This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Bill Gates is a well-known entrepreneur, having co-founded Microsoft (NASDAQ: MSFT) in the mid-1970s. This made him a fortune, and he constantly ranks among the richest people in the world. He established the Gates Foundation Trust, one of the world's most well-funded foundations.

By examining its holdings, investors can gain insight into what one of the world's brightest minds considers top stock picks, and they've identified an AI stock that has been a stellar performer in recent years. In fact, the stock has more than doubled since the start of 2023 alone.

What is this stock? It's none other than Microsoft.

Microsoft is the foundation's top holding

This really shouldn't come as a surprise to anyone. Bill Gates runs the fund, so he will fill it with a company that he thinks will succeed. Most of this stock was donated from Gates' wealth; however, if the foundation didn't think Microsoft was set to succeed, they would have sold it a long time ago and moved on to something else.

About 25% of the foundation's worth is tied up in Microsoft stock, valued at around $10.7 billion. That's a concentrated bet for a charitable foundation, but it has worked out well with Microsoft's recent success.

Microsoft has emerged as a top AI pick due to its role as a facilitator in the space. It isn't developing its own generative AI model; instead, it's offering many of the leading ones on its cloud computing platform, Azure. Developers can choose from OpenAI's ChatGPT, a leading option, Meta Platforms' Llama, DeepSeek's R1 (a more affordable alternative from China), or xAI's Grok, a company founded by Elon Musk.

By offering a wide range of generative AI models, Microsoft isn't locking its clients into a single provider. This has made Azure a top choice for building AI models on, which is why it has outgrown its peers in recent quarters.

We'll get an update on how the other cloud computing providers -- namely Alphabet's Google Cloud and Amazon's Amazon Web Services (AWS) -- in the next few weeks, but I'd be shocked if Azure isn't growing quicker than they are. Azure has become a top platform for building AI applications, but has it done enough to make Microsoft a top buy now?

Microsoft's stock is starting to look a bit pricey for its growth

If Microsoft derived all of its revenue from Azure, I'd be a buyer at nearly any price. However, Microsoft has other product lines that aren't growing as quickly, which slows the company's overall growth pace.

In its latest period -- the third quarter of fiscal 2025 -- overall revenue rose to $70.1 billion at a 13% pace. While Microsoft doesn't break out the revenue generated by Azure, we know from prior information that it accounts for over half of the Intelligent Cloud division, which brought in $26.8 billion during Q3 (ending March 31). They do provide Azure's growth rate, which was Microsoft's top-performing division in Q3, rising 33% year over year.

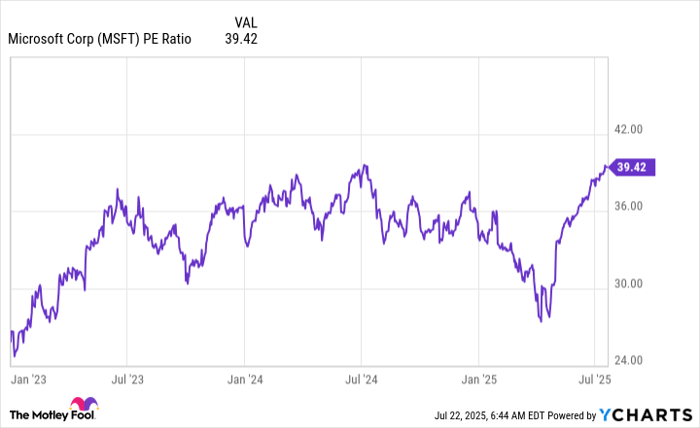

Microsoft's diluted earnings per share also rose an impressive 18%, but is that fast enough to justify its valuation? Microsoft trades at nearly 40 times trailing earnings, which is a very expensive price tag and exceeds its recent highs reached during the AI arms race period.

MSFT PE Ratio data by YCharts

Wall Street analysts project $15.14 in earnings per share for fiscal 2026 (ending June 30, 2026), which indicates the stock trades at 33.7 times forward earnings. That's still a high valuation, and investors need to start being a bit cautious when stocks reach that level, especially when they're growing at Microsoft's pace.

Yes, Microsoft is growing faster than the market, but it's not growing as fast as some of its peers. Take Meta Platforms, for example. It trades at 28 times trailing earnings and grew revenue at a 16% pace during its last quarter with 36% earnings-per-share growth. That's a cheaper stock growing faster, which should cause Microsoft investors to question whether it's the best big tech stock to be in right now.

Numerous other big tech stocks have better growth numbers and cheaper valuations than Microsoft. Although it's a dominant company, it's starting to look a bit expensive compared to its peers.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.