This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

One of the most important companies in the world reports earnings on July 31. Apple (NASDAQ: AAPL) -- maker of the iPhone, Apple Watch, Air Pods, and more -- is set to give investors another financial update for the second quarter of 2025. The stock has soared in the last five years but has recently hit a rough patch in 2025, with shares down 14% year to date (YTD) due to concerns over slowing growth and tariffs implemented by the United States on other nations.

2025 is shaping up to be a pivotal year for Apple as it tries to find new ways to grow. Does that mean you should buy or sell the stock before the July 31 earnings? The answer is clear when looking at the numbers

Struggles to keep growing with peers

It is undoubtedly one of the most profitable products ever, but the iPhone is now hitting maturity in relation to its annual sales around the globe. Pricing power can help the $200 billion-per-year product eke out a little bit of growth in the coming years, but the fact that upgrade cycles for customers keep expanding will be a consistent headwind for product growth. New phones are now similar to older models, with little technological innovation to spur customers to upgrade to the latest devices.

The iPhone makes up half of Apple's overall revenue. Stagnation in iPhone revenue -- which hasn't grown since 2021 -- is why Apple's overall revenue has barely grown in the last few years. It is searching for the next blockbuster computing product. Last year, it debuted the Apple Vision Pro, a $3,000 mixed reality headset. Today, it is clear that the Vision Pro has been a total flop for the company, with very few headsets actually sold. Yes, Apple's services division is showing steady growth, hitting a record $100 billion in overall revenue in the last 12 months, but it is not going to be a huge needle mover for a stock with a market cap of $3.1 trillion.

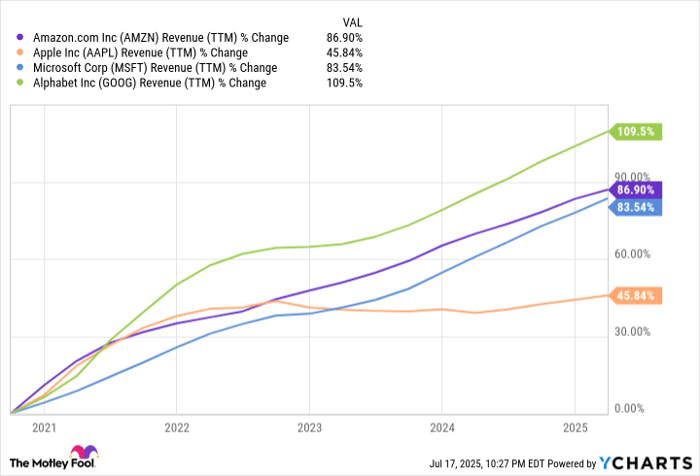

Apple needs a new hardware device to take its business to the next level. Unless that happens, it will keep falling behind its big technology peers. We can see this by indexing revenue growth for Apple, Microsoft, Alphabet, and Amazon in the last five years. Apple's revenue is up 46% and hasn't grown since 2022, while Microsoft's is up 83.5%, Amazon's is up 86.9%, and Alphabet's is up 109.5%. The other big technology players are leaving Apple in the dust.

AMZN Revenue (TTM) data by YCharts.

Potential recovery in China

Another headwind for Apple has been China, where homegrown technology players and smartphone makers have been taking market share from iPhones. Revenue in the country has been in decline since March 2022, which is disappointing since it used to be such a big growth engine for Apple. However, things may be turning around this year, with third-party analysts estimating that China revenue grew 8% year over year for Apple in Q2.

Over the long term, it is hard for investors to be bullish on Apple in China. The country has a "Made in China 2025" mandate, which is driving down demand for Western brands. Apple has a fantastic pull as a brand in China, but it is hard to fight government headwinds like this. There is also the tariff and trade war between the United States and China, which Apple could end up being caught right in the middle of, since it does the majority of its manufacturing in China. This is a risk that investors need to consider before buying Apple stock.

Other countries may provide some level of support to revenue growth, such as India and its large population. However, these are only a tiny portion of Apple's sales today and won't affect its consolidated financials for many years. The company's growth will be driven by North America and China.

Should you buy or sell Apple stock before earnings?

At today's market cap, Apple trades at a price-to-earnings ratio (P/E) of 33. This is much higher than its long-term average, and even higher than some of its big technology peers like Alphabet that are growing revenue much faster.

Looking toward the future, it is difficult to find reasons for Apple to grow besides raising prices on iPhones and incremental services revenue. It has shown zero presence in artificial intelligence (AI), has no cloud computing strategy, and has failed to leap ahead into new computing paradigms. For at least the next few years, it looks like investors will be stuck with the same old Apple and its iPhone, computer, and accessories products.

Even though this is one of the best brands in the world, investors should sell Apple before its Q2 earnings report. There isn't much growth left to be had with this stock.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.