This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Purchasing Apple (NASDAQ: AAPL) stock during his tenure at Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) will be one of Warren Buffett's top legacies. Apple stock has performed well since Berkshire first bought shares in Q1 2016, and has spent a lot of time as the world's largest company (although it currently doesn't hold that title).

However, will Berkshire still hold on to Apple shares with Buffett stepping down as CEO at the end of the year and Greg Abel taking his spot? Or will it find something else to invest in? Let's take a look.

Apple was a genius pick back in 2016

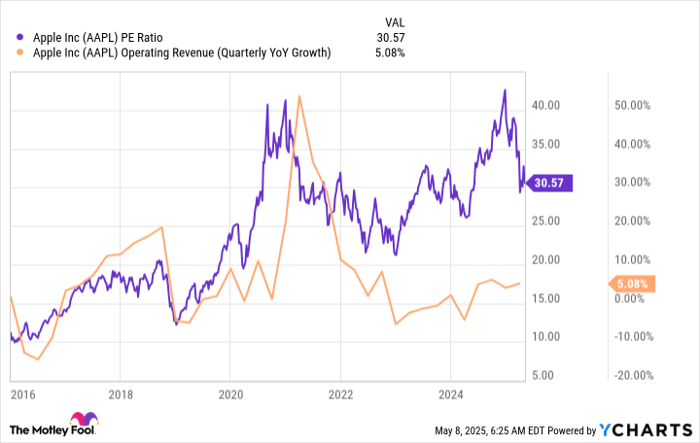

When Buffett first started buying Apple shares in Q1 2016, the stock looked nothing like it does today. It traded around 10 times trailing earnings back then, although its growth was slipping.

AAPL PE Ratio data by YCharts

Still, Buffett and his team recognized that Apple devices, particularly the iPhone, were incredibly popular, and a technology everyone would have on them. They concluded that the sales decline was temporary, and scooped up shares for a dirt cheap price.

The rest is history, as Apple's sales growth returned and the stock increased from its bargain price tag to a more respectable figure. However, the stock looks like it has gotten a bit too expensive.

AAPL PE Ratio data by YCharts

Although Apple is well off its all-time high valuation of more than 40 times earnings, it's still around 3 times more expensive than it was nearly a decade ago when Buffett was buying shares. Furthermore, Apple's growth has slowed to a snail's pace, with revenue only rising 5% during its last quarter.

That's not market-beating growth, yet Apple trades for a valuation well above the S&P 500 (SNPINDEX: ^GSPC), which trades for 22.6 times trailing earnings.

Sometimes, when you have a great success, you become emotionally tied to it. It's possible that Buffett is that way with Apple stock, as it made Berkshire a ton of money and transformed the company into what it is today. However, Apple stock is no longer a value investment (Buffett's favorite variety) or a growth investment; it's just an expensive stock.

With new leadership at the helm, Berkshire Hathaway may decide to unload the rest of its position in Apple, something it started doing in late 2023.

Berkshire has already sold off a big chunk of its Apple stake

In Q3 2023, Berkshire owned its maximum Apple shares: 915.6 million, valued at over $150 billion. Now, that figure has been reduced to an even 300 million shares, with a value of around $75 billion.

We won't see what Greg Abel decides to do with Berkshire's massive Apple stake for at least another year, but if I were Abel, I would consider selling shares.

Apple's thesis has played out, and it hasn't developed a new idea or technology to drive sales. It's making minor updates and tweaks to existing products while trying to match last year's sales. Additionally, Apple has been embarrassingly late to the artificial intelligence (AI) game, and nearly every smartphone competitor has outclassed it in terms of AI innovation.

Apple isn't the innovative company it once was, and its biggest product, the iPhone, isn't driven by a one- or two-year demand cycle. Consumers don't feel the need to upgrade their smartphone after just a year, and instead are pushing that upgrade cycle out to three to four years. This effect could become even more pronounced if Apple had to manufacture more of its smartphones in areas of the world at higher costs than China (like India or the U.S.).

All this means it's not a great time to be an Apple shareholder, and even though Buffett may hold fast to his position, it doesn't mean that Greg Abel will. If you're an individual investor holding shares, I'd say it's time to move on from Apple, as multiple companies are trading for a lower price tag than Apple that have far more growth ahead.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.