This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

It was nearly one year ago that Nvidia (NASDAQ: NVDA) last split its stock. That 10-for-1 stock split was the sixth in the company's history since entering the public markets in 1999. Shares proceeded to march to an all-time closing high about six months after last June's stock split.

Shares have since retreated along with many others as the Nasdaq Composite index briefly entered bear market territory in early April, declining more than 20% off recent highs. Yet Nvidia has been resilient and its share prices have recently rebounded. While the downturn in the stock market may not be over, it will eventually gain ground again. Nvidia continues to have a leading business covering artificial intelligence (AI), gaming, robotics, driver assistance, and self-driving technologies.

Stock-split facts

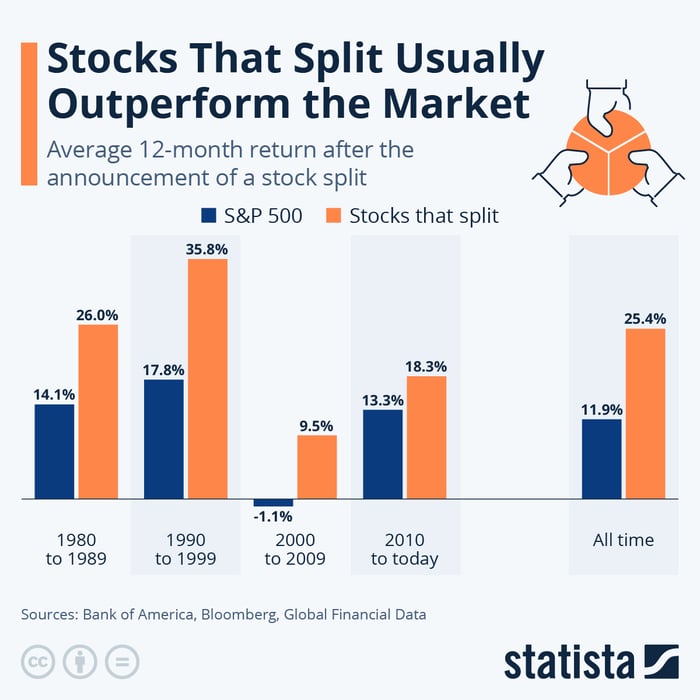

That business is what should attract investors to Nvidia stock. Another stock split could also be in its future, though. And history shows that owning shares before they split can pay off.

Image source: Statista.

To determine why that might be, let's look at reasons companies split their stocks in the first place. After all, a split doesn't affect the value of the company one bit and even adds some expenses in logistics, legal fees, and other nominal costs.

Splitting a stock can increase liquidity by making shares more affordable for a larger group of investors. Retail investors are likely part of the increased trading volume because lower-priced shares look more attractive to those just starting out or with limited funds to invest. Fractional shares are offered at many brokerages now, but most people probably don't utilize that rarely-promoted option. So a lower share price can appeal to more buyers. It is a perception of affordability.

Companies also tend to split stocks that have trended higher. Announcing a split tends to give investors added confidence that further strong performance is ahead. The stock may also be included in more major stock indexes, especially those that use price-weighted calculations. Lastly, splits may also be announced with company employees in mind. Employee share purchase plans may get more participation if shares are more affordable to participants.

Value ahead for Nvidia

So while stock splits don't directly affect the company's value, i.e., its market capitalization doesn't change, investor perception and market activity can tend to aid future performance. Nvidia management can also look beyond short-term volatility toward positive future business developments to gain confidence to announce another stock split.

Most investors are focusing on Nvidia's growing data center revenue. That segment accounted for the bulk of its revenue growth in the past fiscal year ended Jan. 26, 2025. But each of its other three segments has increased revenue annually over the last two years. Gaming is a more than $10 billion segment. It only accounted for about 9% of sales last year, though, so many investors are discounting Nvidia's other growth areas.

Perhaps its greatest growth potential comes from automotive and robotics end uses. That segment is at a much lower base than data centers, and its total addressable market could be ready to go through a growth spurt. Automakers already include advanced driver assistance packages and may be on the cusp of selling fully autonomous vehicles. Robotics technology may also be at the point of transition from stationary industrial uses to mobile, humanoid versions that can help businesses further improve efficiency.

Is a stock split coming?

Those are better reasons to buy Nvidia stock than anticipating the next stock split. History does show that a split announcement could result in market-beating returns. Yet I think Nvidia stock will outpace the market simply for fundamental reasons.

Nvidia's management and board of directors will likely wait for ongoing market turmoil to settle before announcing its next stock split. It makes sense for investors to own the stock regardless, though. That way, you can participate in a fast-growing company along with any future stock splits that might be announced.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.