Berkshire Hathaway Inc (NYSE: BRK.A) (NYSE: BRK.B) is arguably the most closely monitored portfolio in the world.

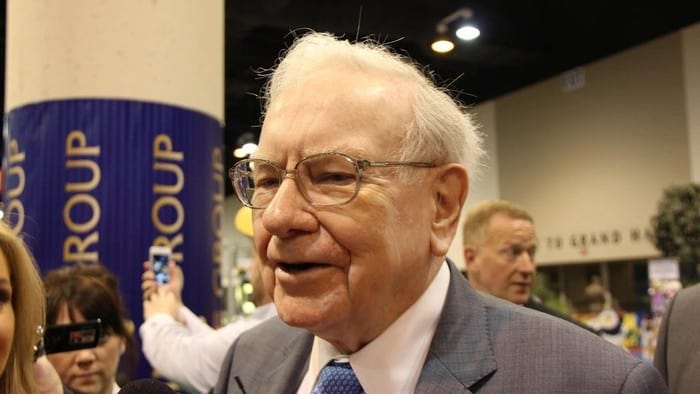

Under legendary investor Warren Buffett, Berkshire Hathaway has delivered a compound annual growth rate (CAGR) of around 20% over the past six decades.

That's double the S&P 500's long-term average market average of around 10%.

Investors have become accustomed to expecting Berkshire Hathaway to beat the market, and often look to its portfolio for stock ideas.

However, at the time of writing, Berkshire Hathaway is trailing the S&P 500 for the year to date.

Berkshire Hathaway has risen 11% so far, while the S&P 500 is currently sitting 13% higher.

The S&P 500's impressive run has largely been driven by strong artificial intelligence (AI) enthusiasm, with the Magnificent 7 delivering particularly strong returns. Notably, the poster child for AI, Nvidia, which also makes up around 8% of the index, is up 29% for the year to date.

So, what has driven Berkshire's underperformance so far?

While there are many moving parts to consider, the following three drivers can explain the majority of Berkshire's performance this year.

Stock picks

Berkshire Hathaway's investment returns reflect the companies that it's invested in.

While Berkshire's portfolio includes more than 40 individual stocks, it is highly concentrated in a select group of companies. More than 60% of the portfolio's market value is concentrated in just five stocks.

These are Apple, American Express, Bank of America, Coca-Cola, and Chevron.

Although Berkshire Hathaway dramatically reduced its position in Apple last year, it remains its largest position. Apple's share price is up just 5% for the year to date, creating a drag on Berkshire's performance relative to the S&P 500 benchmark.

Coca-Cola and Chevron have also trailed the market, rising 6% and 9% for the year to date.

Meanwhile, American Express and Bank of America have outperformed the S&P 500 this year, rising 17% and 15%, respectively.

Large cash position

Another contributor to Berkshire Hathaway's underperformance is its large cash balance.

Over the past few quarters, Warren Buffett has warned that the S&P 500 is trading at a high valuation.

This has caused Berkshire to sell stocks and accumulate cash.

At the end of the second quarter of 2025, Berkshire had a cash balance of US$344 billion. That's the second-highest in Berkshire Hathaway's history.

Holding a large amount of cash detracts from returns when the market goes up. On the other hand, it can deliver outperformance during a downturn.

For now, this strategy has caused Berkshire Hathaway to underperform the S&P 500 for the year to date.

However, only time will tell whether Berkshire will finish the year behind the market. As we have seen this year, the stock market can be volatile and turn at any moment.

Historically, when Buffett has held high levels of cash, a stock market downturn has eventually followed.

Warren Buffett's retirement

Earlier this year, Warren Buffett announced his retirement and named Greg Abel his successor.

News of Buffett's exit triggered investor scepticism about the company's future, leading to an erosion of the "Buffett Premium".

The "Buffett Premium" refers to the extra valuation assigned to Berkshire Hathaway due to Buffett's track record.

In January 2026, Buffett will officially hand over the reins to incoming CEO Greg Abel, beginning a whole new era for the investment conglomerate.

Will there be an "Abel Premium"? We'll likely need to wait quite a few years to find out.