This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Nvidia (NASDAQ: NVDA) has entered the moment all Nvidia-watchers and investors have been waiting for: The tech giant is about to officially launch its Blackwell architecture and chip. Why is this so important? For a couple of reasons. First, Blackwell includes Nvidia's very latest innovations, demonstrating the company's technological strengths, and therefore potentially ensuring its leadership in the artificial intelligence (AI) market. And second, this platform could be transformative for customers' AI projects, and this should translate into more revenue growth for Nvidia.

As the AI boom has progressed, this tech giant has proven itself to be central to this high-growth market's development. Nvidia dominates the AI chip market and has launched an entire portfolio of related products and services to form a complete AI empire. The Blackwell release will become a key part of the Nvidia picture. Now, with the launch set to happen, here's what to look for.

Nvidia's GPUs: From gaming to AI

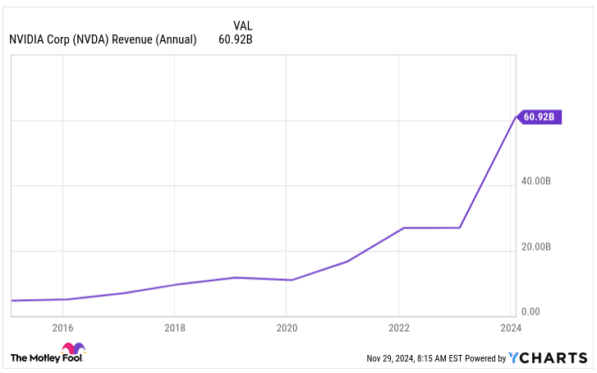

First, a brief glance at Nvidia's story so far. The company's graphics processing units (GPUs) today bring in revenue primarily from AI customers, but this wasn't always the case. Just a few years ago, GPUs mainly served the video games market, and Nvidia's revenue was a fraction of today's levels. But the GPU's ability to process many tasks at once made it ideal for uses well beyond gaming — and it showed great potential in the area of AI.

NVDA Revenue (Annual) data by YCharts

As Nvidia broadened into these markets, including AI, earnings took off and so did share performance. Earnings in most recent quarters have climbed in the triple digits, and Nvidia stock is heading for a 2,300% gain over the past five years.

Now, with Blackwell on the way, Nvidia and investors could see gains ahead in both earnings and share price performance.

So, let's take a look at what we know so far about the Blackwell release and what to look for ahead. Nvidia already has started bringing this top new platform to customers. In the third quarter, the company sent out 13,000 sample GPUs to customers. And also in the quarter, companies including Microsoft and Oracle posted on social media, saying they'd started to receive Blackwell.

The first cloud to run Blackwell

"Microsoft Azure is the 1st cloud running Nvidia's Blackwell system with GB200-powered AI servers," Microsoft Azure wrote on X (formerly Twitter) on October 8.

And Nvidia said in the company's November 20 fiscal third-quarter 2025 earnings call:

"Blackwell is now in the hands of all of our major partners, and they are working to bring up their data centers. We are integrating Blackwell systems into the diverse data center configurations of our customers."

Demand for Blackwell has surpassed supply so it may take some time for Nvidia to serve every customer — and reach its maximum revenue potential. But there's reason to be optimistic about significant growth even in the early stages of product release. This is because Nvidia says it's "racing to scale supply" — and has predicted that Blackwell revenue in this current fourth quarter may beat its initial forecast of several billion dollars.

What we should look for next are trends among Nvidia's customers: Have they succeeded in their scaling up of Blackwell? Are they offering Blackwell-powered products and services to their customers?

Right now, according to Nvidia, customers are preparing to offer Blackwell at scale. So, it will be important to be on the lookout for announcements or social media posts from cloud service providers and other major Nvidia customers for any details.

The key moment for Nvidia is now

Nvidia has said it's ramping Blackwell production now in the fourth quarter, making this a major moment for the company. And, of course, any comments from Nvidia about the pace of the launch or demand should offer us clues about what to expect in the coming months.

We should also keep in mind that Blackwell represents an opportunity that will extend well beyond this initial rollout period. And greater benefits should come once this phase has passed. For example, Nvidia's gross margin will be lower — in the low 70% range — as the company manages the logistics and expenses of the launch. But it will move back to the mid-70% range once the production and delivery process has become more of a routine.

All of this means, if you're an Nvidia investor or potential investor, now is a crucial time to keep your eye on the company — this launch should set the tone for several quarters to come.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.