This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

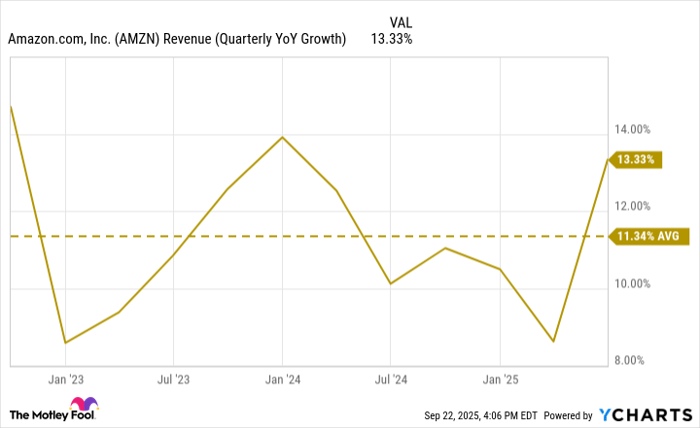

- Amazon's sales rose by 13% last quarter, which was largely in line with how it has done in previous years.

- Investors may have been expecting more of a jump in sales due to its significant investments in artificial intelligence.

- The stock is trading at a lower price-to-earnings multiple than normal.

The stock market is having another solid year, with the S&P 500 up by 14% as of Monday's close. What's a bit surprising is that tech giant Amazon (NASDAQ: AMZN), has risen by less than 4%. Despite being a big name in tech and investing in artificial intelligence (AI), there doesn't appear to be much hype around the stock these days.

Is there something wrong with Amazon's stock for it to have seemingly fallen out of favor with growth investors? Let's take a closer look at what's been going on with the business this year and if there is indeed a reason to avoid Amazon right now, or if instead, this could be a glorious time to buy it.

Amazon's growth rate continues to be strong

Over the past three years, Amazon has averaged a growth rate of around 11%. There have been fluctuations from one period to another, but it has generally been a safe bet to grow by double digits. And in its most recent quarter, which ended on June 30, its top line rose by 13% to $167.7 billion.

AMZN Revenue (Quarterly YoY Growth) data by YCharts

Analysts, however, may have been expecting more from the business given its significant investments into AI. Amazon plans to spend up to $100 billion on AI this year. And with a guidance for the current quarter of $15.5 billion to $20.5 billion in operating income, that means the mid-point is less than Wall Street estimates of $19.5 billion. There's a growing concern that AI investments may not be paying off for companies, and those fears could be weighing on Amazon's stock, especially in light of its recent projections.

Has Amazon simply fallen out of favor with tech investors?

Amazon's growth rate is on par for the course and in line with how it has done in previous year. But that might not be enough, particularly at a time when other tech companies are growing at faster rates and when AI-related spending is coming more under the microscope.

There are also a growing number of AI stocks to invest in, and if Amazon isn't knocking it out of the park with its numbers and guidance the way data analytics stock Palantir Technologies is, investors may simply opt for other stocks. Palantir is not nearly as profitable as Amazon, yet it has experienced tremendous growth due to AI. Its shares are up over 135% this year. Data storage company Seagate, although not directly involved with AI, has benefited from an uptick in business due to AI-related spending. With its growth rate accelerating, Seagate has been one of the hottest stocks on the S&P 500 this year, up 166%.

Amazon, unfortunately, with little to show from its AI investments, may simply not be winning investors over anymore. It trades at a price-to-earnings multiple of 35, which is significantly lower than its historical average, when it wasn't uncommon to see it trade at more than 50 and 60 times its profits.

The question for investors is whether a lower premium is justifiable and should be the new norm for Amazon, or if it is a bargain buy.

Why I'd buy Amazon today

Other tech stocks may be experiencing faster growth than Amazon, but this company has many practical use cases for AI. From enhancing the online shopping experience to making the robots in its warehouses more efficient, Amazon is one stock where I don't doubt that it can benefit from AI in the long run.

Investments can take time to pay off, and given Amazon's impressive growth and results over the years, investors should trust in its processes and ability to unlock the most value for its shareholders. And that's why I think buying the stock at any type of discount can be a great move for the long haul.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.