This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

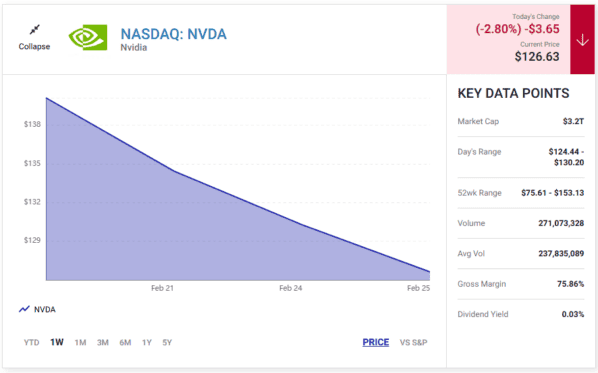

Nvidia (NASDAQ: NVDA) stock was heading lower in Tuesday's trading. The company's share price was down 2.8% as of market close against the backdrop of a 0.47% decline for the S&P 500 index and a 1.35% decline for the Nasdaq Composite index. The artificial intelligence (AI) leader's stock had been down as much as 4.5% earlier in trading.

Nvidia stock was slipping on Tuesday as investors considered the potential impacts from new tariffs, new Chinese chip sanctions, and other pressures. The tech giant is also due to report its fourth-quarter report after the market closes on Wednesday, and investors are feeling some jitteriness when it comes to valuation profiles for AI stocks.

Is Nvidia stock a buy right now?

Nvidia's fourth-quarter release tomorrow is poised to be one of the biggest stock market events in 2025 so far. The average analyst estimate calls for the business to post net income of approximately $21.1 billion on sales of over $38 billion. The company's forward guidance will also be under the microscope and treated as a key indicator for overall growth in the AI market.

Investors are on the edge of their seats. A recent report that Microsoft is cutting back on some of its data centre expansion plans has raised growth concerns, and Nvidia's Q4 report has taken on even more significance following the market disruption caused by the DeepSeek R-1 model in January.

To summarise, there are a lot of catalysts on the near horizon that could cause significant volatility for Nvidia stock. Accordingly, the stock probably isn't a good fit for investors without high risk tolerance right now.

On the other hand, the company continues to occupy a leadership position in the graphics processing unit market at the heart of the AI revolution, and it's still in the early stages of expanding its presence in categories including software, processing services, and robotics. The company's advantages in key artificial intelligence categories are significant, and these technologies still look poised for massive long-term growth. Investors should move forward with the knowledge that Nvidia stock has the potential to be volatile in the near term, but it looks like a worthwhile buy-and-hold investment on recent pullbacks.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.