This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

There is a list of investors that you might call Wall Street legends, and sitting near the top (if not at the very head of the list) is Warren Buffett.

Buffett is the chief executive officer of Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B), a stock that hasn't just beaten the S&P 500 Index (SP: .INX) over the long term, it has trounced it.

But don't worry, Buffett and Berkshire Hathaway aren't done making millionaires out of shareholders just yet.

What has Berkshire Hathaway done?

Warren Buffett lives in Omaha, Nebraska, and his superhero name is the Oracle of Omaha. Investors make an annual pilgrimage to listen to him speak at Berkshire Hathaway's annual meeting.

Why are so many investors so enamoured of this man? Because he's turned many of Berkshire Hathaway's shareholders into millionaires.

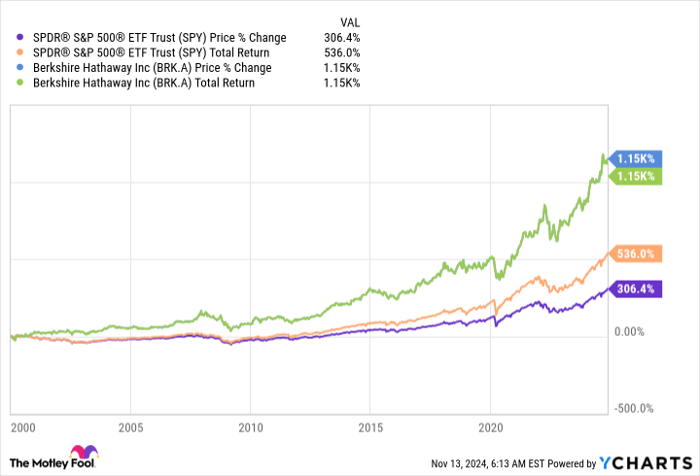

The chart above shows just how strong Berkshire Hathaway's performance has been since just the turn of the century.

While the S&P 500 index is up 300% on a stock-only basis and 530% when you look at total return (which assumes the reinvestment of dividends) Berkshire Hathaway's stock is up about 1,150%! Berkshire Hathaway doesn't pay dividends, so total return and stock price return are the same for the company.

That's a phenomenal performance, especially when you consider the company's business. If you go back further, the outperformance gets even more impressive.

Often viewed as an insurance company, Berkshire Hathaway is really a conglomerate with a highly diversified portfolio of companies inside of it. The business spans insurance, railroads, utilities, pipelines, retail, chemicals, and manufacturing, among many other sectors.

It's possible that Berkshire Hathaway is the most diversified company you can buy, to the point that it's almost like a mutual fund. In fact, when you buy Berkshire Hathaway shares, you should probably view it as hiring Warren Buffett to manage your money.

The good times probably aren't over for Berkshire Hathaway investors

Given the remarkable past performance and the size of the company today (it has a $1 trillion market cap), it is going to be hard for Buffett to generate the same kind of returns in the future that he has in the past.

It simply takes larger investments to move the needle today. And there are only just so many possible investments that are large enough, not even taking into consideration attractive enough.

But don't let that dissuade you from investing alongside Buffett, who has a simple but effective investment approach.

To sum it up, he tries to buy good companies while they are reasonably cheap and then lets managers do their jobs. The problem today is that the stock market is trading near all-time highs, and finding anything that's reasonably cheap is hard to do.

Buffett isn't letting that stop him from preparing for a future in which there are good investment candidates. One key aspect of his approach is that he doesn't mind holding cash if he can't find a place to put it.

And cash is starting to pile up on Berkshire Hathaway's balance sheet. The numbers are kind of staggering. The company ended 2023 with nearly $168 billion in cash. After the first quarter of 2024 that had grown to $189 billion. By the end of the second quarter cash stood at $277 billion. And now that the third quarter 2024 has been reported, investors around the world know that the cash hoard is sitting at $325 billion.

It seems very clearly like Buffett is gearing up for a time when he can put some cash to work, perhaps during a bear market. At that point, valuations will likely be much more attractive as he looks at the types of companies that could have an impact on Berkshire Hathaway's long-term financial results.

Time will tell, but history is a good guide

There's no way to know what will happen with Berkshire Hathaway in the future. It could start paying a dividend with all of that cash or repurchase huge swaths of its own stock.

However, history suggests that Buffett is more interested in putting that money to work in new investments when he thinks the time is right. For now, investors just have to sit and wait.

But when Buffett moves, it is likely to be big. And there's a good chance that Berkshire Hathaway will make some more millionaires along the way.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.