This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

In April, I highlighted Nvidia (NASDAQ: NVDA) as one of two tech stocks that looked surprisingly cheap when it was trading for around $100 per share.

A few months later, the stock trades at $173, making the chip supplier the most valuable publicly traded company in the world, with a market capitalization topping $4.2 trillion. With shares near all-time highs, let's take a closer look at Nvidia's most recent earnings, what management is saying about the future, and whether the stock still looks like a buy today.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Nvidia's growth continues to impress, even with geopolitical challenges

Nvidia's meteoric rise was made possible with unprecedented growth, which was exemplified by Nvidia's fiscal Q1 2026 results. The company generated $44.1 billion in revenue, up 69% year over year and 12% quarter over quarter. The highlight was its data center segment, which produced $39.1 billion alone, fueled by continued demand from cloud providers, government agencies, and enterprises building out artificial intelligence (AI) infrastructure.

As for its bottom line, Nvidia posted $18.8 billion in net income for the quarter, up 26% from the prior year but down 15% from the preceding quarter. The decline was primarily due to a $4.5 billion inventory charge related to U.S. export restrictions on its H20 chips, which were designed specifically for the Chinese market. In April, the U.S. government imposed new rules requiring Nvidia to obtain a license to sell these chips to China, a key growth market now effectively out of reach. As a result, the company was forced to write down excess inventory and purchase commitments tied to the H20 line.

CEO Jensen Huang was blunt on the earnings call: "The $50 billion China market is effectively closed to U.S. industry," he said. "Shielding Chinese chipmakers from U.S. competition only strengthens them abroad and weakens America's position."

More recently, however, Nvidia revealed that it's actively seeking approval to resume H20 sales in China. The company noted that U.S. officials committed to issuing the necessary licenses, with shipments expected to begin shortly. As part of the arrangement, Huang reiterated Nvidia's plans to boost U.S.-based investment, including job creation, bolstering domestic AI infrastructure and expanding manufacturing operations.

For now, Huang and Nvidia appear to be navigating the geopolitical turbulence with minimal long-term damage. Following the update, shares rose 4%, suggesting investors are optimistic that the worst may be in the past.

And looking ahead, Nvidia previously guided for $45 billion in revenue for the second quarter, with an $8 billion shortfall tied to export limitations. Those results may fare even better now that those limitations have been lifted, albeit late in its fiscal second quarter.

Nvidia's strong balance sheet gives management flexibility

In its most recent quarter, Nvidia reported a formidable $53.7 billion in cash and marketable securities, a 71% increase from $31.4 billion the year prior. That cash generated $515 million in interest income during the quarter, more than double the $244 million paid out in dividends.

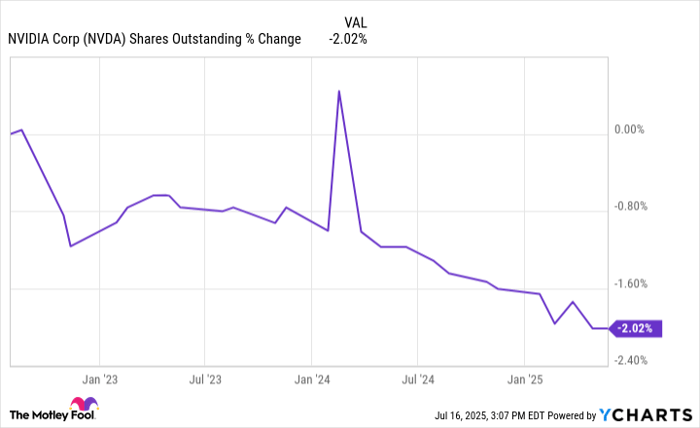

With a dividend yield of just 0.02%, Nvidia's management clearly favors share repurchases as its primary method of returning capital to shareholders. In the first quarter of its fiscal year, the company bought back $14.1 billion worth of stock, up from $7.7 billion a year earlier. While that figure is modest relative to Nvidia's $4.2 trillion market cap, it still signals management's confidence in the company's long-term value, even after its extraordinary stock surge. Moreover, share repurchases enhance the value of existing holdings by shrinking the total share count, which Nvidia trimmed by 2% over the past three years.

NVDA Shares Outstanding data by YCharts

Is Nvidia still a buy?

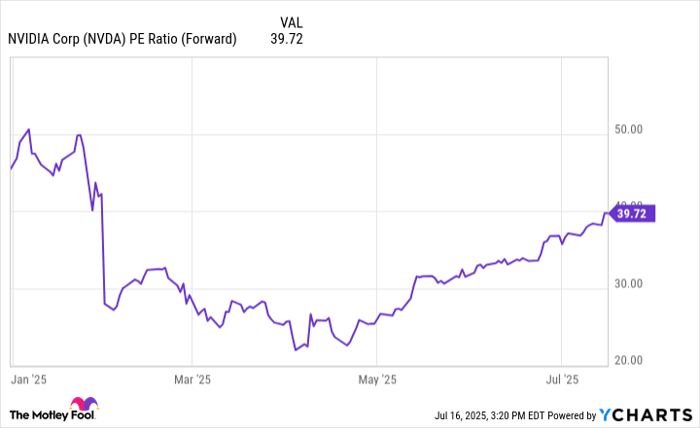

Nvidia's stock is no longer the bargain it was a few months ago, with a valuation of nearly 40 times forward earnings.

But valuation alone doesn't tell the whole story. Nvidia is the undisputed leader in AI computing, a position becoming more entrenched with each product cycle. For a glimpse at how much companies are spending on AI, look no further than tech giants Amazon, Apple, Meta Platforms, and Microsoft, which are expected to spend at least $320 billion on technology in 2025, including data centers, up from $230 billion in 2024.

NVDA PE Ratio (Forward) data by YCharts

Huang underscored Nvidia's growing leadership in AI computing, calling this era "the next industrial revolution." The company continues to push the boundaries of innovation, most recently with the launch of its Blackwell NVL72 AI supercomputer, a "thinking machine" built for advanced reasoning, which is now in full-scale production.

Without question, Nvidia has positioned itself at the forefront of this revolution; however, with its stock surging in recent months, some investors might opt for a pullback before entering. For long-term investors, a more gradual approach, such as dollar-cost averaging, may offer a prudent strategy for gaining exposure to one of the most influential companies driving the future of technology.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.