This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

- Nvidia may be best-known for its GPUs, but the company's CUDA software architecture is the driving force behind the company's dominance.

- By offering a comprehensive ecosystem across hardware and software, Nvidia has become the go-to ecosystem for generative AI development.

- Alphabet is following a similar playbook tailored for the rise of quantum computing.

Over the past few years, Nvidia has cemented its position as the undisputed leader in artificial intelligence (AI). Its graphics processing units (GPUs) are more than just hardware -- they serve as the foundation of a tightly integrated ecosystem built on the CUDA programming architecture.

CUDA transformed Nvidia's chips from a commoditized product into a comprehensive infrastructure layer for AI developers. Simply put, if you want to train high-quality AI models, chances are you're doing it with Nvidia's hardware and software.

Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) may be charting a similar path in quantum computing. Through a series of strategic moves in recent years, the company is laying the groundwork to become the Nvidia of quantum platforms.

Building the hardware foundation like Nvidia's GPUs

Nvidia's GPUs were the gateway for developing the CUDA framework. Alphabet's parallel effort on the hardware side centers on its tensor processing units (TPUs) and its research into superconducting quantum processors (i.e. Willow). While TPUs are not quantum devices, they highlight Google's capability to design custom silicon tailored for new, increasingly sophisticated computational needs.

The company's Sycamore processor -- which demonstrated quantum supremacy in 2019 -- provided a proof-of-concept that its approach to building quantum hardware was viable. Since then, Alphabet has poured years of investment into refining its AI and quantum stacks -- assembling the engineering talent and technological expertise to iterate on architectures until they achieve practical utility.

Much like Nvidia's cycle of GPU innovation, Alphabet is positioning itself to develop successive generations of quantum processors that can be paired with proprietary systems and software -- creating an integrated ecosystem just as Nvidia has.

Cirq could be Alphabet's version of CUDA

Hardware alone rarely creates a durable moat. Nvidia's true competitive advantage comes from its one-two punch of GPUs and CUDA. This combination has created a powerful lock-in effect, making the switching costs to competing platforms -- even those with lower upfront investment -- extremely steep. Once developers build and optimize their models on CUDA, abandoning Nvidia's walled garden becomes almost unthinkable.

Alphabet is pursuing a similar strategy in quantum computing, though with a different design philosophy. Its analogue to CUDA is Cirq -- an open-source quantum programming framework the lets developers build and run applications across multiple backends. Unlike CUDA, Cirq does not tie developers exclusively to Google's hardware. In fact, platforms such as Microsoft Azure and IonQ already integrate with Cirq, underscoring its interoperability.

Paradoxically, this openness may strengthen Alphabet's position. By fostering a larger community of developers who become fluent in Cirq -- even outside of Google's hardware stack -- the company is ensuring that when its own quantum applications reach commercial scale, an ever-growing developer base is already aligned with its tools.

In other words, while Nvidia's moat is supported by tight integration, Alphabet is cultivating an ecosystem anchored in accessibility and collaboration -- an open framework that could become just as sticky, but drawing developers in voluntarily rather than lock-in.

DeepMind: The path to unlock valuation expansion

While CUDA has been the foundation of Nvidia's dominance, the company's success ultimately hinged on widespread external adoption and validation by developers.

Alphabet, by contrast, already controls one of the world's premier AI research labs -- DeepMind -- which gives it a built-in feedback loop to stress-test its quantum algorithms, refine Cirq, and push next-generation processors like Willow forward more quickly.

This vertical integration across research, hardware, and software mirrors the Nvidia GPU-CUDA dynamic that made it indispensable to AI development. Nvidia's ecosystem has translated into years of explosive revenue growth, expanding profit margins, and record valuation expansion.

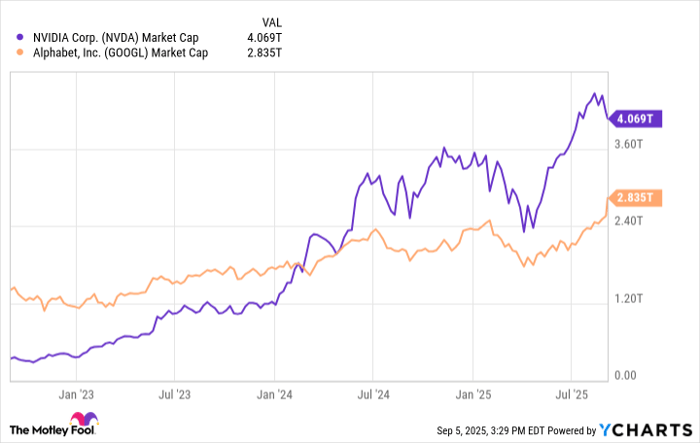

NVDA Market Cap data by YCharts

Alphabet appears to be deploying a similar playbook -- but adapted for the quantum era. Instead of a closed system, Alphabet is building an open, yet sticky, ecosystem designed to attract developers by choice and create a powerful gravitational pull around its platform.

For investors, the takeaway is clear. As AI workloads grow more complex and quantum computing inches closer to real-world utility, Alphabet is positioned to drive and monetize this shift at scale.

Long-term investors should view Alphabet not just as a leader of today's technology landscape, but one that is at the forefront of the next frontier of AI. I think that buying and holding Alphabet stock offers exposure to a potential Nvidia-like return over the next several years.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.