This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

-

Amazon's AWS segment continues to grow rapidly.

-

This growth should be sustained for years to come.

Amazon (NASDAQ: AMZN) has been one of the best long-term investments in history. But with its market cap of $2.4 trillion, some investors worry that the stock has become too expensive. Shares don't look dirt cheap, but there's one exciting growth opportunity that could make Amazon stock cheaper than you think.

Amazon's Web Services division is the future

Most laypeople know Amazon as an e-commerce behemoth. But savvy investors understand the company in two parts. Yes, Amazon operates the largest e-commerce business the world has ever known. But it also operates the world's largest cloud infrastructure business, a division colloquially referred to as AWS.

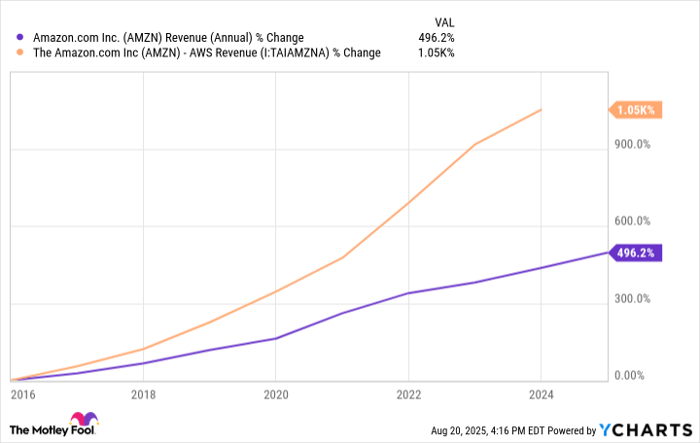

Over the past decade, growth in Amazon's AWS division has been the biggest factor in sales growth. As you can see below, AWS revenue growth has surged by more than 1,000% over that time period. Slower-growing divisions like e-commerce have dragged down the average, leading to total company revenue growth of just 496%.

AMZN Revenue (Annual) data by YCharts

Since 2020, AWS revenue has grown by more than 150%. Online store sales for Amazon, meanwhile, have grown by just 26%. But it's not just revenue growth that AWS is contributing to. Last quarter, AWS contributed the majority of Amazon's operating income. Profitability in that segment simply trounces the e-commerce division.

The best news is that AWS may be just getting started. It already holds a 30% global market share -- the largest of any cloud infrastructure provider. This gives it the scale and capital to invest heavily in growth. Where will that growth be coming from? Mostly from increased artificial intelligence spending. AI companies rely on cloud computing to train and run their models. With AI spending expected to grow by more than 30% per year over the next decade, AWS is in a prime position to grow its business rapidly.

AWS nearly ensures that Amazon's growth will continue for years to come, making the stock cheaper than most expect over the long term.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.