This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

The world's biggest companies have proven themselves over time, generating earnings growth and stock performance. They've built rock-solid businesses, demonstrated they can prevail even in competitive industries, and generally these points should set them up for future success too. And, according to Motley Fool research, all but one of these companies has delivered five-year annualised returns in the double digits. So investors who have bought these players and held on for the long term have scored a win.

Today, about half of the 20 largest companies are in the technology field, specialising in everything from artificial intelligence (AI) chips to social media and smartphones. And speaking of smartphones, the company that tops the list as the biggest by market value is iPhone maker Apple (NASDAQ: AAPL). The tech giant was worth $3.53 trillion as of January 14, a step ahead of the $3.23 trillion Nvidia. And Apple is also the first company ever to reach market cap levels of $1 trillion, $2 trillion, and $3 trillion.

Founded in 1976, Apple has come a long way, building a consumer electronics and services empire that generates billions of dollars in earnings annually — and the stock has soared more than 184,000% since its market debut in 1980. Now the question is: Should you buy stock in Apple, or is it too late to get in on this market powerhouse? Let's find out.

A strong competitive advantage

So, first, a little bit of background on Apple. I probably don't have to tell you that the company is maker of some of today's best-known consumer products, from the iPhone as I mentioned, to the Mac and iPad. What's kept Apple ahead is its innovation and ability to keep users loyal to its products — they'll wait for the latest iPhone release, for example, and won't opt for lower-priced rivals. This moat, or competitive advantage, has played a key role in Apple's earnings growth over time.

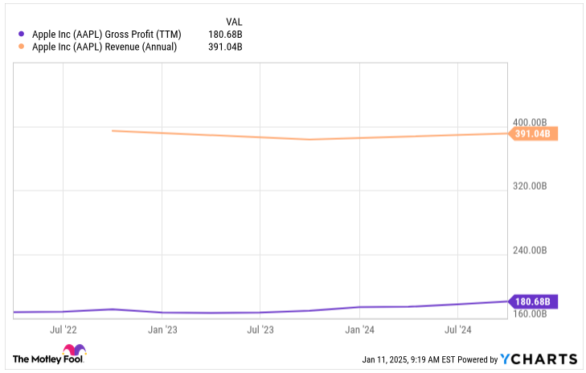

Apple's gross profit on a trailing-12-month basis totals more than $180 billion, and revenue tops $390 billion.

AAPL Gross Profit (TTM) data by YCharts

And thanks to the company's earnings strength, the stock has delivered a five-year annualised return of more than 27%. Last year, Apple rose 30% as tech companies drove gains in all three major benchmarks: the Nasdaq, the S&P 500, and the Dow Jones Industrial Average.

Since Apple has been around for so long, you may wonder if its biggest phases of growth are in the past. It's true that this company probably won't deliver the same growth you'll find in a younger player that's just starting to build its business or a company like Nvidia that's at the heart of the high-growth AI revolution. But the dominance Apple has built in its market over time as well as it's own expansion into AI could power a new phase of growth ahead.

A significant new opportunity

Apple now has an installed base of more than 2.2 billion products worldwide, and that has paved the pathway to a new, massive opportunity: services revenue. The company offers users of its products a variety of them, from digital content to cloud storage. And that has led to record services revenue quarter after quarter in recent times.

On top of that, the company has launched its AI offering, Apple Intelligence, and is integrating it into its products. That should reinforce the loyalty of fans, bringing them an even more powerful experience across devices.

So now let's get back to our question: Should you buy stock in the world's largest company? This depends on your investment strategy. If you're an aggressive investor looking for enormous growth, you may find better opportunities elsewhere. But for most other investors, Apple today still makes a compelling buy as the company has a strong moat to ensure its market leadership — and services and AI should add to growth moving forward. All of this means the stock has room to run and could help you score an investing win over the long haul.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.