This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Nvidia (NASDAQ: NVDA) shares have been beaten down over the past two weeks thanks to the release of DeepSeek's efficient generative AI model. Because DeepSeek reportedly trained its artificial intelligence (AI) model for less than $6 million, many investors are assuming that companies like Nvidia that supply this computing power are in trouble, as the AI hyperscalers won't spend as much because more efficient computing methods are possible.

While this is a reasonable train of thought, I don't think it's valid, as there are multiple indications that Nvidia will be fine. I've got three reasons why Nvidia stock is still a buy right now, and investors would be smart to take advantage of it while it's on sale.

1. Nvidia's largest clients are still spending big

The biggest fallacy from investors assuming that Nvidia is toast due to more efficient AI models becoming available is the premise that U.S. AI hyperscalers are concerned with efficiency. The reason DeepSeek chose to make its model more efficient is because it had to.

DeepSeek is limited to what computing power it has access to, as the U.S. imposed strict export restrictions on Nvidia's hardware to China. As a result, DeepSeek had to train on H800 GPUs versus the more powerful H100 counterparts that are normally used in the U.S. Because it had to focus on efficiency to make the model, the result was naturally efficient.

Domestic AI companies don't have these same limitations, as they have access to near-unlimited computing power without any regulations to deal with. So, they haven't focused on efficiency but are instead building out as much computing capacity as possible to produce the most powerful AI models.

This is why initiatives like the $500 billion Stargate Project or companies like Meta Platforms are spending $60 billion to $65 billion on capital expenditures this year, most of which will be directed toward AI computing power. These companies will still be spending truckloads of money with Nvidia throughout 2025 and beyond, so there shouldn't be fears of Nvidia's sales slowing down in 2025.

2. Nvidia's Blackwell GPU production has yet to meet demand

Another innovation Nvidia has up its sleeve is its next-gen Blackwell architecture. The Blackwell architecture far exceeds the performance of the previous-generation Hopper architecture, including being able to train AI models four times faster. These GPUs are an incredible performance boost, and many companies are trying to get their hands on them. But Nvidia can't keep up right now.

During its Q3 conference call (which occurred on November 20), Nvidia CFO Colette Kress stated, "Blackwell demand is staggering, and we are racing to scale supply to meet the incredible demand customers are placing on us." Nvidia is still realising this growth catalyst, which bodes well for the stock in 2025.

3. Nvidia's stock can almost be considered cheap

During Nvidia's run, it has rarely looked cheap. However, I'm willing to state that it has nearly reached that level.

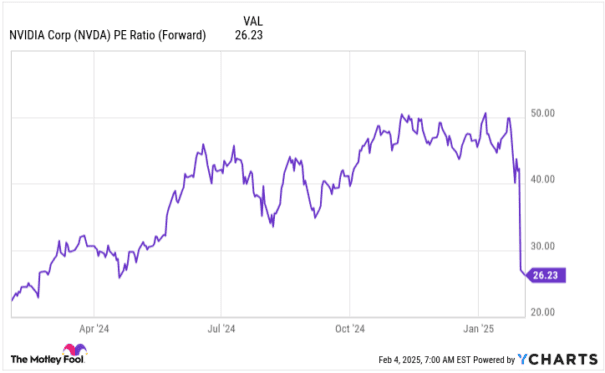

Because of Nvidia's rapid growth, using trailing earnings metrics isn't a great way to assess the stock. As a result, I'll use Nvidia's forward price-to-earnings (P/E) ratio. Thanks to the massive drop-off, Nvidia's stock trades for just 26 times forward earnings.

NVDA PE Ratio (Forward) data by YCharts

For the growth that Nvidia is putting up, that's dirt cheap. For comparison, the S&P 500 (SP: .INX) trades for 22.3 times forward earnings, so Nvidia really doesn't hold that much of a premium to the broader market. This is despite multiple growth catalysts and a generational technological shift that Nvidia is at the centre of.

With Nvidia's stock down around 16% from its all-time high, I think it's a smart move for investors to take a position now, as it's rare that Nvidia goes on sale like this.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.