This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Key Points

-

Like all funds and portfolios, Berkshire Hathaway has underperformed from time to time.

-

Warren Buffett's quality-oriented approach to buying and holding stocks has paid off of late.

Artificial-intelligence-related tech stocks like Nvidia and Palantir have dominated headlines and led the marketwide bullish charge over the past five years. But, not every market-beating stock has been an AI technology name -- or even a growth name -- during this stretch. Warren Buffett and his team have proven their mettle once again, leading value-oriented Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) to a market-beating performance of its own since the middle of 2020.

Back in fighting form

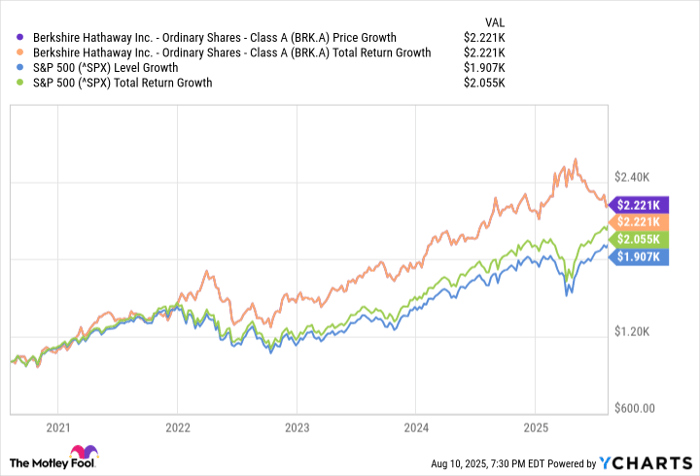

If you had you invested $1,000 in Berkshire Hathaway shares in early August of 2020, as I write this on Aug. 10, you'd be sitting on $2,221. That's an annualized growth rate of 17.3%, outpacing the S&P 500 's (SNPINDEX: ^GSPC) average annual growth pace of 13.8%, or 15.5% when factoring in reinvested dividends.

Making this five-year run even more impressive is that Berkshire has performed relatively poorly since May. That's not only when Buffett announced his end-of-year retirement, but also when investors began shedding their defensive value stocks that Buffett's conglomerate holds so they could plow back into growth-oriented technology names. It's still well ahead despite the headwind.

There's also some vindication in this market-beating performance.

You may recall that Berkshire's persistent underperformance for several years prior to 2021's rekindled leadership was prompting criticisms and questions of his old-school stock-picking approach. The past three years have reminded everyone that patience pays off when you prioritize owning quality businesses rather than chasing growth.

Buying and holding quality is always a sound strategy

Don't misunderstand. Just as it did for several years prior to 2021, there will come another time when Berkshire Hathaway shares lag the market. That's just the nature of Warren Buffett's value-minded style -- it tends to underperform when investors are captivated by new, game-changing industries.

Just remember the past five years the next time that happens, and the past three years in particular. A truly great stock is worth buying and holding even through the rough patches.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.