This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Nvidia (NASDAQ: NVDA) stock has been a great performer over the long term, though its performance notably revved up starting in 2023. From the start of that year through to today, Nvidia stock has gained almost 750%. The main catalyst has been powerful demand for the artificial intelligence (AI) chip leader's graphics processing units (GPUs) and related technology to enable generative AI, the tech behind the ChatGPT chatbot.

Nvidia has many competitive advantages, but one big one that probably flies under the radar of many investors is that employees really like working for the company.

Tech companies need top technical talent to prosper over the long run

Along with a highly capable top management team — which Nvidia has — a tech company also needs strong bench strength to succeed over the long run. Top tech talent, the folks who actually do the technical work, is rightfully often called the "lifeblood" of technology companies.

Nvidia, the other so-called big tech companies, and Nvidia's main semiconductor competitors are largely competing for the same tech talent — such as software engineers (also called software developers), hardware engineers, and computer scientists. People in these occupations are often in high demand and short supply. That's even more true with folks with educational or work experience in AI and other specialised areas, such as robotics.

Moreover, Nvidia and many tech companies are based in the same area: California's Silicon Valley. That makes competition for employees who work out of a Silicon Valley headquarters even more intense.

Nvidia: The best workplace among the big techs and key competitors per Glassdoor ratings

Since many tech companies are competing for employees with similar skills, it's a huge competitive advantage for a company to be considered an "attractive employer" or an "employer of choice." This is achieved by offering a good work environment, providing opportunities for advancement, and providing competitive compensation and benefits.

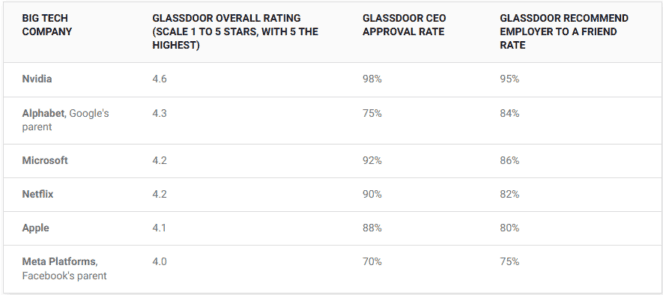

Nvidia gets top marks here, according to thousands of reviews by its employees and former employees on Glassdoor.com.

Data source: Glassdoor.com. I didn't include Amazon and Tesla because their workforce compositions are very different from the companies in this chart. Even though they both have significant tech operations, they also both have a large percentage of hourly employees who do manual labor. Data as of January 28, 2025.

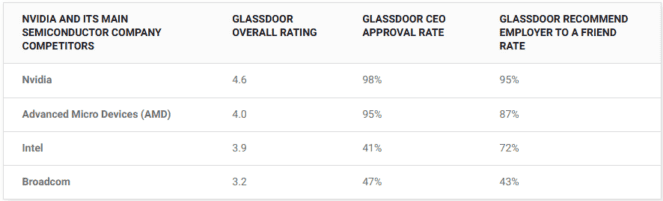

Nvidia also outshines its competitors in the data centre AI GPU chip market, Advanced Micro Devices and Intel, according to Glassdoor. And it outscores Broadcom, with which it competes in high-performance networking technologies for AI-driven data centers. Broadcom's Glassdoor reviews are particularly weak in the category of company culture, or work environment. Part of this dynamic probably stems from Broadcom's heavy emphasis on growth by acquisitions. Like many companies that employ such a strategy, layoffs often follow each acquisition and sometimes precede them, too.

Data source: Glassdoor.com. Data as of January 28, 2025.

Broadcom's second-highest-frequency "con" in the reviews was "frequent layoffs and [reorganizations]." AMD's highest "con" was "there is always a downsizing somewhere." Intel's third most mentioned negative aspect was "frequent reorganizations and layoffs."

That Nvidia doesn't engage in layoffs is a big plus. Living with the job insecurity that surrounds possible layoffs is stressful and stressed people probably can't do their best work. Moreover, layoffs can negatively affect the morale of employees who are not let go. It seems safe to opine that employees, as a whole, are not apt to be as loyal and hardworking as they otherwise might be when they feel like they don't get loyalty in return.

Nvidia aims to be a "place where people can build their careers over a lifetime"

Nvidia's turnover rate is very low, as you might expect. In fiscal year 2023, its overall turnover rate was 5.3%. And in its annual report for fiscal year 2024, which ended in late January 2024, here's what the company said on this topic:

We want NVIDIA to be a place where people can build their careers over their lifetime. Our employees tend to come and stay. In fiscal year 2024, our overall turnover rate was 2.7%.

To be clear, Nvidia's very low turnover rate doesn't mean that it has not hired many new employees in recent years. It has. The company has been growing, so it's nearly always in a hiring mode.

In short, it seems probable that happy employees tend to be more loyal and hardworking. Happy employees tend to treat customers better. Happy employees tend to treat suppliers and subcontractors better. All these factors are important for a company's long-term success.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.