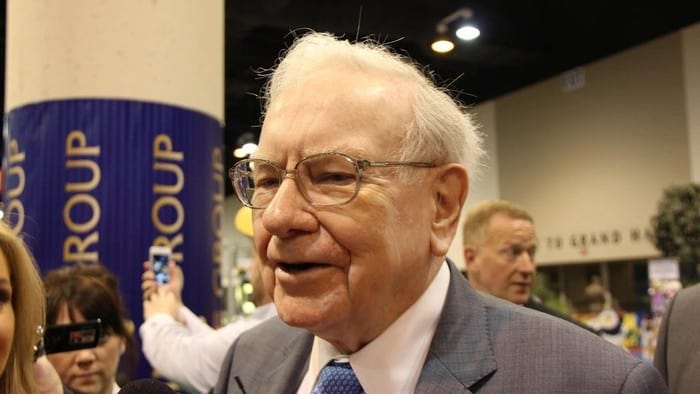

Warren Buffett, the outgoing CEO of Berkshire Hathaway Inc (NYSE: BRK.A; NYSE: BRK.B), is known as the 'Oracle of Omaha' for a reason.

Buffett has delivered outstanding results for more than half a century, consistently beating the market with his soothsayer like abilities.

Towards the end of last year Buffett started to downsize Berkshire's positions in key holdings such as Bank of America (NYSE: BAC) and Apple Inc (NASDAQ: AAPL).

Once again, Berkshire Hathaway's cash pile grew and then markets tumbled.

Buffett's ability to seemingly gaze into the future is built on focus, a disciplined investing mindset, and a talent for analysing companies and markets.

And one of the investing tools Buffet has utilised over the decades to determine whether or not the market is over valued has come to be known as the 'Buffett Indicator'.

What is the Buffett Indicator?

The Buffett Indicator is simply a method of comparing the total value of the stock market to gross domestic product (GDP).

From there, it can be determined whether or not the market is overvalued by looking at how closely aligned it is with the state of the economy.

This is done by dividing the total value of the stock market by GDP.

If the result is 1, or 100%, the market is in sync with the economy, based on the indicator.

If the figure is higher, it can suggest the market is overvalued.

Conversely, if the figure is lower than 1, it may show the market is undervalued.

What does the indicator say about the ASX?

The total market cap of all companies listed on the ASX is currently sitting at around $3.29 trillion.

Based on projections from the International Monetary Fund, Australia's GDP for 2025 is expected to be around $2.74 trillion.

If we divide the ASX market cap by projected GDP, we are left with a figure of 1.2, or 120%.

As such, depending on how the Buffett Indicator is interpreted, it appears the ASX's valuation is ranging from fair value to overvalued.

Of course, to give more meaning and context to readings from the Buffett Indicator, results should be compared to historical averages.

And it should be noted that while the Buffett Indicator can be a useful tool, it is just one way of gauging a share market's fair value.