This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

- Nvidia’s stock has enjoyed a run-up since crashing after President Donald Trump’s tariff announcement.

- Thanks to strong sales, Nvidia’s net income grew an impressive 59% year over year.

- Nvidia expects AI infrastructure spending to increase in the coming years, fueling further demand for its products.

Nvidia (NASDAQ: NVDA) shares are trading up about 30% this year, through the week ending Aug. 29, driven by the frenzy around artificial intelligence (AI). The semiconductor chipmaker's stock bounced back from a 52-week low reached on April 7 after President Donald Trump's announcement of new tariffs triggered a stock market crash.

Just because Nvidia's share price rebounded doesn't mean you missed the boat to buy. One factor suggesting Nvidia stock still has room to run is its share price valuation.

Gauging Nvidia stock's valuation

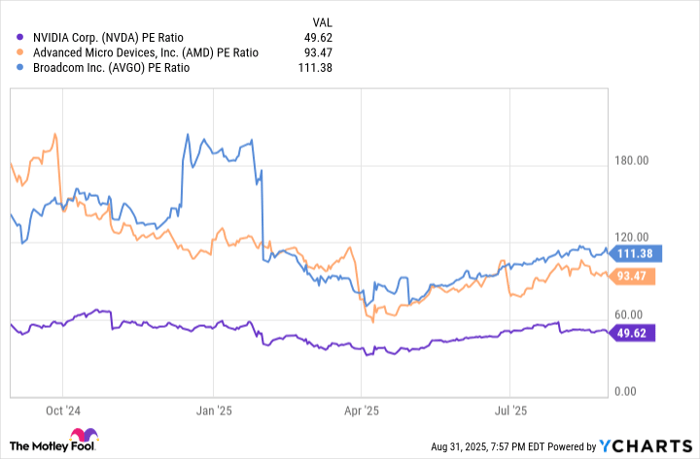

The price-to-earnings (P/E) ratio is a common method to assess the value of Nvidia stock. Comparing it to some of the company's AI semiconductor competitors, such as Advanced Micro Devices and Broadcom, can offer valuable insights.

Data by YCharts.

The chart reveals Nvidia's earnings multiple is significantly below that of AMD and Broadcom, indicating its stock is a better value. In fact, its current P/E ratio of about 50 is lower than it was last year when it was trading at all-time highs, so its valuation has improved.

Nvidia's performance explains why. For its fiscal second quarter, ended July 27, its net income soared 59% over the prior year to $26.4 billion as revenue rose 56% year over year to $46.7 billion.

Nvidia's share price dropped after Q2 results showed its data center revenue missed Wall Street's expectations, creating a buy opportunity.

Part of the shortfall was due to the U.S. government blocking AI chip sales to China. Consequently, Nvidia excluded the region from its forecast fiscal Q3 revenue of $54 billion. Even so, that figure is a substantial increase from the previous year's $35.1 billion, demonstrating demand for Nvidia products isn't slowing down.

The company's management predicts AI infrastructure spending will hit at least $3 trillion by 2030. While forecasts vary widely, with some predicting global capital expenditures will exceed $7 trillion by the end of the decade, AI spending to date has shown explosive expansion, which means Nvidia could see more years of revenue growth ahead.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.