This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

2024 was another great year for investors. The S&P 500 Index (SP: .INX) and Nasdaq Composite Index (NASDAQ: .IXIC) gained 24% and 30%, respectively. This is thanks in large part to tailwinds fueled by artificial intelligence (AI), blockbuster weight loss drugs, and even some consumer resiliency given a steadily improving macroeconomic picture.

One company that quietly had a milestone year in 2024 is streaming platform Netflix (NASDAQ: NFLX), which gained 85% and is currently trading near all-time highs.

I'm going to break down why 2024 was such a pivotal year for Netflix. More importantly, I'll also be detailing why investors should keep an eye on the stock as January 6 fast approaches.

2024 was a transformational year for Netflix

Netflix is best known for its vast content library, which spans every genre from comedies and thrillers to cartoons and anime and much more. Over the last several years, Netflix has invested significant capital into its own original content, striking deals with Hollywood's biggest stars and creating new television series and movies that are exclusive to the Netflix platform.

For some time, this strategy helped Netflix separate itself from other streaming platforms, while also giving the company new ways to appeal to viewers who may be tired of watching reruns of old, syndicated content.

However, creating original content is a blueprint that's easy to follow. Other streaming services offered by Amazon, Apple, Paramount, and Disney have followed suit. As a result, Netflix has been faced with the daunting task of differentiating itself from other streamers, while also maintaining an appropriate level of customer acquisition costs.

Over the last year, Netflix swiftly moved into its next big category: Live sporting events. To be fair, Amazon and Apple also offer some degree of live sports with the NFL and Major League Baseball. However, Netflix's approach is a bit different, and below I'll outline just how successful this campaign has been so far.

Here's how live events have performed on the platform

In 2024, Netflix's two high-profile live sporting events included a boxing match between YouTube star Jake Paul and boxing legend Mike Tyson, and streaming the NFL games on Christmas Day.

According to data compiled by TVision, the Paul-Tyson match was the most streamed sporting event in history, reaching an estimated 108 million live viewers around the world. Nielsen estimates that each of the NFL games on Christmas reached an average of 24 million viewers, making them two of the most streamed games in NFL history.

While Netflix's experience in sporting events is limited, early results indicate that the company's ambitions in live broadcasting are paying off. On January 6, Netflix will unveil its latest project in live entertainment, this time featuring wrestling content from WWE Raw.

Is Netflix stock a buy before January 6?

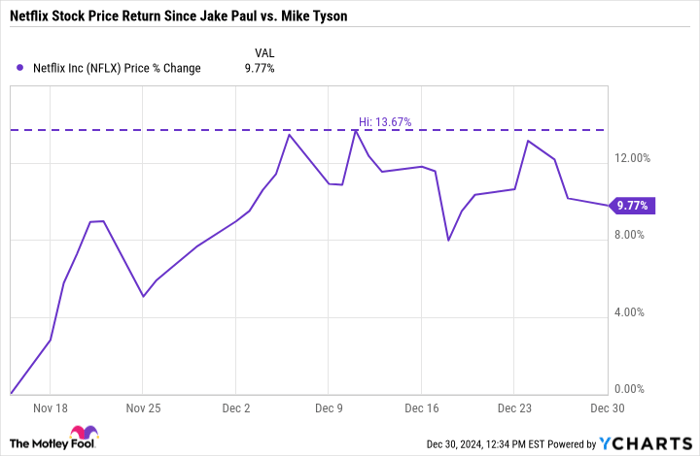

The Jake Paul-Mike Tyson match took place on Friday, November 15, 2024. As the chart below illustrates, shares of Netflix popped as high as 14% following the event, and have gained a net of 10% through December. 30.

Interestingly, Netflix stock experienced a fleeting pop in the days leading up to the Christmas Day NFL games. However, as I write this, shares of Netflix have dropped by roughly 3% following the games.

Given these two data points, I think it's fair to say that Netflix stock has witnessed some pronounced momentum around its live events. Given their abnormal levels of volatility, I tend to discourage investing in momentum stocks.

To me, buying Netflix stock before January 6 is not so important. The more important idea here is that Netflix's live events have so far been record-setting broadcasts. While there is no guarantee that the WWE Raw campaign will follow the same path as the Paul-Tyson match or NFL games, I think there's a good chance that wrestling could become another tailwind for Netflix.

I see live events becoming an enormous opportunity for Netflix and am bullish on the company's ability to strike more long-term partnerships in sports and entertainment.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.