This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

-

While most of Nvidia's revenue hails from the U.S. and Europe, the Chinese market represents an estimated $50 billion opportunity.

-

Recent changes to tariff policies and export controls have stifled Nvidia's potential in China throughout 2025.

-

Nvidia and the U.S. government have formed a deal structure that helps pave the way for Nvidia to reclaim dominance in the key Asian market.

Although it's only August, 2025 has already played out like a modern-day Greek tragedy for semiconductor powerhouse Nvidia (NASDAQ: NVDA). Its year has been marked by a litany of setbacks, comebacks, and everything in between.

Earlier this year, more than $1 trillion of Nvidia's market value was wiped out. Yet today, the company boasts a market cap of $4.4 trillion -- reclaiming the crown as the most valuable company in the world.

At the center of Nvidia's headaches in 2025 is China -- and no, not because of DeepSeek. The real culprit has been a wave of sweeping tariff policies and export controls that have curtailed Nvidia's influence in the Chinese AI market.

Now, after months of negotiations with regulators in Washington, it appears that the tide may be turning. Nvidia could be on the precipice of reestablishing its presence in one of its most crucial Asian markets.

Let's unpack the details of Nvidia's new deal structure in China and examine why it should be celebrated as a massive win for investors.

How big an opportunity is China for Nvidia?

According to accounting and consulting firm Deloitte, the global total addressable market (TAM) for semiconductors, as measured by sales, reached $627 billion in 2024. Deloitte projects that the market will grow at a compound annual growth rate (CAGR) of 19% over the coming decades -- ultimately reaching $2 trillion by 2040.

Outside of the U.S., China remains one of the most important markets fueling demand for high-performance chipsets, particularly graphics processing units (GPUs). Nvidia CEO Jensen Huang has estimated that the AI opportunity in China alone could be worth as much as $50 billion.

In 2024, Nvidia generated $130 billion in revenue, with China capturing roughly 13% of this sum. During the first quarter of 2025, Nvidia's $5.5 billion of China sales accounted for roughly 12.5% of total revenue.

This leveling trend underscores how the current administration's policies toward China have started to constrain Nvidia's growth potential in the region.

Why is Nvidia's new China deal so important?

According to multiple news outlets, Nvidia has reached an agreement with Washington regarding its operation in China. Under the terms, Nvidia will pay 15% of its China-based sales to the U.S. government. In effect, the arrangement provides Nvidia with a pathway to penetrate this critical market through its tailored H20 chips.

While this might initially resemble a tax, investors should avoid viewing it through that lens. First, the agreement applies to sales of Nvidia's AI chips rather than to profits, unlike traditional forms of taxation. Moreover, the 15% rate does not appear to be variable in structure like a royalty, which is typically tied to intellectual property (IP) and subject to fluctuate.

While this deal might appear unusual at first glance, these structures are not without precedent in global business practices. For example, energy companies that extract natural resources or commodities in foreign countries often operate under similar revenue-sharing agreements with host nations in exchange for distribution rights.

In my view, dedicating a modest share of sales to secure access to China represents a strategic trade-off. In the long run, it allows Nvidia to preserve its dominant position in one of the world's most important AI markets and prevents domestic rivals such as Huawei from eroding its competitive moat.

Is Nvidia stock a buy?

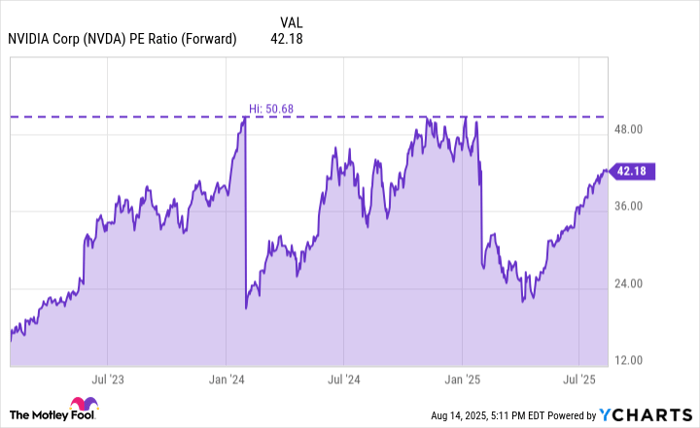

While Nvidia's forward price-to-earnings (P/E) ratio has been expanding recently, levels remain muted compared to peaks reached previously during the AI revolution. In my view, part of this multiple compression reflects concerns surrounding China -- perhaps overly so.

NVDA PE Ratio (Forward) data by YCharts.

Nvidia's new agreement in Washington offers the company renewed momentum, securing revenue in a critical market without forfeiting much in the way of profits -- even with the 15% remittance to the U.S. government.

Over the long term, I see this arrangement as a strategic mechanism for Nvidia to strengthen its position overseas and deliver durable growth across the global AI infrastructure market.

As these fundamentals take hold, I think the company's valuation multiples could expand further, potentially driving the stock to new highs sooner than many investors may be expecting. For that reason, I see Nvidia stock as a no-brainer opportunity to buy hand over fist right now and hold for years to come.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.