Commonwealth Bank of Australia (ASX: CBA) shares reset their record high again on Tuesday, rising 2.18% to $188.36.

Meanwhile, the S&P/ASX 200 Index (ASX: XJO) is also up strongly, by 1.09%, following news of the Iran-Israel ceasefire this morning.

Australia's largest bank has been on a tear since the ASX 200 bank stock run began in November 2023.

CBA shares are up by 81% since then.

Could Australia's largest listed company be heading toward the $200 mark?

Let's find out.

CBA shares reset their record

CBA is now the most expensive bank stock in the world, trading at a price-to-earnings (P/E) ratio of 29.34x.

This is significantly higher than its peers, as Tony Locantro of Alto Capital points out.

Courtesy of The Bull, Locantro says:

Relative to its peers, the CBA is expensive.

Westpac Banking Corp (ASX: WBC) was recently trading on a price/earnings ratio of about 16 times and ANZ Group Holdings Ltd (ASX: ANZ) was on 13 times.

In our view, this bank is priced to perfection and is exposed to a correction if economic growth slows.

Investors may want to lock in some profits at these levels.

Locantro is not alone with his sell rating on CBA.

Many other analysts also say it's time to take your profits and run.

There are 15 analysts on the CommSec platform rating CBA shares.

Their consensus rating is a moderate sell. Ten analysts have a strong sell rating, four have a moderate sell rating, and one says hold.

John Athanasiou, CEO of Red Leaf Securities, also thinks investors should hold onto their CBA shares for now.

Some analysts are more excited about some promising ASX small-cap financial shares.

Macquarie is firmly in the sell camp on CBA shares.

In a note released on 17 June, Macquarie reaffirmed its underweight rating and 12-month price target of $105 on CBA shares.

That $105 price target is not a typo.

Macquarie thinks CBA stock is set for an almighty crash to the tune of more than 40% over the next year.

However, CBA has a big tailwind that has nothing directly to do with the bank's business performance.

Could CBA stock go to $200 apiece?

CBA shares are benefiting more than any other stock in the ASX 200 from passive investing.

This is one factor that could keep the CBA share price on an upward path.

CBA shares are directly benefiting from the billions of dollars in investment funds that retail investors (that's an industry term for us ordinary folk) are ploughing into exchange-traded funds (ETFs) tracking major indices such as the ASX 200 and ASX 300.

CBA benefits from this passive investing more than any other ASX stock because it's the largest share by market capitalisation.

The most popular ASX ETF today is the Vanguard Australian Shares Index ETF (ASX: VAS), which tracks the ASX 300 before fees.

Another popular option is the Betashares Australia 200 ETF (ASX: A200), which tracks the benchmark index before fees.

In its May update on ASX ETFs, Betashares reported an eighth consecutive month of more than $3 billion of inflows into ETFs.

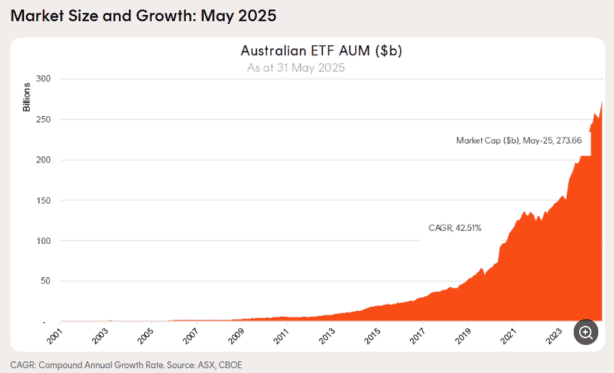

Betashares said very strong inflows in May, combined with a positive market performance, pushed the ASX ETF industry to a new record high of $273.7 billion in funds under management.

There are now 425 ASX ETFs trading on the ASX and CBOE exchanges.