This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

From the beginning of 2019 to the end of 2020, Nvidia (NASDAQ: NVDA) more than tripled its market capitalization. Three years later, the value of the company tripled again. And in just the past 12 months, Nvidia stock is on the verge of tripling its market cap once again. Already one of the largest companies in the world with a $3.2 trillion market cap, is it possible Nvidia extends its streak to surpass $10 trillion over the next five years?

Nvidia's end markets are going crazy

Nvidia ended 2019 with a market cap of $144 billion. At the time, nearly half of its revenue stemmed from chips designed for the video game market, while the data center segment accounted for about 30%. But as of the most recent quarter, 87% of the top line comes from the data center and AI segment. This is undoubtedly the category that will most influence the future of the business.

Part of the reason AI chips now dominate the company's top line is the sheer growth of the industry. In 2024, Gartner expects demand for AI chips to rise 33%. Over the next five years, average annual growth is expected to top 20%. Right now, Nvidia has a stranglehold on the market with an estimated 88% share of GPU spending. Data from Jon Peddie Research suggests Nvidia's market share has only continued to grow over the last 12 months.

Even if Nvidia's market share pulls back in the face of competitive pressure over the next few years, the underlying market growth can still fuel strong results for the company. AI is on its way to becoming the biggest new trend in a generation, and there will be plenty of industry spending to go around. Wall Street analysts are forecasting 52.5% annual sales growth for Nvidia over the next five years, which is only a small decrease from the 57.2% compound annual growth it's delivered in the previous five years.

But can Nvidia support a $10 trillion valuation?

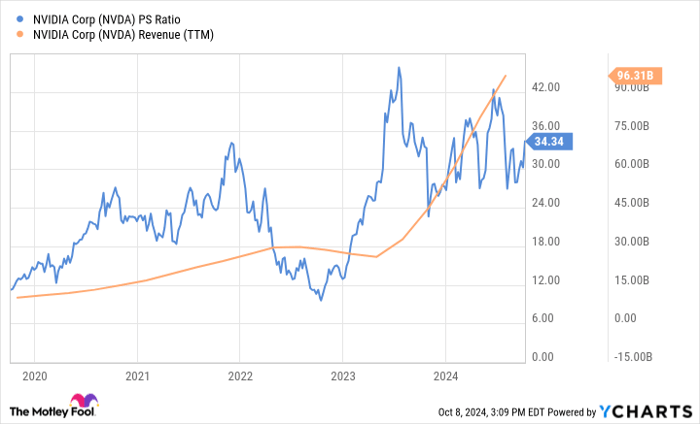

When Nvidia had a $144 billion market cap five years ago, shares were valued at 15 times sales. As a $3.2 trillion company as of this writing, Nvidia's price-to-sales valuation has climbed to 34 (down from its peak at 46). Based on that year-end 2019 multiple, Nvidia would be worth $1.4 trillion today. While that's still impressive, it's a stark reminder to investors that Nvidia's value has surged thanks to multiple expansion as well as its underlying sales growth.

Data by YCharts.

Because Nvidia is growing so quickly, though, one could argue its premium valuation is justified. And if the company lives up to analysts' expectations for 52.5% annual revenue growth going forward, Nvidia will report a whopping $794 billion of revenue by 2029. At that level, the company would need a price-to-sales multiple of about 12.5 to bring its market cap to $10 trillion.

There are zero guarantees this incredibly bullish scenario will come to pass, but if analysts' growth forecasts for Nvidia are even close to accurate, the company could indeed approach the $10 trillion milestone.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.