This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Nvidia (NASDAQ: NVDA) has gotten off to a bad start on the stock market in 2025, losing almost 7% of its value as of this writing, with Chinese artificial intelligence (AI) start-up DeepSeek's launch of a low-cost but capable AI model playing a key role in the semiconductor giant's troubles.

When DeepSeek claimed that it spent just $6 million to train its R1 reasoning model that's capable of competing with OpenAI's o1 reasoning model, AI stocks in the U.S. took a big beating. Nvidia stock was one of the biggest victims of the sell-off, dropping 17% on January 27 after it emerged that DeepSeek overtook ChatGPT's downloads on the Apple app store in the U.S.

DeepSeek's low-cost model sparked concerns about major cloud computing companies and governments reducing their demand for the AI chips Nvidia sells. However, a closer look at recent developments in the AI space suggests that the spending on AI chips could continue to head higher, opening the possibility of Nvidia stock regaining its mojo once it releases its fiscal 2025 fourth-quarter results on February 26.

Let's look at why Nvidia could offer a bright update about the state of AI spending later this month along with its quarterly report.

Nvidia could win big from this project thanks to its solid share of AI chips

Over the last few years, tech giants and governments around the world have poured a lot of money into the development of AI infrastructure, and President Donald Trump gave AI spending prospects a massive boost last month.

On Tuesday, January 21, Trump announced at the White House that SoftBank, OpenAI, and Oracle are forming a joint venture that plans to invest $100 billion in AI infrastructure. The joint venture, known as Stargate, is eventually planning to spend up to a whopping $500 billion on building AI infrastructure in the U.S. over the next four years.

Stargate's first AI data center is already under construction in Texas, according to Oracle chairman Larry Ellison. The joint venture is expected to construct 20 data centers, creating an estimated 100,000 jobs.

In a post announcing the Stargate project, OpenAI pointed out that the initial funding will be provided by SoftBank, OpenAI, Oracle, and Abu Dhabi's AI-focused investment company, MGX. The post further highlighted that Nvidia is going to be among the "initial technology partners" in Stargate.

Nvidia has been at the forefront of the AI revolution with its powerful graphics processing units (GPUs) based on the Ampere architecture that helped OpenAI train ChatGPT. It has kept pushing the envelope in the AI accelerator market, churning out more powerful chips in the past three years based on its Hopper and Blackwell architectures.

This explains why Nvidia has maintained a solid grip on the AI chip market with an estimated share of 90%. Given that Nvidia has created a technology advantage over rivals in the AI chip market, it could remain the dominant force in this space. As Nvidia's GPUs are the basic building blocks of AI data centers given their ability to perform massive calculations simultaneously, allowing companies to train and deploy AI models quickly, Stargate's ambitious investment plan should ideally help improve the chipmaker's addressable market.

For instance, Oracle has been relying on Nvidia's GPUs to create AI infrastructure to rent out to customers so that they can train AI models in the cloud. In September last year, Ellison remarked that one of Oracle's largest data centers "is 800 megawatts, and it will contain acres of NVIDIA GP clusters able to train the world's largest AI models." This was followed by a remark from Oracle CEO Safra Catz on the December 2024 earnings conference call that the company "delivered the world's largest and fastest AI supercomputer, scaling up to 65,000 Nvidia H200 GPUs."

Oracle is planning to deploy an additional 35 cloud regions around the globe in addition to the 17 it already has. It won't be surprising to see the company's appetite for Nvidia's GPUs increasing. More importantly, as Nvidia has been working with its supply chain partners to increase the output of its AI GPUs in 2025, it should be in a position to meet the higher demand for its chips that's likely to arise following Stargate.

Meanwhile, the likes of Meta Platforms and Microsoft aren't going to curtail their spending on AI infrastructure following DeepSeek's breakthrough. Both companies believe that heavy AI investments are required to support the growing demand for AI applications, thanks to the potential arrival of more efficient models as demonstrated by DeepSeek. Dutch semiconductor equipment giant ASML suggested something similar after the company witnessed solid growth in orders and received way more bookings than Wall Street was anticipating.

All this suggests that the AI spending environment could remain robust, and that could help Nvidia deliver solid results and guidance later this month.

Stronger-than-expected growth could lead to more upside

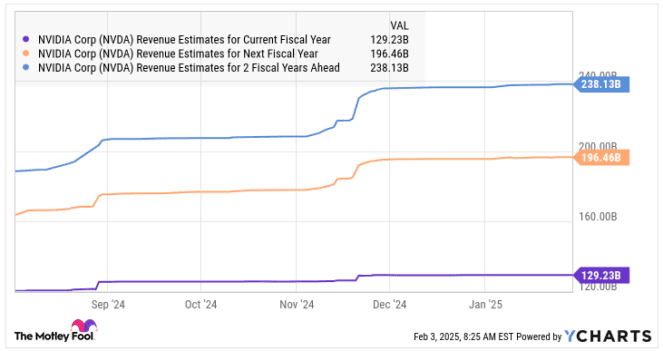

Analysts are currently expecting Nvidia's revenue in fiscal 2026 (which has just begun) to increase 52% to just over $196 billion, followed by a 21% increase in fiscal 2027.

NVDA Revenue Estimates for Current Fiscal Year data by YCharts

However, expect to see those estimates head higher in light of the above discussion, paving the way for more upside in Nvidia stock. It is worth noting that Nvidia's 12-month price target of $175, according to 66 analysts covering the stock, points toward 36% gains from current levels.

Nvidia's revenue estimates for both fiscal years 2026 and 2027 have jumped higher of late, a trend that could continue thanks to continued investments in AI. As a result, Nvidia's price target could also witness upward revisions.

So, investors who have been on the sidelines and are wondering if it is a good idea to buy shares of Nvidia following the stellar returns that the stock has delivered in the past couple of years can consider buying it right away as it can regain its mojo. The stock's forward earnings multiple of around 26 is very attractive considering that the tech-laden Nasdaq-100 (NASDAQ: NDX) index has a forward earnings multiple of 27. That's why buying Nvidia right now could turn out to be a smart move as its healthy earnings growth momentum is likely to continue.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.