This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

- Nvidia has a key partnership it just signed with OpenAI.

- The competition from its customers building their own chips is looming, but is not going to kill the business overnight, if ever.

- Nvidia's market cap will be determined by future spending on AI data centers.

The world is Nvidia's (NASDAQ: NVDA) oyster. As the spending boom on artificial intelligence (AI) data centers gets kicked into overdrive, the largest company in the world by market capitalization keeps moving higher and higher, with the stock at a price of $188 as of this writing on Oct. 8. Nvidia has a dominant market share for AI computer chips and is signing lucrative deals with companies such as OpenAI that will drive even more growth in the years ahead.

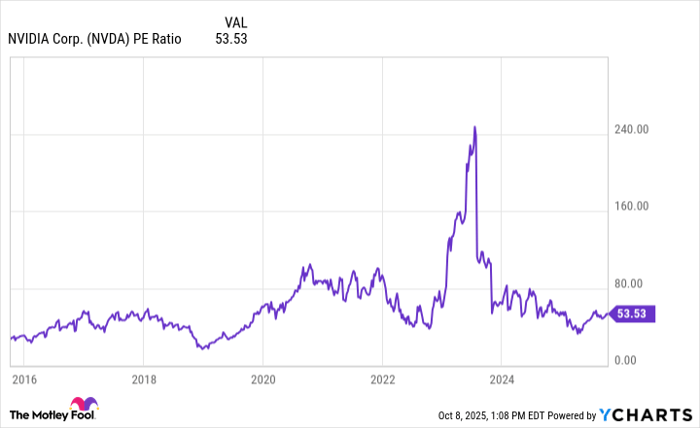

But at a market cap of over $4.5 trillion and an expensive looking price-to-earnings ratio (P/E), some investors are rightfully nervous that the best returns are in the past. Is that true? Let's dig into the numbers and try to estimate where the company's market cap will be five years from now.

An OpenAI partnership for data center spending

The most important player in AI today could be OpenAI, a disruptor aiming to dethrone the likes of Alphabet's Google and even other technology giants. It recently achieved a valuation of $500 billion.

On the back of this announcement, the company has opened the floodgates for funding to expand its computing capacity (which is important for powering its AI software). The largest of these deals is with Nvidia. Over the next few years, Nvidia has committed to investing $100 billion into OpenAI, which it will use to buy Nvidia computer chips to build out advanced data centers. As a part of this deal, beginning in 2026, OpenAI will use Nvidia's new Rubin chips, which are built to process advanced AI video capabilities better than present computer chips.

Partnering with OpenAI is almost a can't-lose scenario for Nvidia. You might think it is taking a risk by investing $100 billion into OpenAI, but that will directly lead to more purchases of the company's computer chips while simultaneously giving it an ownership stake in the fast-growing AI company. The companies plan to build 10 gigawatts of computing capacity, which will be around 20% of the existing data center footprint in all of the United States. In other words, it is a gargantuan planned expansion for OpenAI that directly points to new sales for Nvidia chips.

Competition from customers

While the deal with OpenAI should be a slam dunk for Nvidia, it is facing a growing threat from some of its other customers building their own computer chips for AI data centers. The largest players in the industry, such as Alphabet, Amazon, Microsoft, and Meta Platforms -- all huge spenders on Nvidia chips -- are creating their own custom-built hardware. If they can scale up these computer chips, that could mean decreased demand for Nvidia in future years.

Except for Alphabet's tensor processing unit (TPU), which has been deployed in its internal data centers for a decade and is on its seventh iteration, these competing chips from customers are nowhere near as powerful and efficient as the latest Nvidia models. When it comes to training and running AI systems, efficiency and computer processing scale are what matter above all else.

If Nvidia can maintain this large lead over the internal chips built by its cloud infrastructure customers, it should maintain its presence as the dominant player in AI. Even Alphabet still uses Nvidia chips for Google Cloud despite its long-running innovations with the TPU.

NVDA PE Ratio data by YCharts; PE = price to earnings.

Where will Nvidia's market cap be in 5 years?

With its current industry lead, it looks likely that Nvidia will maintain its market share of AI computer chips over the next five years, barring any major disruptions.

Today, Nvidia stock trades at a P/E ratio of 53, an expensive earnings ratio that indicates large expectations for future growth over the next five years. What investors need to consider is the uncertainty around semiconductor spending in regards to AI computing. This is a booming industry that could go through a bust if the data center players get ahead of actual customer demand for AI software. It hasn't happened yet, but is entirely possible to occur in the next five years.

This leaves us with a wide set of potential outcomes for Nvidia's revenue and earnings power five years from now. It is possible that its revenue will be cut in half if AI data center demand dries up. Or, it could be double today or close to the exact same level. This is the uncertainty that comes with investing in hypergrowth stocks.

Combined with the expensive earnings ratio, I think it is likely that Nvidia's market cap is around the same level today or even lower five years from now, despite how well the stock has performed in the last five years. Don't pile into Nvidia stock at a market cap of $4.5 trillion.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.