond to and sidestep its competitive threats were so successful that its P/E ratio overtook that of Meta Platforms. Amid that move, Alphabet remains a buy; here's why.

The changing state of Alphabet

Alphabet stock appeared to turn a corner following the release of its earnings for the third quarter of 2025. The stock shot 3% higher in the trading session following the report's release.

Also, while it was already a more expensive stock than Meta, its 30 P/E ratio makes it significantly more costly than Meta at 24 times earnings. Despite the rising valuation, Alphabet is still the second-least expensive of the "Magnificent Seven" stocks, and the Q3 report points to indications that the stock will move higher.

Data by YCharts.

The difference is that the market appears to perceive the Google parent more as an AI company and less as a search and digital ad giant. Indeed, Alphabet still earns about 73% of its revenue from digital advertising.

Additionally, the 13% year-over-year rise in digital ad revenue in Q3 only slightly lagged the 16% revenue increase for the overall company. Still, considering that its AI app Gemini is up to 650 million monthly active users, the demise of search appears to have been exaggerated.

Overall, the company generated a total of over $102 billion in revenue for Q3, marking its first quarter exceeding $100 billion.

Nonetheless, Google Cloud experienced a 34% revenue increase over the same period. For now, that $15 billion in revenue is just under 15% of Alphabet's total revenue, but that improvement strongly indicates that the Google parent is becoming more of an AI company.

The company is also leaning into this strength. It took capital expenditures (capex) for 2025 up to a range of $91 billion to $93 billion. This is up from the original $75 billion it had expected to invest for the year and far above the $53 billion spent in 2024.

This money seems to be going a long way to transforming Alphabet into an AI juggernaut. Earlier in October, the company announced that its Willow quantum chip ran an algorithm 13,000 times faster than one of the world's most advanced supercomputers.

Moreover, its autonomous driving unit, Waymo, announced expansions into additional cities as it obtains approvals for fully autonomous driving in more locations. Although Waymo does not yet appear in Alphabet's financials, it is gearing up to become a significant source of revenue, further reducing Alphabet's dependence on search and digital ads.

Alphabet remains a buy

Given the Google parent's investments and growing AI-driven revenue, the 30 P/E ratio looks increasingly like a bargain for Alphabet stock.

Indeed, digital advertising remains its largest source of revenue, and the increase in capex to the $91 billion to $93 billion range seems like a staggering amount of capital for one year.

However, the rapid growth of Google Cloud strongly indicates its AI investments are paying off for the company. Additionally, the company has made significant technical advancements in quantum computing and autonomous driving, both of which heavily rely on AI.

Amid such improvements, the Google parent has an increasingly clear path to AI-driven gains. That likely means Alphabet is a bargain at 30 times earnings, indicating the stock should continue moving higher.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.