This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

- Nvidia will report its Q3 earnings in late November.

- The company should keep growing its revenue in 2026.

- Margin compression potential may make this stock overvalued right now.

In 2023, Nvidia (NASDAQ: NVDA) surpassed a $1 trillion market cap. By 2024, it had surpassed $3 trillion. This year, it zoomed higher to become the largest company in the world, with a current market cap of $5 trillion. Investors cannot get enough of the semiconductor company that is powering the artificial intelligence (AI) revolution.

Nvidia keeps signing large contracts with partners like OpenAI, keeping the semiconductor floodgates open. With the sector set to spend trillions of dollars on capital expenditures in the next few years, Nvidia looks primed to continue growing its $165 billion in annual revenue, which is up 1,000% in the last five years. Does that mean you should buy Nvidia stock before it reports earnings on Nov. 19?

Sustained AI revenue growth

Even though Nvidia's revenue has soared to $165 billion, the end market demand for its high performance computer chips looks ready to grow over the next few years. OpenAI -- the fastest-growing AI company in the world -- is set to spend around $1 trillion on infrastructure through various funding deals, over many years. It recently announced a $100 billion partnership with Nvidia.

As a part of the deal, Nvidia will be investing $100 billion into OpenAI, which will turn around and use those funds to buy Nvidia computer chips. While it may look like a circular financing deal for OpenAI, this could be a worthwhile investment for Nvidia to maintain a customer relationship with a company that could be worth trillions of dollars someday.

Outside of OpenAI, the large data center builders like Amazon are estimated to spend $550 billion on capital expenditures next year, which would be 24% growth from 2025. If we take that as a proxy for spending on Nvidia chips, we could see significant revenue growth for Nvidia yet again in 2026, bringing its total revenue to around $200 billion or higher.

Cost pressures and competition?

Revenue growth looks promising for Nvidia in 2026, but what about profits? If we look at the company's income statement, there are some signs that profits may face some headwinds next year.

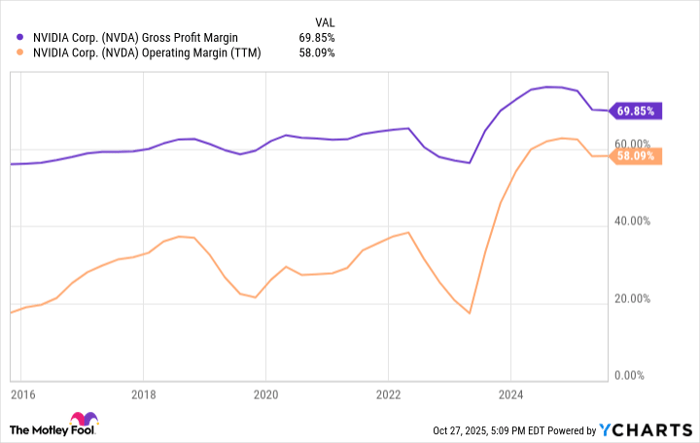

First, Nvidia's profit margin is coming down after soaring to a record in 2023 and 2024. Gross margin has slipped to 70%, while operating margin is down to 58% over the last 12 months. More headwinds may be coming because of the growth of shipments coming from Taiwan Semiconductor's factories in Arizona, which have higher costs than Nvidia chips fabricated in Taiwan. These costs may be added on to the selling price Nvidia buys from Taiwan Semiconductor, and if it cannot make up for it with higher selling prices to its own customers, Nvidia's gross margin will keep falling.

Second, there is increasing competition in AI chips from its own customers. Amazon is spending heavily on its custom-built Trainium computer chips, while Alphabet has been quickly increasing the amount of its own Tensor Processing Units (TPUs) it uses instead of Nvidia products. An increase of supply that can compete with Nvidia may lead to declining prices for Nvidia chips, which have sold at a premium price for years now. This could bring Nvidia's operating margin back to its historical level of 30%-40%.

NVDA Gross Profit Margin data by YCharts

Should you buy Nvidia stock?

When analyzing Nvidia stock, it is fairly clear that revenue will grow at a substantial double-digit rate in 2026. However, when you factor in potential for margin compression, its earnings growth may fall well short of its revenue growth.

Today, Nvidia stock trades at a trailing price-to-earnings ratio (P/E) of 54.5, which is the most expensive out of all the megacap technology stocks excluding Tesla. A high earnings ratio puts high expectations on future earnings growth from Nvidia, which it may fail to meet if margins keep going down.

For this reason, investors should avoid buying Nvidia stock going into its Q3 earnings report on Nov. 19. There are much better big tech stocks you can buy for your portfolio today.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.