This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

In the past year, Google parent Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG) lost two key antitrust cases targeted at its search engine and advertising businesses. But the tech giant can appeal these defeats, so they aren't the greatest threat Alphabet faces.

The larger risk to its business right now is artificial intelligence (AI). Consumers are flocking to AI apps such as OpenAI's ChatGPT, so much so that research company Gartner estimates search engines will see a staggering 25% drop in usage next year. This could cause Google's search business to collapse if the prediction comes true.

AI certainly holds the potential to unseat Google's reign atop search engines. In fact, for the first time since 2015, Google's market share dropped below 90% in the fourth quarter of 2024, and was at 89.7% in April.

These signs suggest cracks in Google's armor, so Alphabet must succeed at its own AI efforts if it wants to protect its all-important search business. Here's a deeper look into how the company is faring in the battle for AI supremacy.

Alphabet's answer to the rise of AI

The AI stakes are high for Alphabet. Maintaining Google's search success is essential because this part of Alphabet's business produced $50.7 billion of its $90.2 billion in first-quarter revenue. Alphabet is determined to win at AI. The company spent $52.5 billion in capital expenditures last year as it built out the infrastructure needed to support its AI ambitions. It plans to up that investment to $75 billion in 2025.

The expenditures involve investing in cutting-edge technology to power its AI systems, such as a proprietary Tensor Processing Unit (TPU). Alphabet's TPUs are hardware specifically engineered to efficiently train AI models and boost AI inference, which is a term describing an AI's ability to apply what it has learned to real-world situations.

So far, its AI investments have paid off. Alphabet began inserting AI-generated results into Google's search results nearly a year ago, and as of the end of Q1, CEO Sundar Pichai noted, "We continue to see that usage growth is increasing as people learn that Search is more useful for more of their queries" thanks to AI.

Moreover, according to Alphabet management, Google's revenue generation remains at the same rate as before AI was introduced, which indicates the company's addition of AI didn't take away from its ability to earn income from search queries. In fact, Google's $50.7 billion in Q1 search revenue represented growth from the prior year's $46.2 billion.

Alphabet's AI efforts in other areas of its business

AI is also a central component to Alphabet's success in other parts of its operations. One of these is its cloud computing business, Google Cloud. Through the Google Cloud platform, the conglomerate makes its AI tech available for other companies to use. Customers building AI through Google Cloud include Verizon Communications and Loews. Because of growth in AI adoption by other firms, Google Cloud's Q1 sales increased an impressive 28% year over year to $12.3 billion.

Alphabet's AI accomplishments also extend to its self-driving car business, Waymo, which uses AI to make driving decisions. As of Q1, Waymo is providing over 250,000 passenger rides per week, a fivefold increase from the prior year. Waymo's growing popularity is another example of Alphabet's accomplishments with AI.

Evaluating if Alphabet is a good AI stock to invest in

Alphabet's AI achievements demonstrate it's succeeding with artificial intelligence. Every product the company owns -- representing at least half a billion users -- is using Alphabet's AI now. This is translating into revenue growth with Q1 sales hitting $90.2 billion, up from the prior year's $80.5 billion.

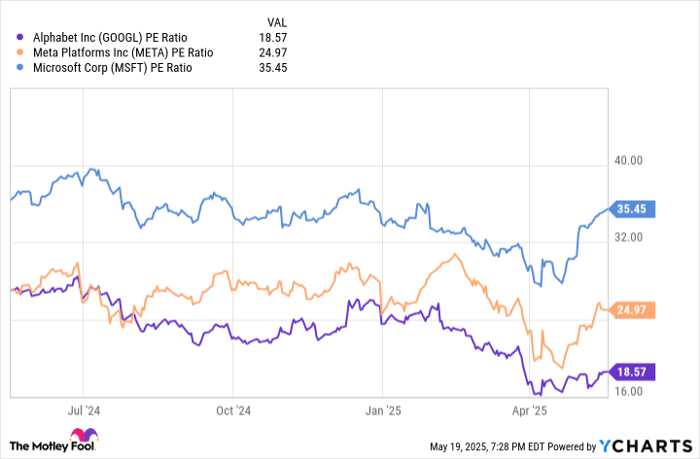

And now is a good time to scoop up Alphabet shares. That's because its stock valuation looks reasonable when comparing Alphabet's price-to-earnings (P/E) ratio to competitors Meta Platforms and Microsoft. Meta is second only to Alphabet in terms of digital advertising market share, and has also invested heavily into AI. Microsoft competes against Alphabet across the search, advertising, and cloud computing markets.

Data by YCharts.

Alphabet's P/E multiple is the lowest among its competitors, indicating its stock is a better value. A combination of economic uncertainty fueled by President Donald Trump's tariff policies and the loss of federal antitrust lawsuits contributed to Alphabet's P/E ratio declining over the past year.

Although the challenges of economic volatility and ongoing antitrust battles will persist in the short term, these are transitory, unlike the secular trend of AI that will play out over the long haul. Despite Google's search market share dipping below 90%, it still holds a massive lead over competitors. OpenAI's ChatGPT is predicted to reach 1% search engine market share this year, but that's still a far cry from Google's share.

Alphabet's strategic AI investments are bearing fruit, and its relatively low valuation makes Alphabet an attractive AI investment for the long term.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.