This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

- The high-profile technology company's stock is priced nearly twice as high as the broad market.

- This rich valuation, however, is supported by the company's results and growth trajectory.

- While arguably worth their steep price, expensive stocks also tend to be more volatile than average.

Given that shares are priced at more than 40 times this year's expected earnings of just under $4.40 per share, buying into AI technology giant Nvidia (NASDAQ: NVDA) may feel a little intimidating. For perspective, the S&P 500 currently trades at less than 25 times its trailing earnings and just under 24 times its forward-looking profits.

Still, there's a case to be made for buying Nvidia stock despite its steep valuation. One simple chart will explain why.

One amazing chart

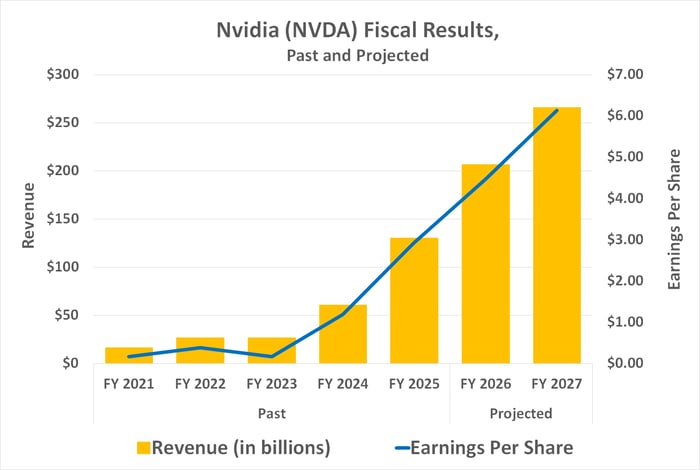

As the image below illustrates, projected revenue growth of 53% for Nvidia's fiscal year 2026, currently underway, is expected to lead to a per-share profit of nearly $4.40, up 46% from last year's $2.99 and en route to next year's anticipated earnings of $6.04 per share. That's simply enormous growth that few -- if any -- other companies are matching.

Data source: StockAnalysis.com. Chart by author.

This incredible growth isn't apt to end in just a couple of years, though. The expanding demand for artificial intelligence (AI) technology is likely to last far longer. An outlook from Global Market Insights suggests the worldwide AI hardware market is set to grow at an average annualized pace of 18% all the way through 2034.

Not actually all that unreasonable

Generally speaking, what's considered a reasonable price-to-earnings ratio is the same as a company's rate of earnings growth. For instance, Nvidia's per-share profits are projected to grow by an average of a little more than 40% this year and next, which is in line with Nvidia's fiscal 2026 P/E ratio of just above 40.

In other words, given the company's current rate of earnings growth, the stock's valuation actually is rather reasonable.

Still, even if they're worth it in the long run, Nvidia shares' frothy valuation makes them vulnerable to extreme volatility. Buckle up if you're buying here following the slight post-earnings setback.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.