This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

- Warren Buffett is a Wall Street legend, but he was trained by another legend, Benjamin Graham.

- Graham said that overpaying for a good company can turn it into a bad investment.

- Buffett has found something to buy, but it's just a drop in the bucket when you look at Berkshire Hathaway's balance sheet.

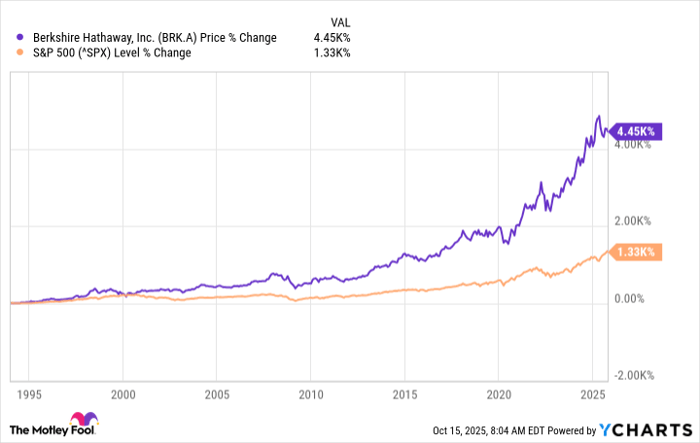

Most modern investors, and probably most people in general, know about Warren Buffett, the CEO of Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B). But fewer people know the man who helped to train him, Benjamin Graham. Right now, however, is a good time to think about one of value investor Graham's most prominent contributions to Warren Buffett's investment approach. It has had a $344 billion effect on Berkshire Hathaway.

The Warren Buffett way

Berkshire Hathaway is best described as a surprisingly diversified conglomerate. The company owns 189 companies outright, and it also has a large portfolio of publicly traded stocks. The truth is that Berkshire Hathaway isn't a normal company at all -- it is best seen as the investment vehicle of Warren Buffett.

Buffett's investment approach is deceptively simple. He likes to buy good companies when they are attractively priced, and then hold them for the long term. Each part of that approach is important, but one stands out today in an important way. Buffett doesn't chase stocks -- he waits for "Mr. Market" to get irrational and offer up deals that are hard to refuse.

"Mr. Market" is the construct of Benjamin Graham, who was a value investor. Graham used Mr. Market to highlight that investors can, and do quite frequently, missprice stocks to the upside and the downside. Investors are supposed to try to figure out if the long-term value of a business is worthwhile relative to the price the stock is being afforded by Mr. Market. Pay too much, and even the best company can end up leading to losses in your brokerage account.

Buffett has long taken Graham's value focus to heart, though he has softened his value focus over time. Still, if he can't find something worth buying, Buffett will just sit on cash and wait. Conversely, he will consider selling stocks that the market may be overeager to buy, even if that means letting the sale proceeds sit on the balance sheet in the form of cash and short-term investments (Treasury bills, for example).

The $344 billion warning you'll want to think about

Over the last couple of years, Buffett has been channeling his inner Graham. He has been selling stocks, and with the S&P 500 (SNPINDEX: ^GSPC) near all-time highs, he hasn't chosen to make any significant investments. As of the end of the second quarter of 2025, the outcome is a massive $344 billion cash hoard sitting on the balance sheet.

That's a drag on the company's financial performance. Sure, interest rates have risen so that cash is earning interest income that, given the total sum on cash, adds up to a material figure (Berkshire Hathaway generated roughly $6 billion in interest and dividend income in Q2). But Buffett could probably achieve higher returns with a good investment, given Berkshire Hathaway's track record as a business.

Ultimately, it's a big deal that Buffett can't find anything he wants to buy. Well, almost. Just as he's planning to step down as Berkshire Hathaway CEO (he's going to remain the chairman of the board of directors), Buffett has agreed to pay around $10 billion for Occidental Petroleum's (NYSE: OXY) chemicals business. The chemicals sector is out of favor right now, so he probably got a bargain.

Here's the thing. While the Oxy deal is material in size, it represents less than 3% of the cash on Berkshire Hathaway's balance sheet at the end of Q2. Simply put, Buffett found a deal, but he's still not finding enough good deals to put a lot of cash to work.

The warning you shouldn't ignore

Buffett hasn't stopped investing, and you probably shouldn't either. But he is being highly selective, and you should probably be just as selective, too. All of that cash is a warning that the market is expensive today. That's highlighted by the lofty levels of the S&P 500 index, but the excesses are broader than that, considering recent hot trends like AI and meme stocks.

If you follow Buffett, pay attention to the warning that his actions are giving. It's probably a time to be more cautious than aggressive when you make your investment decisions. Benjamin Graham would likely tell you the same thing.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.