This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

- Meta's dominant social media platforms are funding its AI investments.

- Even after an impressive multi-year run, the stock isn't all that expensive.

Meta Platforms (NASDAQ: META) has been one of the top-performing stocks this year, with a nearly 30% rise so far. Despite that strength, I still think it's an excellent stock to buy now. I've got five reasons why Meta is a no-brainer buy, although there are probably many more when you really dig into the stock.

1. Dominant platforms

Meta Platforms' social media sites include Facebook, Instagram, Messenger, WhatsApp, and Threads. Those are collectively the most widely used social media apps in the world.

In Q2, Meta's advertising revenue rose by an impressive 22%. In Q3, Meta expects its revenue to rise by 20%, indicating further strength. Although Meta has had a dominant run, that run is far from over.

2. AI ads

One of the reasons Meta's revenue is growing so quickly is that it's starting to incorporate artificial intelligence (AI) features into its ad platform. Management noted that its ad conversions have improved since it implemented some of its tools, and users are spending more time on its platforms.

We're just in the early innings of advertising tools with integrated AI, and further advancements could drive significant revenue growth for Meta if they lead to dramatically improved conversion rates.

3. All-star AI team

Meta has attracted some of the brightest minds in AI with nine-figure signing bonuses. With Meta's top-notch talent divided up to work on several AI projects at once, it may be a few years before we see the fruits of their labor. And while there are no guarantees, some major innovations could very well come from this talent pool.

4. Inexpensive growth

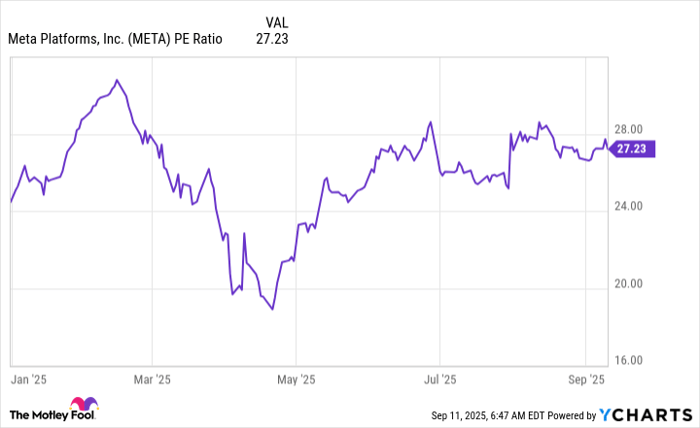

Moving to the stock, Meta isn't dramatically overvalued despite its business being at the forefront of the AI investing movement.

META PE Ratio data by YCharts

The stock trades for just a bit over 27 times trailing earnings, which isn't very expensive relative to the broader market. The S&P 500 trades for 24.8 times earnings although it tends not to grow nearly as quickly as Meta is. This bodes well for Meta's future, as it shows the company can deliver outsize returns with a reasonable price tag and strong growth rates.

5. Revenue potential

Meta Platforms may be focused on integrating AI with its social media platforms, but it is also developing several other exciting technologies. One of them is its AI glasses, which could be a must-have item if Meta can get the price, form factor, and abilities correct.

Its uses could be quite varied. According to one news report, users might be able to look at a sign and automatically translate it into another language. Or it might coach users on how to cook. The possibilities could be endless.

All the projections for Meta's growth and performance over the next few years essentially exclude any contributions from its Reality Labs division. Should one of these products become a must-have device, a massive new revenue stream could emerge and push Meta's stock higher.

Although this is far from certain, start-up-like upside within Meta would be the cherry on top for a solid company, and I think it makes for an excellent stock to buy right now.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.