This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

In 2021, social media company Facebook changed its name to Meta Platforms (NASDAQ: META), partly to reflect its new focus on its metaverse ambitions. Although it is still working on that project, over the past two years, Meta's work in artificial intelligence (AI) has become the company's primary focus. The tech leader is making moves, and if enough things go right, these initiatives could lead to superior returns in the next five years and beyond. Here's why Meta Platforms could potentially double investors' money by the end of 2030.

Meta Platforms is sparing no expense

Meta Platforms has been investing a significant amount of money in its AI ambitions. The company announced it would build AI data centers, a project it expects will cost hundreds of billions of dollars. Meta Platforms has made other strategic moves. It recently acquired Play AI, a company that generates human-like voices through AI. The financial details of the transactions were not disclosed.

Elsewhere, Meta Platforms deepened its partnership with EssilorLuxottica, the company that owns RayBan and Oakley, both of which sell glasses and eyewear accessories. Meta Platforms and EssilorLuxottica have been working together for years, but the recent investment, estimated at roughly $3.5 billion, brings their partnership to a new level. Meta Platforms has also been trying to poach top AI talent from competitors, including OpenAI.

How will Meta Platforms' AI investments pay off? Consider the company's AI hardware vision. CEO Mark Zuckerberg predicted that AI glasses will likely dominate the industry within the next five to 10 years. Perhaps he is being too optimistic, but it's worth pointing out that Meta's AI glasses, developed in collaboration with EssilorLuxottica, have impressive features. They can be controlled through voice command, take pictures and videos, and users can even share what they see on video calls on WhatsApp.

Meta Platforms' revenue from these glasses currently makes up a tiny percentage of its total sales. However, provided Zuckerberg's vision for the future is even close to the truth, that segment could see incredible sales growth in the next five years and perhaps contribute more meaningfully to the tech leader's financial results. And that's just one example. Here's another: Meta Platforms' large language model (LLM), Llama, is available for free. That may seem counterintuitive. It certainly wasn't free for Meta Platforms to create Llama.

However, the company aims to attract talented developers to work on and refine its LLM, ultimately (hopefully) making it the leading one on the market. Since Llama powers some of the company's AI-related initiatives, including its virtual assistant, Meta AI, this strategy could, eventually, have positive spillover effects across all these other initiatives.

Revenue and earnings could double by 2030

Meta Platforms' work in AI will also help improve its advertising business, from which it currently generates the overwhelming majority of its sales. The company is looking to automate the ad creation and launch process, something that will almost certainly increase ad demand and related revenue for Meta Platforms. With an ecosystem of 3.43 billion daily active users as of the end of the first quarter, Meta Platforms' websites and apps will remain favorite targets for businesses looking to advertise to a large audience.

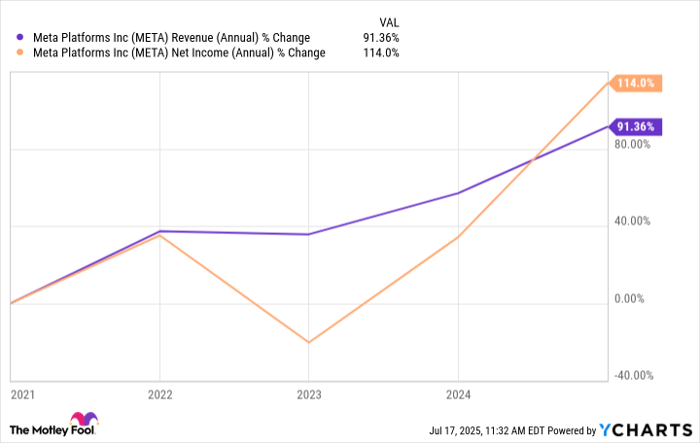

Further, Meta Platforms has also improved engagement on its apps thanks to AI-powered recommendation algorithms. The company's business is being transformed thanks to AI, with improved productivity and more lucrative opportunities across its business. In the next five years, we could see Meta Platforms' revenue and earnings double. It almost accomplished this feat in the past half-decade.

META Revenue (Annual) data by YCharts

But with a laser focus on AI and multiple avenues for growth, the Facebook parent can pull it off, even with some potential headwinds, such as President Donald Trump's trade policies that have already decreased ad demand from some Asia-based companies -- not that this prevented Meta Platforms from delivering strong results in the first quarter. It's also worth mentioning that Meta Platforms now pays a dividend. Investing in the stock today while setting up automatic dividend reinvestment could lead to the kinds of returns that will more than double your initial capital by the end of 2030.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.