This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

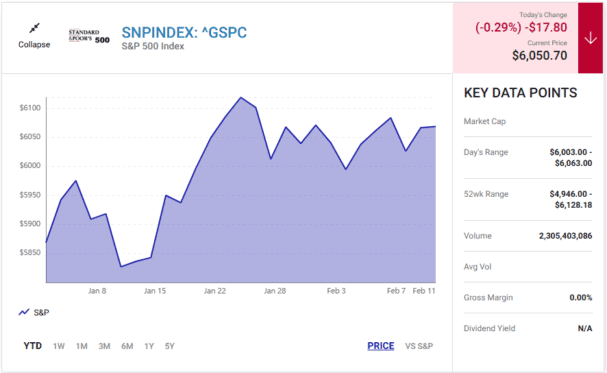

The S&P 500 (SP: .INX) has advanced 3% year to date due to expectations that its member companies will report accelerating earnings growth this year against a strong economic backdrop. The index currently trades within a percentage point of its record high.

However, Wall Street anticipates more gains and new highs in the remaining months of 2025. The S&P 500 has a median year-end target of 6,600 based on forecasts from 27 analysts. That implies about 9% upside from its current level of 6,060.

However, the S&P 500 also trades at a historically expensive valuation, which leaves investors with a difficult decision: Is it smart to buy stocks with the market trading near its record high? Consider this brilliant investing advice from Warren Buffett.

Be greedy when others are fearful, but fearful when others are greedy

Warren Buffett in 2008 authored a famous opinion piece for The New York Times. "A simple rule dictates my buying: Be fearful when others are greedy, and be greedy when others are fearful," he wrote. Investors at the time were scared because the S&P 500 had fallen 40% from its record high amid the Great Recession, the worst economic downturn since the Great Depression.

Buffett's advice is still relevant today, though the market environment is much different. The S&P 500 returned more than 20% in each of the past two years, something it last did during the dot-com bubble in the late 1990s. The index now trades at a cyclically adjusted price-to-earnings (CAPE) ratio of 38, a valuation so expensive it has only been seen during two periods since the S&P 500 was created in March 1957.

Importantly, since its inception roughly 815 months ago, the S&P 500's monthly CAPE ratio has exceeded 37 only 37 times. Put differently, compared to the current valuation, the S&P 500 has been cheaper 95% of the time during its seven-decade history. Additionally, after a monthly CAPE reading above 37, the S&P 500 has declined by an average of 3% during the next year.

Let me be clear: That does not mean the S&P 500 is definitely going to decline over the next year. Following a monthly CAPE reading above 37, the index's one-year returns have ranged from negative 28% to positive 20%. So, what readers should take away from the current CAPE ratio is that stocks are historically expensive. That is a sign of greed, so caution is warranted in the current market environment.

Buy stocks whose earnings are likely to increase substantially, but only if the price is right

Warren Buffett in his 1996 shareholder letter summarised the difficult process of picking stocks in simple terms: "Your goal as an investor should simply be to purchase, at a rational price, a part interest in an easily understandable business whose earnings are virtually certain to be materially higher five, ten, and twenty years from now."

Notice Buffett did not mention the valuation of the broader stock market as a factor worth consideration. Investors should never hesitate to buy a stock that checks those three boxes — (1) understandable business, (2) compelling growth prospects, and (3) reasonable price — even if the broader stock market is trading at a historically expensive valuation.

Investors get into trouble when they chase momentum for fear of missing out on the next big winner. Buffett says that bad habit has become more common. "For whatever reason, markets now exhibit far more casino-like behaviour than they did when I was young," he wrote in his most recent shareholder letter.

Here is the bottom line: The S&P 500's current valuation is in the 95th percentile, meaning the index has only been more expensive 5% of the time since it was created. Consequently, investors should be very selective about which stocks they add to their portfolios, but not so selective that they miss good buying opportunities.

As a caveat, owning good stocks will not prevent losses during a market crash. Equities fall indiscriminately, such that even the best stocks usually suffer losses when the S&P 500 declines. The difference is good stocks will recover.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.