This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

- Nvidia is the world's leading GPU company, placing it at the foundation of the current AI megatrend.

- Hyperscalers are mapping out their chip demand years in advance, shedding light on the scale of the opportunity for Nvidia.

With a market cap of around $4.3 trillion as of this writing, Nvidia (NASDAQ: NVDA) is the world's largest company. However, the company's leadership believes its market cap could go much higher, and it has fairly solid data to back that premise up.

During Nvidia's fiscal 2026 Q2 earnings call, executives unveiled a jaw-dropping growth projection, and if they're right, by 2030, Nvidia could be worth $15 trillion or more. That would amount to approximately 250% upside from today's share price.

GPUs are in huge demand

Nvidia makes graphics processing units (GPUs), which are specialized parallel processing chips that were originally designed to speed up the rendering of video game graphics. Back in the late 1990s, video game software featured some of the most demanding workloads a computer was likely to face. But the specific tasks that were the most problematic for a standard central processing unit (CPU) could be handled rapidly by a parallel processor. So various companies, including Nvidia, developed GPUs -- the right tool for the problem.

Eventually, it became clear that GPUs were useful in a host of other situations in which computational problems could easily be broken down into many small pieces that could be solved simultaneously -- engineering simulations and mining cryptocurrency, among others. However, one use case for GPUs surfaced that has dwarfed all the others: training and powering artificial intelligence (AI) models. And this market for the chips only looks to be getting bigger.

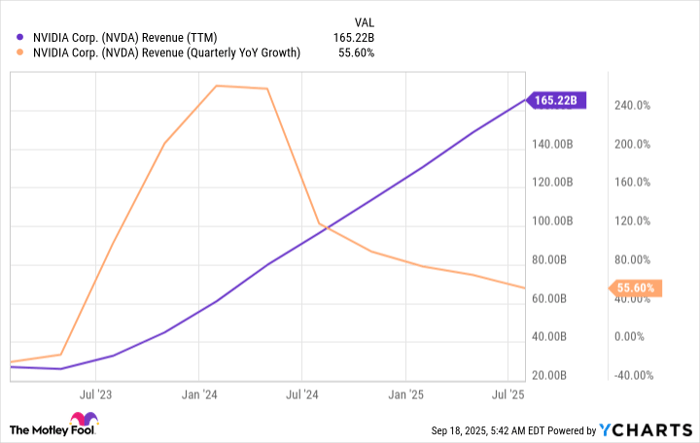

Over the past 12 months, Nvidia's revenue totaled $165 billion, and it's still growing at a rapid pace. Wall Street analysts project that in the current fiscal year (ending Jan. 2026), Nvidia's top line will hit $206 billion, but even that amount is nothing compared to where management believes the business could go by fiscal 2030.

Data by YCharts.

During the late-August earnings call, management discussed the AI data center market's growth trajectory. Currently, they estimate companies will spend $600 billion this year on AI-related capital expenditures (capex) with the bulk of that coming from just four hyperscalers -- Amazon, Microsoft, Alphabet, and Meta.

Considering data center revenue made up 89% of Nvidia's top line in the past year, the company could end up claiming as much as 30% of that capex spending. And there's more: By 2030, Nvidia estimates global data center capex could total $3 trillion to $4 trillion.

While some investors may be quick to write off this massive market projection, data centers take years to build. The process includes identifying a location, sourcing power, designing the facility, building it, and outfitting it with computing equipment. This means many of the data centers companies are announcing plans for in 2025 won't be operating until 2026 and beyond. So AI hyperscalers (and other big enterprise buyers) must coordinate chip supply with Nvidia. Otherwise, they could face GPU shortages for their data center buildouts.

So while Nvidia's forecast deserves scrutiny, investors should also consider what it means for the stock if that forecast proves accurate.

Nvidia could be a $15 trillion company by 2030

If Nvidia's market forecast pan out, its path to becoming a $15 trillion company by 2030 is fairly clear. Based on the midpoint of its market projection, $3.5 trillion, the company's revenue can top $1 trillion by 2030 assuming it continues to capture a 30% share of that spending.

Combined with Nvidia's strong net income margin, currently 52%, its profits could climb to $500 billion by the end of the decade. Put it all together, and the stock would only need a forward earnings multiple of approximately 30 (it currently trades at 40 times forward estimates) to bring Nvidia's market cap up to $15 trillion.

Many investors will find these numbers hard to believe, and this is undoubtedly a bull-case scenario based on optimistic projections from CEO Jensen Huang and his team. However, recall that just three years before Nvidia became the world's first $4 trillion company, it was worth about $300 billion.

And even if the actual market opportunity comes in below Nvidia's outlook, the rapid growth of AI development should still be enough to support the stock's market-beating track record, making it a buy regardless.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.