This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

- The British government is partnering with OpenAI to build out the country's AI infrastructure.

- As U.K. investment in AI accelerates, Amazon and Alphabet are stepping up their AI game as well, such as the former's partnership with Anthropic.

- Amazon and Alphabet are pouring billions of dollars into building the world's most powerful AI.

The arrival of ChatGPT in 2022 instantly made OpenAI one of the key players in the artificial intelligence (AI) space. On Sept. 16, the company announced an AI infrastructure project called Stargate UK, whereby it is partnering with other businesses and the British government to boost AI tech in the United Kingdom.

This followed the government's call "to make sure that Britain maintains its position as a world leader in AI." To do so, the country plans to increase its computing capacity by a minimum of 20x by 2030, with Stargate serving as a step toward that goal.

Great Britain's flurry of AI activity this year led Nvidia CEO Jensen Huang to declare, "The U.K. will be an AI superpower." While OpenAI's Stargate project helps the British government meet its AI objectives, it also creates opportunities for Amazon (NASDAQ: AMZN) and Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL). Here's what investors should know about Stargate UK's implications for this pair of tech giants.

How Stargate UK helps Amazon and Alphabet

The Stargate UK initiative illustrates why the AI market is expected to see incredible growth in the coming years. Analyst forecasts estimate the industry will hit $244 billion in 2025 and expand to $1 trillion by 2031 as businesses and governments around the world rush to adopt AI. OpenAI's Stargate can't support this level of expansion alone, which will enable Amazon and Alphabet to gain from the rising demand for computing capacity.

Both possess some of the world's largest cloud computing infrastructure. Amazon is the global leader here, and Alphabet is third behind Microsoft. Building on this success, they have constructed custom semiconductor chips to power their AI systems, creating competitors for Nvidia's pricey AI chips. This allows them to enhance AI performance while managing costs, which can help them capture customers.

In addition, Amazon partnered with artificial intelligence start-up Anthropic last year, integrating the latter's AI models into Amazon's services.

Meanwhile, Alphabet's research division, Google DeepMind, achieved a milestone on the path to artificial general intelligence. DeepMind's AI became the first to win a gold medal in an international computer programming competition, demonstrating AI's potential to match human thinking. DeepMind is based in the U.K.

Factors contributing to Amazon and Alphabet's AI might

Such AI advancements mean Amazon and Alphabet are well placed to meet the growing artificial intelligence needs of organizations, which require technologies tailored to the unique demands of AI systems.

The two companies now find themselves in a technological position similar to that of the broadband providers that replaced dial-up providers in the early days of the internet.

Moreover, Amazon and Alphabet continue to invest heavily in tech infrastructure to power their AI ambitions. Alphabet poured $67 billion into capital expenditures over the trailing 12 months through the second quarter. Amazon's capex was an astounding $103 billion over the same period.

Alphabet committed 5 billion pounds in support of the British government's AI efforts, including the opening of a data center near London on Sept. 16, coincidentally, the same day OpenAI announced Stargate UK. Amazon aims to rival Stargate's scale through Project Rainier, which the company calls "the world's most powerful computer for training artificial intelligence (AI) models."

The pair can afford these costs. After its $67 billion in capex spending, Alphabet was left with $66.7 billion in free cash flow (FCF) over the last 12 months through Q2. Amazon's FCF was $18.2 billion over that time.

Investing in these quiet winners

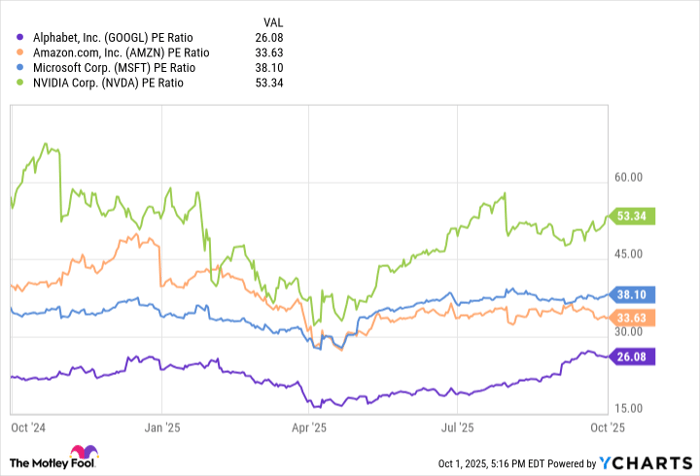

With AI as the latest growth driver for Amazon and Alphabet's businesses for years to come, now is a good time to consider scooping up their stocks. Here's a look at each one's share price valuation using the price-to-earnings (P/E) ratio, which reflects what investors are willing to pay for every dollar of earnings based on the trailing 12 months.

Contrasting these numbers against those of AI luminaries Microsoft and Nvidia provides some context. OpenAI is collaborating with Nvidia on the Stargate UK project, while Microsoft invested billions of dollars in OpenAI.

Data by YCharts.

The chart shows Amazon and Alphabet sport more attractive valuations than Microsoft and Nvidia, as indicated by the lower P/E ratios. In fact, Amazon's earnings multiple has dropped from last year, and while Alphabet's has risen, it remains considerably below those of its AI counterparts.

This suggests the potential upside from the U.K.'s AI investments may not be fully baked into Amazon and Alphabet's stock prices, given that they are indirect beneficiaries of the Stargate deal. Investing in these major AI companies now offers an opportunity for share price appreciation over the long term as the AI sector expands.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.