On a weak day for the Australian share market, one ASX 200 healthcare stock is relishing in record-achieving status.

Shares in the high-flying Pro Medicus Limited (ASX: PME) hit a fresh all-time high of $191.75 earlier this morning. The excitement has since partially worn off, with shares in the imaging software company slipping 0.1% to $190.18.

Deal details

Pro Medicus had gone four months and nine days without a major contract signing or renewal — longer than usual compared to the last couple of years. Ironically, now the medical imaging software company has landed two deals less than two weeks apart after today's announcement.

According to the release, a 'large Australian radiology network' has signed a five-year contract extension. Yes, the details of which the Australian radiology operator appears to be hush-hush. Pro Medicus' lips are tightly sealed on this one.

The extension will deliver at least $32 million over five years to use the company's Visage RIS product. Positively, the deal was negotiated with an increased fee rate for Pro Medicus. A higher rate was also a feature of last week's $98 million, eight-year renewal with Mercy Health.

Commenting on the deal, Pro Medicus CEO Dr Sam Hupert said:

This contract extension cements our leadership position when it comes to RIS in the Australian market.

Pro Medicus signed a five-year contract with I-MED Radiology — Australia's leading radiology network — in 2018. However, whether today's extension is with I-MED has not been confirmed.

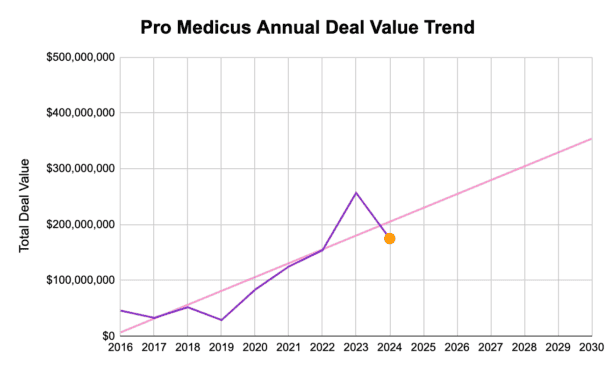

Despite the two recent contract extensions, Pro Medicus is currently looking at a decline in annual deal value, as shown above. There are still another two and a half months left in the year — but as it stands, the company has secured $175 million worth of contracts in 2024 versus $257 million last year.

Is this ASX 200 healthcare stock too high?

The last 12 months have been phenomenal for the Pro Medicus share price.

Setting record high after record high, the software company has climbed 131% to reach $190 per share and a corresponding $19.95 billion market capitalisation.

Given that the company's net profits increased by a much smaller 36.5% in FY24, much of the enlarged valuation comes from an expansion in the company's earnings multiple. That is to say, a large portion of the gain can be attributed to investors' willingness to pay a greater premium for this ASX 200 healthcare stock.

A year ago, the price-to-earnings (P/E) ratio on Pro Medicus shares was roughly 132 times earnings. Today — make sure you're sitting down first — the company trades at 240 times earnings.

Nonetheless, three analysts recommend its shares as a buy or strong buy. In contrast, only two analysts recommend Pro Medicus as a sell or strong sell.