This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

- Alphabet's Echoes algorithm just achieved a major quantum AI breakthrough.

- Elon Musk says Alphabet's achievement is making quantum computing more relevant.

- Despite Google's progress, other quantum computing stocks are getting more fanfare.

Whenever a new megatrend emerges, it seems inevitable that adjacent opportunities will emerge seemingly out of the woodwork -- promising to bring similar levels of abnormally high returns.

For the last three years, the main theme fueling the stock market to new highs has been artificial intelligence (AI). Broadly speaking, AI stocks include companies operating in the semiconductor and software industries. However, certain ancillary markets such as nuclear energy and infrastructure have also benefited handsomely from the AI revolution.

Recently, however, a new pocket within the AI realm has become the newest shiny object for growth investors: quantum computing.

Let's unpack why quantum AI is generating so much buzz. From there, I'll cover a recent quantum breakthrough that Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) just achieved and explain why Elon Musk's subsequent commentary should carry so much weight.

Why is quantum AI important?

Quantum AI is promising to upend the computing world. Traditional systems rely on binary bits (ones and zeros) to process algorithms and programs. Quantum computers, by contrast, use qubits.

Qubits can exist in multiple states at once, a property known as superposition. In theory, the value proposition here is that quantum systems can model multiple outcomes at the same time, rather than evaluating one possibility at a time. This could prove to be particularly useful in complex simulations -- from enhanced financial risk management to predicting weather patterns to clinical research.

Global management consulting firm McKinsey & Company is forecasting that quantum applications could add trillions in economic value over the coming decades. While quantum computing remains largely experimental, notable names outside of the technology world -- including JPMorgan Chase, Amgen, and Honeywell -- have been investing in quantum businesses as of late.

Did Google just achieve a quantum breakthrough?

Alphabet -- the parent company of Google -- is best known for its businesses spanning internet search, consumer electronics, and cloud computing. But underneath the broader umbrella, Alphabet is home to a number of subsidiaries exploring moonshot opportunities.

For example, Waymo is Alphabet's autonomous robotaxi operation, while DeepMind is the company's AI research lab, partially responsible for leading the charge in Google's pursuit of developing quantum applications.

Last week, Alphabet CEO Sundar Pichai announced that Google's Echoes algorithm -- which runs on the company's custom quantum Willow processor -- achieved a "verifiable quantum advantage." In essence, this means that the result found in Google's simulation can be repeated to arrive at the same conclusion. This helps verify (hence the jargon) that the quantum algorithm found a conclusive answer to a sophisticated query.

After Pichai posted the news to X, none other than X owner Elon Musk commented:

Congrats. Looks like quantum computing is becoming relevant.

-- Elon Musk (@elonmusk) October 22, 2025

In addition to being CEO of Tesla, Musk is also leading separate businesses across space exploration, medical devices, social media, and AI. I bring this up to drive home the idea that Musk is not your typical corporate executive. He's a serial entrepreneur and a technologist. For Musk to say that quantum computing is progressing toward commercial relevance is encouraging.

What are the best quantum computing stocks to buy right now?

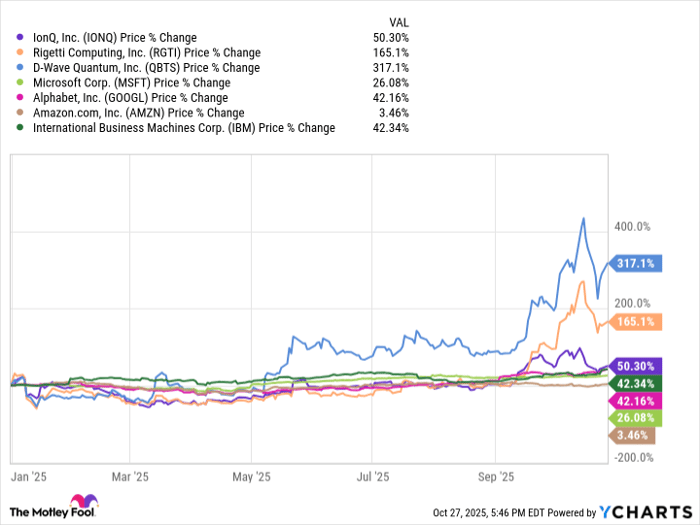

In the table below, I've included a cohort of the most popular quantum computing stocks. Among the biggest gainers are quantum pure plays like IonQ, Rigetti Computing, and D-Wave Quantum.

Do not be distracted by their respective market-beating performances. Each of these companies is highly speculative, barely generating revenue and boasting unsustainable burn rates. Between insider selling activity and a series of stock issuances to raise capital, it's clear that management at these companies is capitalizing on the outsize momentum pictured below.

By contrast, diversified blue chips like Microsoft, Amazon, IBM, and of course, Alphabet, are all exploring quantum computing in different ways -- from custom processors to next-generation computers. Each of these tech titans already has an established footprint in the AI boom, with quantum computing representing merely another catalyst. On the flip side, the trajectory of IonQ, Rigetti, and D-Wave essentially hinges on quantum AI becoming the multitrillion-dollar, global phenomenon it's promising to be.

Against that backdrop, I see the quantum pure plays as nothing more than risky meme stocks that are best left for day traders. Following the momentum now could expose investors to the greater fool theory, eventually leaving them holding the bag when momentum fades.

For these reasons, I see any mixture of the big tech companies featured above as the best long-term opportunities at the intersection of AI and quantum computing.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.